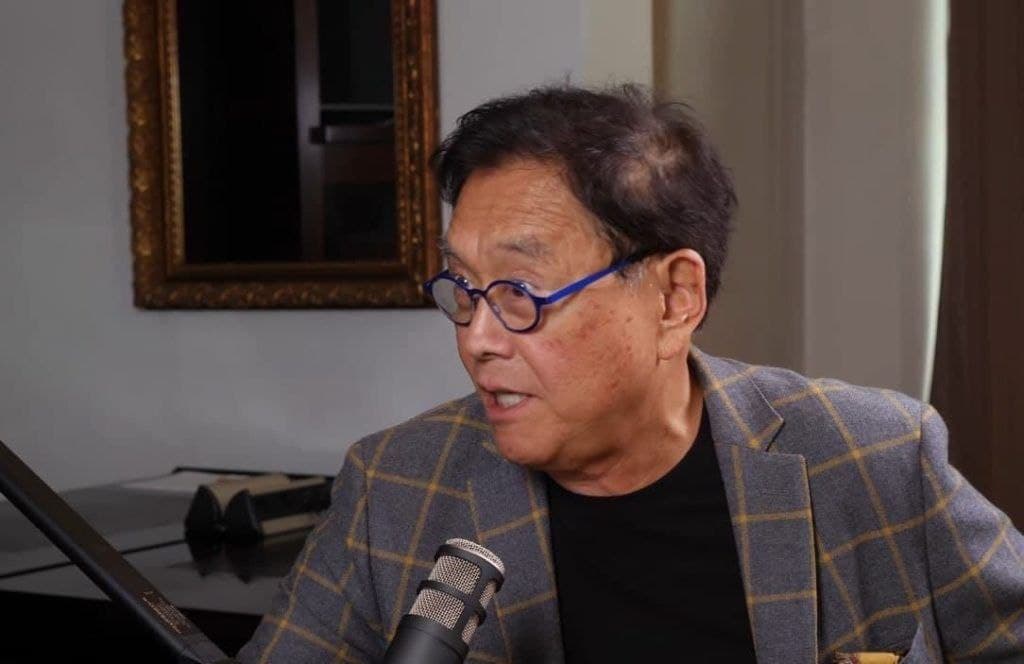

The prominent real estate and commodities investor ‘Rich Dad’ Robert Kiyosaki is well-known for several reasons. For one, as his nickname might imply, he is the author of the best-selling personal finance book ‘Rich Dad Poor Dad’ – and a few dozen other works.

Kiyosaki is also a well-known gold, silver, and Bitcoin (BTC) bull and a doomsayer for the U.S. and the global economy – though some might say he is more of a boy who cried wolf about the latter.

After examining the potential upside to picking up Bitcoin and the precious metals when R. Kiyosaki did, Finbold decided to tackle another one of his common statements and see how accurate it has proven so far.

Kiyosaki’s stock market warnings

For a long time, Kiyosaki has been very skeptical about the sustainability of various aspects of the U.S. economy, and while the dollar has been a frequent target of criticism, stocks have also hardly been spared.

A common throughline has been the prediction of a major stock market wipe set to hit the Boomer generation hardest and, back in December, the author opined that the S&P 500 index will be at the heart of the next crisis as it ‘will toast millions of 401ks and IRAs.’

In stark contrast to the by-press-time performance of his favored assets, the S&P 500 forecast has, so far, been substantially off the mark despite the sentiment being repeated numerous times.

Indeed, on December 11, when the X post was made, the benchmark index stood at 4622.44 points, while the most recent stock market close on April 17 placed it at 5,022.21.

In total, the S&P 500 has risen 8.65% since Kiyosaki issued his dire warning.

Is Kiyosaki wrong about stocks?

Essentially, for the entirety of the first quarter of 2024, Kiyosaki’s warnings appeared very much in discord with reality as both major indices, commodities, and cryptocurrencies were running close to or at their record highs.

April, however, brought a sharp change, with various assets finding themselves decidedly – though still insubstantially for the most part – in the red and warnings of a looming crisis growing ever more frequent.

Perhaps to Kiyosaki’s credit, his doubts about the equity markets have been long-standing as evidenced by a 2017 Facebook (NASDAQ: META) post in which he discusses the safe assets for a coming crisis – and, coincidentally, makes his first, albeit lukewarm, recommendation of Bitcoin.

In 2020, the long-standing prediction came true – though primarily due to the pandemic.

Ultimately, with time being a flat circle and boom and bust cycles being a feature, not a bug, of the U.S. economy, every non-dated bullish or bearish prediction is simultaneously true. This makes Kiyosaki’s prediction of a coming crisis – but not of when the crisis is coming – difficult to asses fairly.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.