American software and data analytics company Palantir (NYSE: PLTR) is among the hottest stocks in the market, having witnessed an 82% rally in 2024.

Notably, the company’s venture into artificial intelligence (AI) and impressive Q2 2024 results have elevated investor interest in PLTR. Amid the overall market sell-off, Palantir is witnessing short-term growth due to factors such as plans to add equity to the S&P 500 index.

As things stand, Palantir aims to sustain its valuation above the $30 support level. As of press time, PLTR was valued at $30.33, reflecting 24-hour gains of about 0.5%.

With Palantir having established bullish momentum in 2024, the company’s rival players are offering opportunities for growth as 2025 approaches. In this line, Finbold has identified the following two Palantir competitors that could potentially turn a modest $100 investment into $1,000.

Snowflake (NYSE: SNOW)

Snowflake (NYSE: SNOW), a cloud-based data warehousing entity, has rivaled Palantir with its services that enable businesses to make data-driven decisions. The Montana-based firm also ranks as a critical rival to Palantir due to factors like partnerships with technology giants like Microsoft (NASDAQ: MSFT). Notably, in 2024, the two firms extended their collaboration to promote flexible data management.

Indeed, SNOW offers growth potential, considering the company has several catalysts. For instance, the tech giant’s guidance for product revenue has risen from $850 million to $855 million for the third quarter, translating to 22% year-over-year growth.

Additionally, Snowflake projects its total addressable market to expand from $152 billion in 2023 to $342 billion in 2028. At the same time, the venture into AI-enabled products will likely allow the firm to tap into the booming sector.

Overall, Snowflake is showing confidence in itself, as the management has resorted to actively buying back shares. In this vein, the company has since authorized a $2.5 billion share buyback plan.

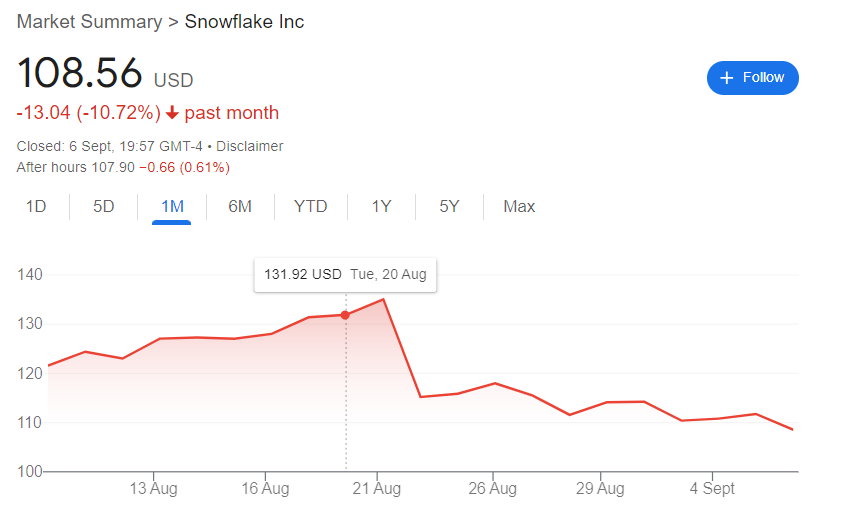

In the meantime, amid the shifting economic landscape coupled with recession uncertainties, the stock has tumbled recently, reaching a 52-week low of about $107. As of press time, the stock was trading at $108, reflecting 24-hour losses of almost 3%.

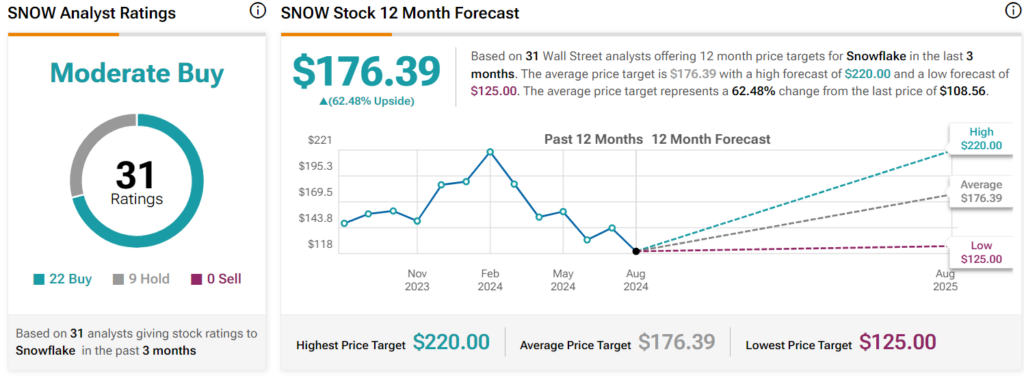

Despite the stock’s bearish sentiment, 31 Wall Street analysts at TipRanks anticipate that SNOW will likely record an upside in the next 12 months. In this line, the experts project the equity will trade at $176 on average, reflecting gains of about 62% from the current valuation, with a high target of $220.

C3.ai (NYSE: AI)

Similar to Palantir, C3.ai (NYSE: AI) focuses on providing AI-based solutions that help organizations optimize their operations. Notably, both companies are heavily involved in AI, predictive analytics, and data modeling, offering grounds for stiff competition.

Indeed, the stock offers investment potential, factoring in its recent growth trajectory. Notably, C3.ai changed its business model in recent years, a factor likely bearing fruit based on the reported revenue. Specifically, the firm reported its first-quarter revenue in 2024 at $87.21 million, reflecting a 21% increase year-over-year.

Its growth potential also lies in its approach to serving the AI market across diverse industries, including manufacturing and oil and gas. Its unique model ensures that C3.ai can offer tailored AI solutions to customers quickly.

For example, Shell acquired 100 C3.ai applications to monitor equipment for predictive maintenance, lowering the chances of catastrophic failure. Such a client base will likely increase investor confidence in the stock.

In the meantime, AI is navigating a rough patch after the company provided full-year sales and adjusted operating income guidance below Wall Street analysts’ projections.

By the time of reporting, AI was valued at $21 with daily gains of 0.8%, while in the past month, the stock is down 14%.

Meanwhile, Wall Street analysts at TipRanks also offer a reason to purchase the stock after projecting that AI will likely record an upside of 31% in the next 12 months and trade at an average of $28. The 11 analysts believe the stock will likely hit a high of $40, while the low forecast is at $20.

Overall, the highlighted stocks have the potential to offer notable returns for investors looking away from Palantir. Notably, both companies’ ventures into AI will likely guide further growth, provided the general economy remains bullish.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.