The Federal Reserve is grappling with significant financial losses, which have grown from around $1 trillion in paper losses from its underwater securities holdings.

Now, these have started turning into more than $100 billion in actual losses, with no immediate relief in sight.

On July 17, Fed Chair Jerome Powell stated that although inflation is easing, it is still not close enough to the Fed’s 2% annual target to lower interest rates from their two-decade high.

Higher rates could leave deep consequences on the Federal Reserve’s balance sheet

High interest rates complicate the Fed’s efforts to repair its balance sheet. These restrictive rates could cost the Fed around $100 billion annually into the next decade.

According to the Fed’s financial statements, there was a $948.4 billion unrealized loss at the end of 2023, compared to over $1 trillion at the end of 2022.

The central bank has been shrinking its balance sheet from a peak of nearly $9 trillion by letting some bonds mature each month without reinvesting the proceeds. This process slowed in June to tighten financial conditions without triggering a recession.

What caused such a large deficit for the Federal Reserve?

The Fed’s current predicament stems from its aggressive balance sheet use during the 2007-2009 financial crisis and the 2020 COVID-19 market panic.

Federal Reserve eased the situation by buying bonds that would otherwise be held by asset managers, 401(k)s, and other investment vehicles but incurred significant costs.

While this expansion helped keep credit cheap and abundant for businesses and households, it also propped up demand for risky assets and contributed to inflation.

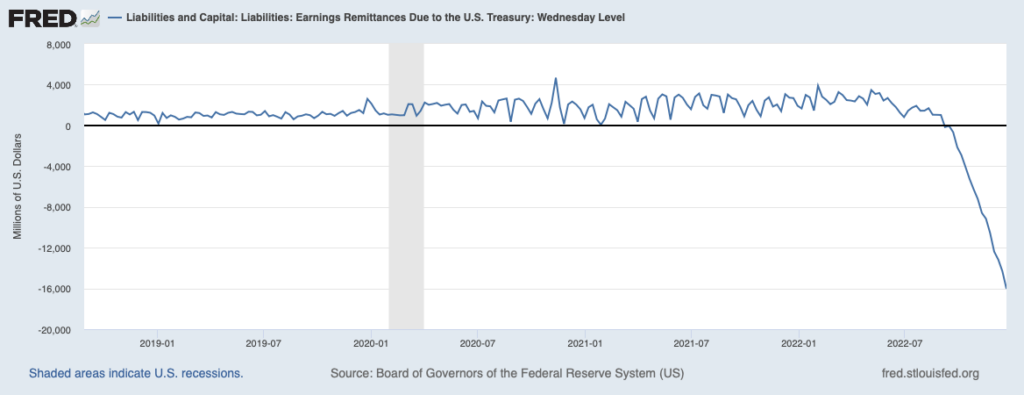

Interest expenses were positive at nearly $68 billion in 2022 but significantly contributed to the Fed’s $114.3 billion loss reported in March.

In contrast to the global financial crisis, where older, higher-yielding Treasurys became more valuable when the Fed cut rates, the COVID era saw the Fed buying low-yielding Treasurys and agency mortgage bonds, which lost value when rates were hiked.

Although the expanded balance sheet supported the economy by making credit accessible, it also carried inflationary risks.

Should Republicans gain control of the White House and Congress, extending Trump-era tax cuts could have risks associated with them, potentially complicating the situation even more.