Viewed as risk-free and one of the safest forms of investment, US treasury bonds are popular among investors, as they offer long-term returns, and the US government stands behind them.

Treasury bonds (T-bonds) are government debt securities issued by the US Federal government with maturities of 20 or 30 years. These bonds earn periodic interest until maturity when the owner receives a par amount equal to the principal.

T-bonds are a subset of US sovereign debt, which is commonly referred to as Treasuries. Treasuries, including T-bonds, are typically considered virtually risk-free due to the US government’s ability to levy taxes on its citizens.

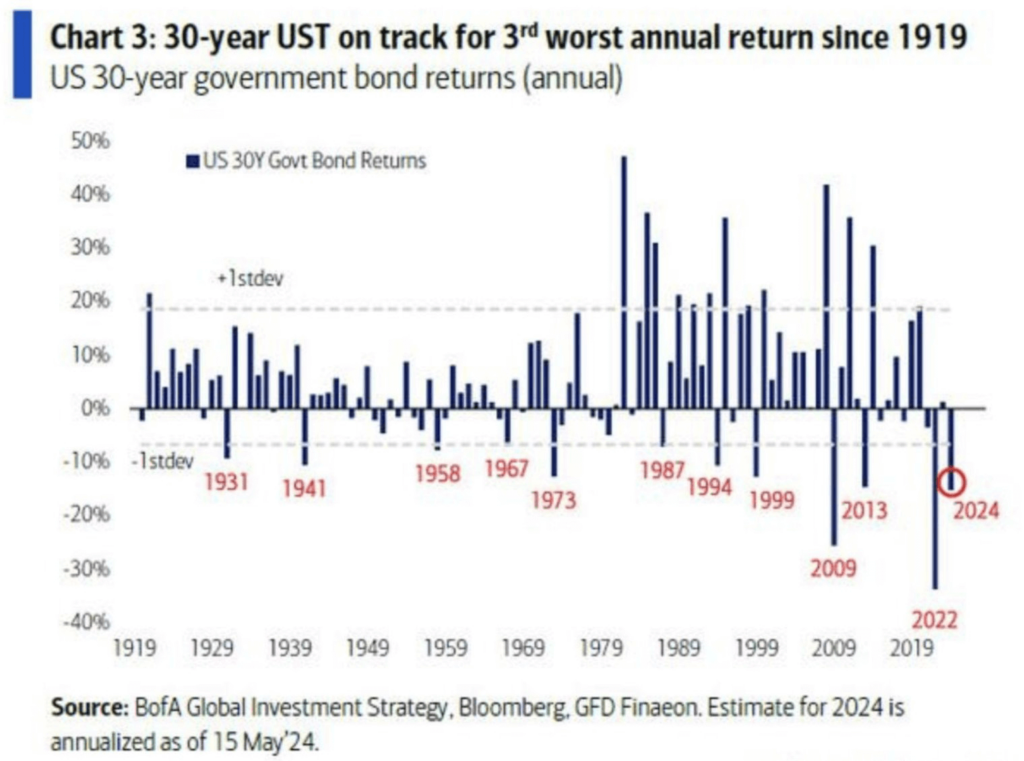

This year is one of the worst for US Treasury bonds

2024 wasn’t so good regarding the performance of 30-year US treasury bonds. They posted a weak performance—the third-worst year in terms of annual return since 2019. With more than half a year to go, it seems this record could easily be broken.

Interestingly, the previous two worst returns came after the 2008 recession and the 2022 post-pandemic economic recovery.

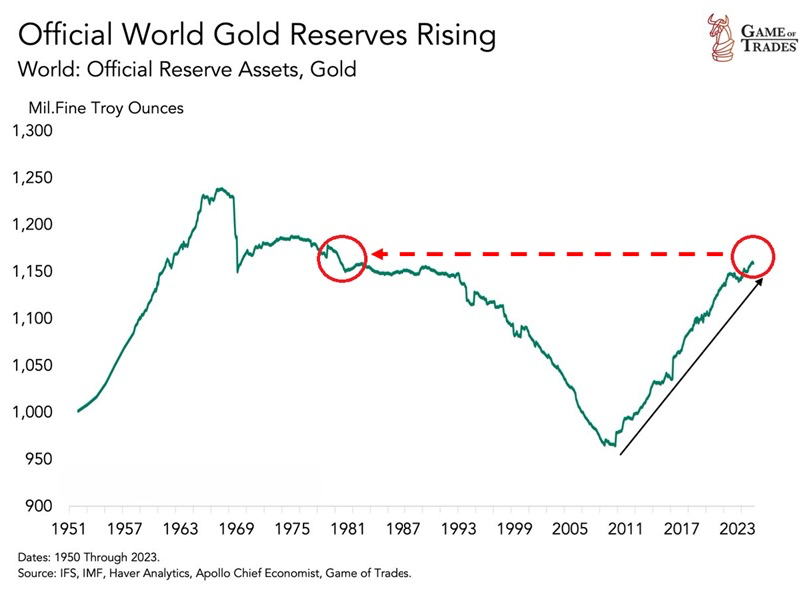

Gold might be the answer to US treasury bond troubles

Although the current performance is far from ideal, investors in this form of security might not need to worry, especially with the current trend that sees multiple government’s gold reserves rising, including the US.

This means that refinancing debt and the strength of the US dollar will be bolstered in the long term as their foundation (gold) expands.

While gold might be a smart alternative investment in the short term, the lack of purchases of US treasury bonds will increase their long-term yields, making them attractive once again.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.