After an exciting few days for AMC Entertainment (NYSE: AMC) stock, the shares of the largest movie theater chain the world have started to lose their momentum, and Wall Street experts have retained their relatively pessimistic view of the outlook for AMC stocks in the next 12 months.

Specifically, AMC shares have recently recorded massively high trading activity, in which retail traders started buying them en masse, pushing the price up and helping the company raise $250 million in new equity capital through the sale of 72.5 million shares of its ‘at-the-market’ offering launched on March 28.

AMC stock price prediction

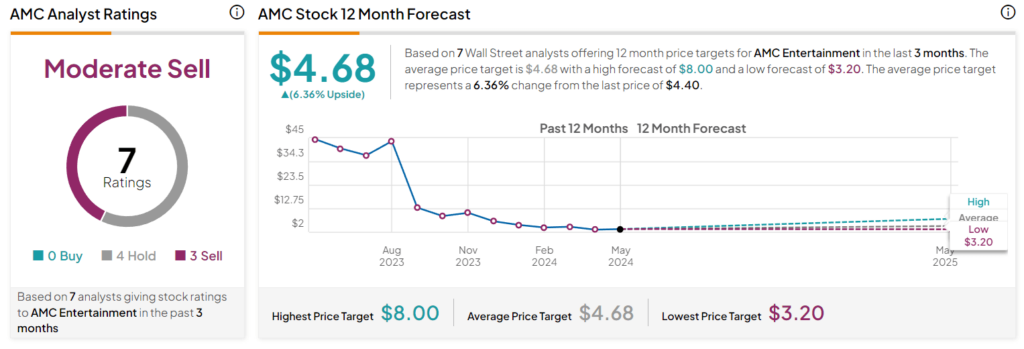

However, a group of seven Wall Street experts who have sheir their predictions of the future performance of AMC stocks during the last three months remain unconvinced, three of them rating it as a ‘sell,’ and four recommending a ‘hold,’ with no votes for a ‘buy,’ as per TipRanks data retrieved on May 20.

At the same time, they have also offered their AMC stock price targets for the following 12 months, suggesting an average price of $4.86, which would indicate an 8.24% gain from its current price, with the lowest price set at $3.20 (-28.73%) and the highest standing at $8.00 (+78.17%).

Among the more bullish analysts are those at B. Riley, who have assigned the AMC shares a ‘neutral’ rating and set a price target of $8. According to them, the cinema chain’s recent announcement of successful debt reduction transitions could improve AMC’s standing with debt holders.

On the other hand, Wedbush has reduced its price target on AMC stock from $4 to $3.50 while maintaining a ‘neutral’ rating from August 2023, when it raised its score on AMC’s shares from ‘underperform,’ underscoring the investment firm’s view of AMC’s underlying value.

Elsewhere, another update comes from Citi, which revised its AMC Entertainment stock target from $3.10 to $3.20 after the company’s first-quarter 2024 revenue and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) while reiterating their ‘sell’ rating.

AMC stock Reddit hype

Separately, Tuttle Capital Management CEO Matthew Tuttle believes that the recent meme rally, which has also seen GameStop (NYSE: GME) and BlackBerry (NYSE: BB) skyrocket, couldn’t have come at a better time for AMC, arguing, however, that it might not be sustainable:

“In stocks like this that there’s no fundamental underpinning, they can’t stay elevated without people constantly coming in.”

So, what happened to AMC stock? As a reminder, the developments in the stock market, sparked by the users of the popular social media platform Reddit, trying to sabotage hedge funds and other short-sellers of GME, BB, and AMC stock, have sent the price of AMC shares sky-high and into a short squeeze.

AMC stock price analysis

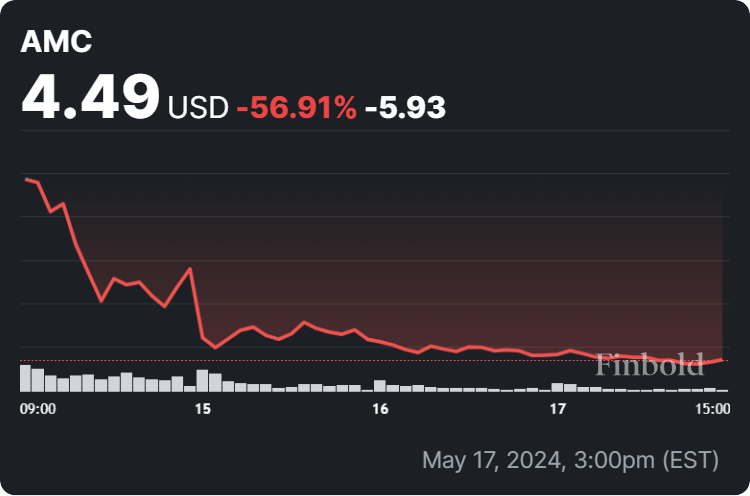

Currently, however, AMC shares are changing hands at the price of $4.49, recording a decline of 5.17% on the day, as well as losing a whopping 56.91% in the past week, as they move to reverse the 28.80% gain accumulated on their monthly chart.

All things considered, AMC stocks have delivered some interesting surprises in the past several weeks but, considering the lack of bullish sentiment among Wall Street experts and its more recent price action, the stock might not achieve much progress in the next 12 months.

That said, doing one’s own due diligence, conducting detailed research, and weighing individual risk tolerance is adamant, considering that the situation in this sector might not remain constant, and experts often disagree about their prognoses, which may as well be less than perfect.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.