Global stock markets experienced a sharp decline on August 5, fueled by growing concerns about a potential U.S. recession.

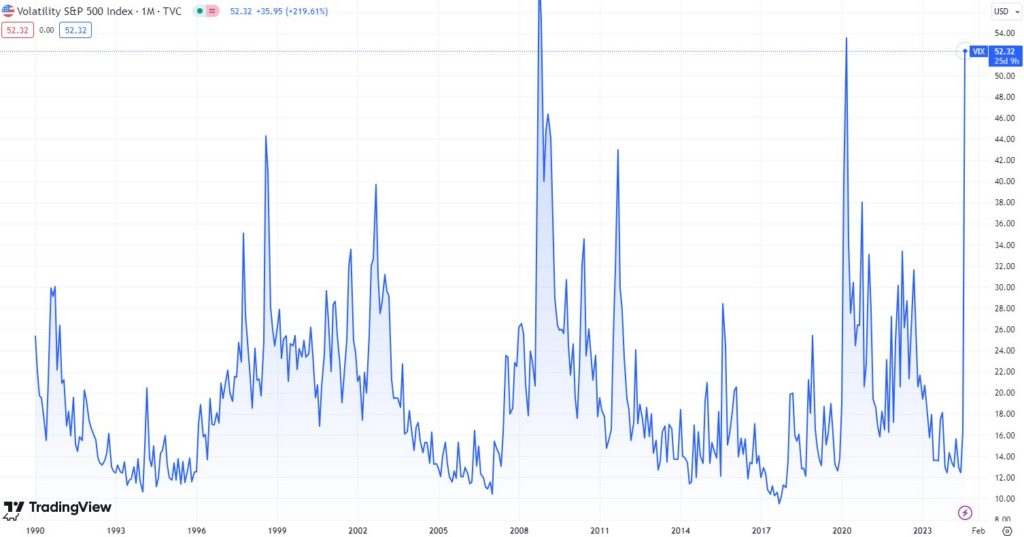

Investors and analysts are now debating whether the Federal Reserve will need to accelerate its policy easing to support economic growth. The market turmoil triggered a dramatic 50% spike in the CBOE Volatility Index (VIX), often referred to as the “fear gauge,” which soared to 52.29, its highest level since March 2020.

VIX was only above 50 in two different instances: the Global Financial Crisis and the COVID-19 pandemic crash.

The VIX measures market expectations of near-term volatility through S&P 500 index options, with higher values signaling increased uncertainty and investor anxiety.

Stock markets worldwide trade in the red

A widespread sell-off in equities accompanied the surge in the VIX. Japan’s Nikkei index plummeted by 12.4%, hitting seven-month lows and marking its steepest loss since the 2011 global financial crisis.

This was mirrored in U.S. markets, where Nasdaq 100 futures dropped 3.3% and S&P 500 futures dipped 2%. European markets were also affected, with EUROSTOXX 50 futures falling 3% and FTSE futures sliding 2.91%.

The sell-off was exacerbated by the release of a weak July payrolls report, which led markets to price in a 78% chance that the Federal Reserve will cut interest rates in September, possibly by a full 50 basis points.

Analysts now believe that recession chances are on the rise

In response to the deteriorating economic outlook, Goldman Sachs has raised its 12-month recession odds by 10 percentage points to 25%.

The firm anticipates the Federal Reserve will implement quarter-point rate cuts in September, November, and December based on the expectation that job growth will rebound in August.

However, if August employment data disappoints, a 50-basis-point cut in September is likely.

Meanwhile, JPMorgan economists are even more pessimistic, estimating a 50% chance of a U.S. recession.

They predict the Fed will cut rates by 50 basis points in both September and November, potentially even considering an inter-meeting easing if economic data continues to weaken.