The esteemed investor Warren Buffett, serving as Chairman of Berkshire Hathaway (NYSE: BRKA, BRKB), has significantly broadened the company’s extensive portfolio through the acquisition of further shares in the Occidental Petroleum Corp (NYSE: OXY).

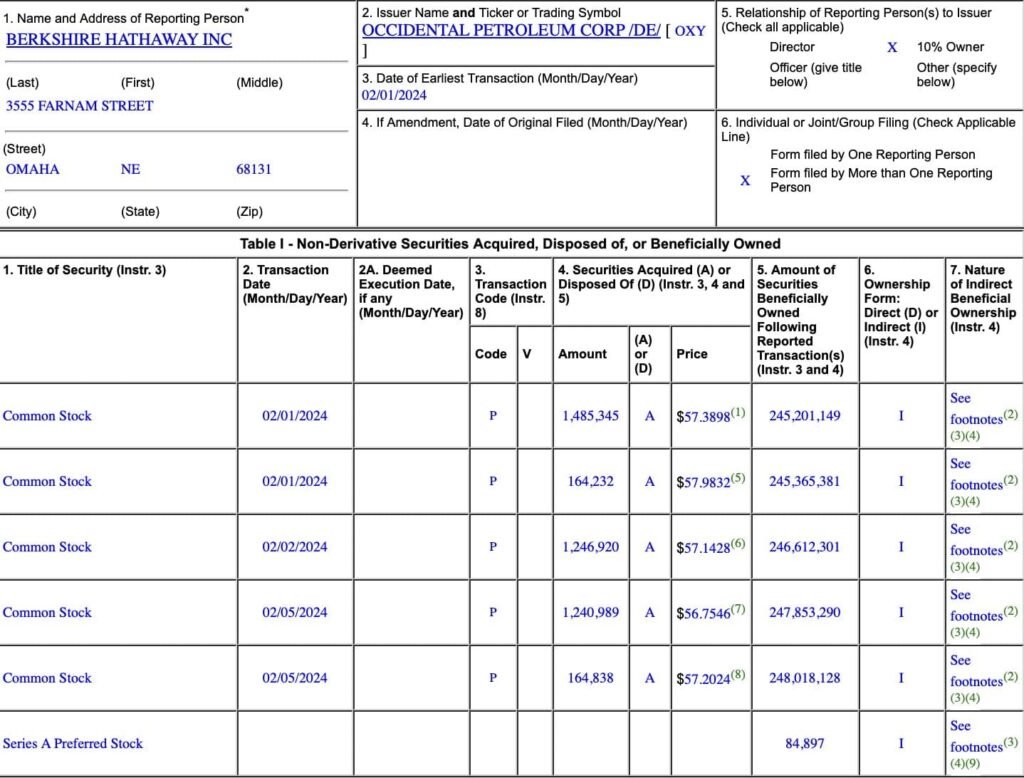

Executed on February 5, the transaction involved acquiring 4,302,324 shares at a trading price of $57.29 each, amounting to $245.9 million. This led to Berkshire Hathaway’s total holdings in the company reaching 248,018,128 shares, filed with SEC.

This acquisition comes after a recent purchase of the same stock, worth over $590 million, in December.

Picks for you

What drives Buffett towards Occidental stock?

Occidental’s appeal to Berkshire Hathaway lies in its stability as a natural hedge amidst inflationary trends, bolstered by its strategic position in the oil market and Buffett’s familiarity with the company.

Despite initial setbacks, Occidental’s resilience amid rising oil prices presents a promising value proposition for investors. With Berkshire’s surplus cash, acquiring Occidental could be strategically beneficial. OXY’s expertise in shale and Buffett’s positive relationship with CEO Vicki Hollub add to its allure.

Additionally, Occidental’s alignment with environmental initiatives, particularly in carbon capture technology, further enhances its attractiveness to Berkshire Hathaway.

OXY stock analysis

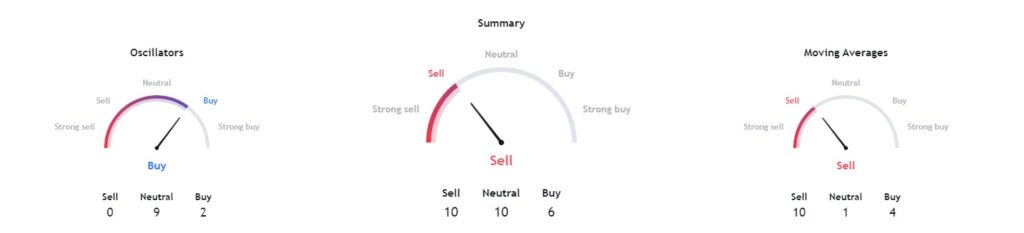

At the time of press, OXY stock was trading at $57.57, indicating an increase of 1.04% since the previous market close on February 6. This stock lost -2.14% of its value in the last five trading sessions.

Technical indicators don’t share the same optimism as Buffett regarding this stock, as they have an overall rating of ‘sell’ at 10, with moving averages tilting towards ‘sell’ as well at 10. Oscillators indicate a ‘buy’ at 2.

While some may think Buffett is keen on acquiring full ownership of this company after he was approved by the SEC to acquire 50% of its shares, that may not be the case, as the “Sage of Omaha” might just be a firm believer in its stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.