Warren Buffett, the renowned investor and Chairman of Berkshire Hathaway (NYSE: BRKA, BRKB), has significantly added to the firm’s extensive portfolio by acquiring shares in the Liberty SiriusXM Group (NASDAQ: LSXMA).

Executed on January 4, the transaction involved the acquisition of 1,090,754 shares at a trade price of $29.76, amounting to over $82 million and resulting in Berkshire Hathaway’s total holdings in the company increasing to 21,298,434 shares, as reported in a post on X by stock market analyst Evan on January 5.

The acquisition has elevated the firm’s position in the company to constitute 0.2% of its portfolio, reflecting a 6.52% ownership stake in the Liberty SiriusXM Group.

Buffett’s long-lasting love for the media business

Berkshire Hathaway, led by Warren Buffett and boasting ownership in more than 65 companies spanning diverse sectors, has a rich history of involvement with media and entertainment enterprises.

The 93-year-old billionaire has maintained a notable connection to the industry, having previously owned 30 daily newspapers, including his hometown publication, the Omaha World-Herald. These holdings were part of Berkshire’s print publishing unit, BH Media Group.

Despite the prevailing challenges in the media industry, Buffett, a lifelong newspaper enthusiast, has expressed enduring interest. Notably, The Washington Post was a key asset within Berkshire’s portfolio until its divestiture to Amazon’s (NASDAQ: AMZN) Jeff Bezos in 2014 for $250 million.

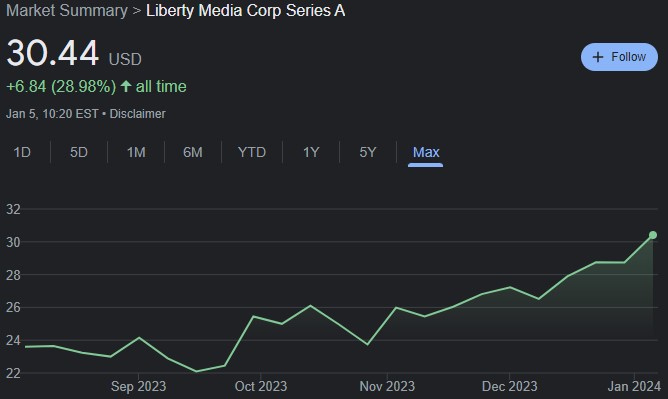

LSXMA stock price analysis

At the time of press, LSXMA was trading at $30.64, adding 2.37% from its previous close and gaining 3.71% during the last 5 trading sessions. Since its merger and rebranding in August, this stock has gained 28.86%.

At the same time, the technical indicators on TradingView for Liberty SiriusXM indicate a sentiment categorized as a Strong Buy. A comprehensive evaluation of these indicators assigns a ‘strong buy’ rating at 16, with moving averages indicating a ‘strong buy’ at 14. Oscillators are inclining towards a ‘buy’ rating, registering at 2.

Investors are wondering whether this acquisition is made out of nostalgia for the days of old or if there is a genuine potential that “the sage of Omaha” sees in it. Most likely, it is a combination of both.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.