After September 3 saw Nvidia (NASDAQ: NVDA) stock erase $279 billion in a single trading session, with mounting problems such as a subpoena by the Department of Justice (DoJ), NVDA shares seem headed for more trouble.

The latest trading session for NVDA stock saw it erase 9.53% of its value amid increased selling, which settled its price at $108 at the close, with losses of 1.68% extending in the pre-market on September 4, indicating that sell-off is set to continue.

These losses further add to the negative trend Nvidia shares have experienced since the August 28 Q2 earnings report. Since then, they have lost 13.65% of their value, prompting questions among the trading community about whether and when this NVDA stock sell-off will end.

Technical analysis reveals further trouble for NVDA stock

Since August 21, NVDA shares experienced a period of heightened volatility, primarily due to a period leading up to its Q2 report, after which a strong negative trend has seen its stock price fall below its closest support zone at $116.69 and thread towards its previous support level at $97.58.

The resistance zone at $108.77 indicates that NVDA shares must first surpass this level to reverse the negative trend.

However, the 50, 100, and 200-day simple moving averages (SMAs) lines show that Nvidia shares are trading at a price lower than all three moving averages.

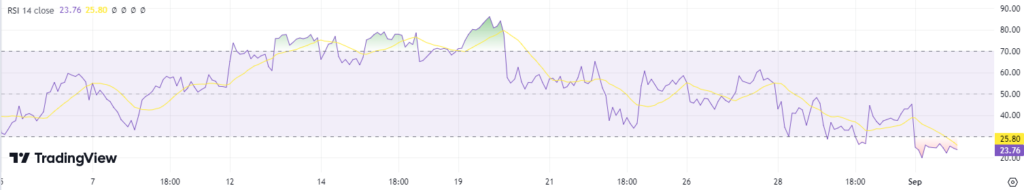

Nvidia’s stock situation becomes even more dire when its relative strength indicator (RSI) shows a reading of 23.76, indicating oversold conditions.

Other technical indicators have shifted their ratings toward a “sell” rating, a notable change from just a day ago when Finbold conducted a previous technical analysis of NVDA shares.

Insider sales are bound to deepen Nvidia stock problems

If the strong trend of Nvidia insider trades continues in the upcoming sessions, especially considering the large amount its CEO, Jensen Huang, has sold in the previous weeks, this semiconductor stock is set to suffer further, with increasing selling pressure.

Despite earning over half a billion from sales of NVDA stock, Huang’s net worth took a deep hit of $10 billion due to yesterday’s loss this microchip producer experienced.

Despite a current setback, history teaches us that Nvidia stock can make up losses surprisingly quickly, as showcased in trading sessions after August 5, when Huang’s company recovered hundreds of billions in losses.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.