Bitcoin’s (BTC) price movement correlation with the global money supply (M2) is signaling a possible massive correction for the asset as it seeks to breach the six-figure valuation mark.

This relationship hints that Bitcoin could experience a steep drop to $20,000, an almost 80% plunge from its current valuation, according to an analysis by financial commentary platform The Kobeissi Letter in an X post on December 21.

Historically, Bitcoin prices have exhibited a lagged correlation with the global money supply, typically trailing by approximately 10 weeks.

The entity stated that this trend aligns with the recent peak in the supply, which hit a record $108.5 trillion in October before falling by $4.1 trillion to $104.4 trillion as of December, the lowest level since August.

Notably, the decline coincides with Bitcoin’s recent retreat, which saw the cryptocurrency face the threat of plunging below $90,000.

“If the relationship still holds, this suggests that Bitcoin prices could fall as much as $20,000 over the next few weeks. Bitcoin’s red-hot run may take a pause,” the platform noted.

The analysis noted that Bitcoin’s valuation may decline if this historical relationship persists.

Fate of Bitcoin price correlation with M2

At the same time, in an X post on December 18, Bitcoin custody firm Theya’s head of growth, Joe Consorti, noted that investors should anticipate two possible outcomes with the two continuing to show correlation.

Consorti suggested Bitcoin could decouple from this pattern, driven by strong demand within its ecosystem. He also warned that tightening liquidity could lead to a deep mid-cycle correction if the correlation persists.

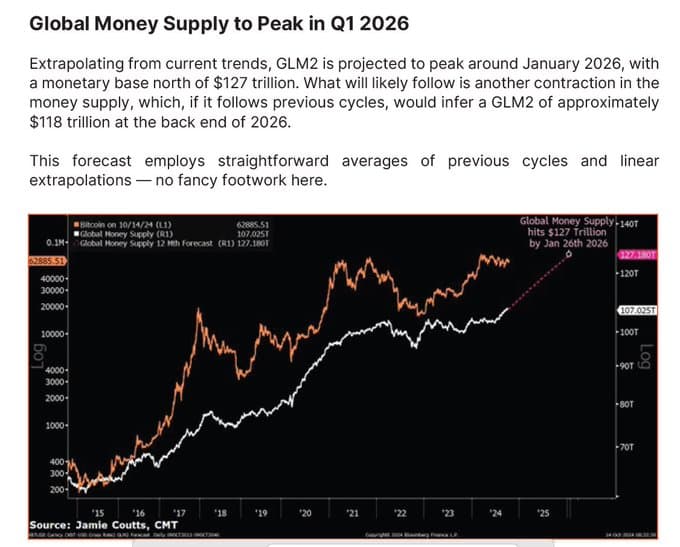

Elsewhere, Jamie Coutts, chief crypto analyst at Real Vision, highlighted Bitcoin’s correlation with global money supply as a key indicator of its future trajectory. In a late November post on X, Coutts projected the M2 money supply to exceed $127 trillion by 2025, an 18% increase driven by economic and monetary factors.

He noted that Bitcoin has historically absorbed about 10% of new liquidity, suggesting the cryptocurrency could see substantial inflows during this period.

However, not all market players believe the M2 correlation with Bitcoin will dictate the digital currency’s price movement. An X user with the pseudonym CryptoAnarchyst argued that the money supply is no longer a key indicator for Bitcoin, as the market has shifted from retail-driven to institutional and derivative-led.

The user stated that with the rise of exchange-traded funds (ETFs), retirement funds, and corporations, the focus has moved away from traditional liquidity measures, and relying on M2 could lead to poor decision-making in the current market.

Correlation between global money supply and risk assets

The global M2 supply measures total liquidity in the economy, including checking and savings accounts and other assets easily converted into cash.

When global liquidity increases, central banks inject more money into the system by lowering interest rates or using quantitative easing, such as buying government bonds, often boosting investment in risk assets like Bitcoin.

On the other hand, when liquidity contracts, risk assets like Bitcoin typically face downward pressure. Bitcoin’s fixed supply also makes it appealing as an alternative to central bank systems, further tying its price to changes in global liquidity.

Bitcoin price analysis

Bitcoin was trading at $97,013 at press time, with daily losses of over 1%. On the weekly chart, BTC is down over 5%.

At the current valuation, Bitcoin’s technical setup suggests that the asset is facing bullish sentiment both in the long and short term.

This is backed by BTC trading above the 50-day simple moving average ($91,748) and the 200-day SMA ($70,040).

Looking ahead, Bitcoin is facing major resistance at $100,000 for a chance to clinch another record high, with $95,000 serving as a strong support level worth watching in the short term.

Featured image via Shutterstock