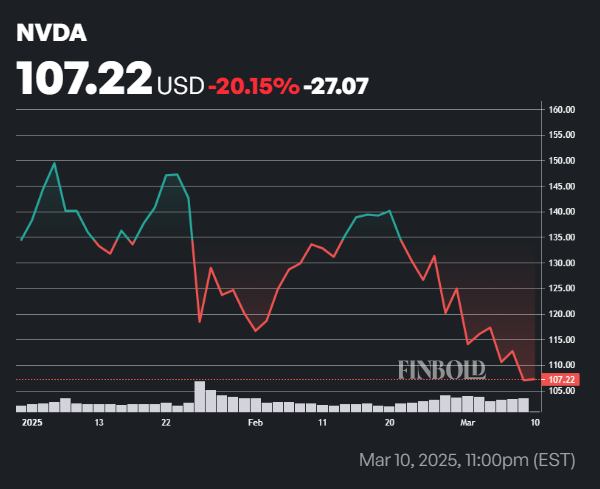

Nvidia (NASDAQ: NVDA) stock is on the brink of falling below the $100 support zone as sustained downward pressure from broader market volatility weighs on the equity.

The technology giant’s stock plunged over 5% in the last session, closing at $106.98, raising concerns that it could erase its artificial intelligence (AI)-driven gains from the past few years. So far in 2025, NVDA has dropped more than 22% year-to-date, making its decline even more pronounced.

With markets showing no signs of a short-term recovery, all eyes are on Nvidia’s interaction with the critical $100 level. Given that the company’s blockbuster Q4 earnings failed to spark a major rally, the chances of NVDA slipping below $100 remain high if the broader market maintains its bearish trend.

NVDA’s stock struggles to stay above $100

Insights on how the stock might move for the rest of the week can be deduced from NVDA’s technical setup. In this line, prominent online trading expert TradingShot, in a TradingView post on March 11, observed that the equity has been locked in a channel up pattern since June 2024, and its current dip is a bearish leg within this structure.

Following the last trading session’s closing price, the analyst noted that the stock touched the higher low trendline, a level that previously triggered strong rebounds.

The last time Nvidia tested this key support was on August 5, 2024, a move that was followed by a sharp rally. Interestingly, each time the one-day relative strength index (RSI) hit 34 over the past 11 months, NVDA staged a minimum 26.85% bounce.

Therefore, if this pattern plays out, the stock could see a recovery instead of dipping below $100.

On the upside, if Nvidia follows its previous Fibonacci extension pattern per TradingShot’s outlook, the next medium-term target is $164.

Meanwhile, an analysis by Stock Whale in an X post on March 11 observed that while Nvidia’s long-term potential remains bullish, the stock might still drop below $100.

According to the stock trading analyst, there is no doubt that bears are firmly in control after Nvidia broke a key trend. The stock has been making lower highs, and analysts are eyeing potential support zones between $102 and $77.

Therefore, based on his identified pivot points at $91 and $75, there’s a real possibility that NVDA could dip below the crucial $100 mark.

Notably, he pointed out that at the current levels, there is hesitation in calling it a bottom, warning that trying to “catch the falling knife” is risky.

“We have been getting lower highs and lower highs, but we might get one more lower high, to continue this downtrend. I do not like catching the falling knife. I do not like trying to time a bottom and see if I can catch it,” he said.

Nvidia stock fundamentals

Nvidia is battling to stay above $100 despite the strong fundamentals built on the company’s leadership in the AI space. Some of the strongest fundamentals stem from the chipmaker’s record-breaking revenue, which came in at $39.33 billion in the fourth quarter, surpassing estimates of $38.05 billion, while net income nearly doubled to $22.09 billion.

Nvidia’s next-generation Blackwell AI chip contributed $11 billion in revenue, the fastest adoption in the company’s history. Looking ahead, Nvidia expects $43 billion in first-quarter revenue, reflecting a 65% year-over-year growth.

The bullish outlook is backed by insights from Wall Street analysts who foresee NVDA surpassing the $150 mark in the next 12 months.

Featured image via Shutterstock