Tesla (NASDAQ: TSLA) has faced a lackluster first quarter, seeing its shares plummet nearly 40% since the start of 2024. It has fallen below several support levels, leaving investors questioning how far this downward trend will go and whether it will breach the $100 mark.

Troubles seem neverending with announced layoffs, scrapping low-cost model plans, issues with Cybertrucks, and now some wondering whether Elon Musk is to blame.

What do analysts think about TSLA stock?

Barclays predicts Tesla’s upcoming earnings call will likely disappoint due to weak performance, including missed delivery targets and a shift away from mass-market vehicles. Analyst Dan Levy expects Tesla to fall short of estimates, affecting gross margins and free cash flow. Despite maintaining a ‘hold’ rating, Barclays slashed the price target by 20% to $180 from $225, reflecting uncertainty about Tesla’s strategy.

Other analysts share a bearish outlook on TSLA. JPMorgan’s Ryan Brinkman values Tesla stock at just $115 per share and rates it as a sell, implying a 23% downside.

Meanwhile, GLJ Research’s Gordon Johnson lowered the price target to $22.86 and maintained a ‘strong sell’ rating, indicating a pessimistic view of Tesla’s prospects.

What is the verdict from technical indicators on TSLA shares?

Analyzing the price chart of TSLA stock reveals a 1.39% loss in pre-market trading, adding to losses of nearly 14% over the past five sessions.

Currently valued at $149.03, TSLA stock has yet to reach its next support level at $127.47 and faces resistance at the $154 threshold.

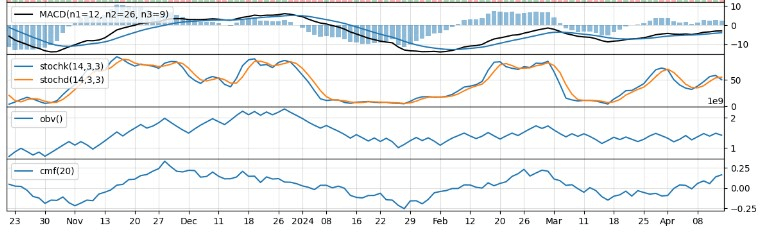

Based on technical analysis, TSLA’s stock price is expected to move sideways in the coming days, with a chance of a short-term bearish reversal. Momentum is currently neutral, but there are signs of a possible shift.

Traders should closely monitor the MACD Histogram for potential trend reversals and watch for significant breakouts from the Bollinger Bands to confirm new trend directions.

Regardless of traders’ bullish sentiments on TSLA shares, it’s evident that the current technical outlook and market sentiment, combined with declining performance, don’t favor the EV giant.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.