Positive sentiment grows in the cryptocurrency market after weeks of bearish and neutral dominating sentiments. However, some cryptocurrencies are trending mostly due to negative sentiments, and investors should avoid trading them next week.

It is worth noting that the crowd’s sentiment is volatile and does not necessarily reflect the intrinsic fundamentals of the trending projects. Still, social indicators and public perception can potentially impact a cryptocurrency’s short-term price action.

Avoiding trading particular cryptocurrencies trending for the wrong reasons can help investors keep a solid risk management strategy.

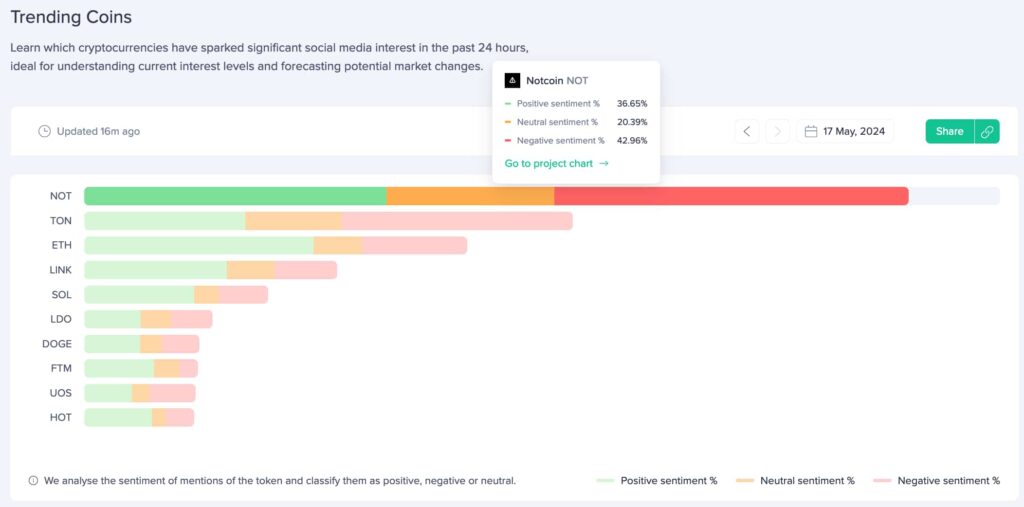

In this context, Finbold retrieved data from Santiment’s trending cryptocurrencies on May 17, looking for insights. Notcoin (NOT) and Toncoin (TON) lead today’s top 10 trends, with a dominating negative sentiment.

Avoid trading Notcoin (NOT) and Toncoin (TON)

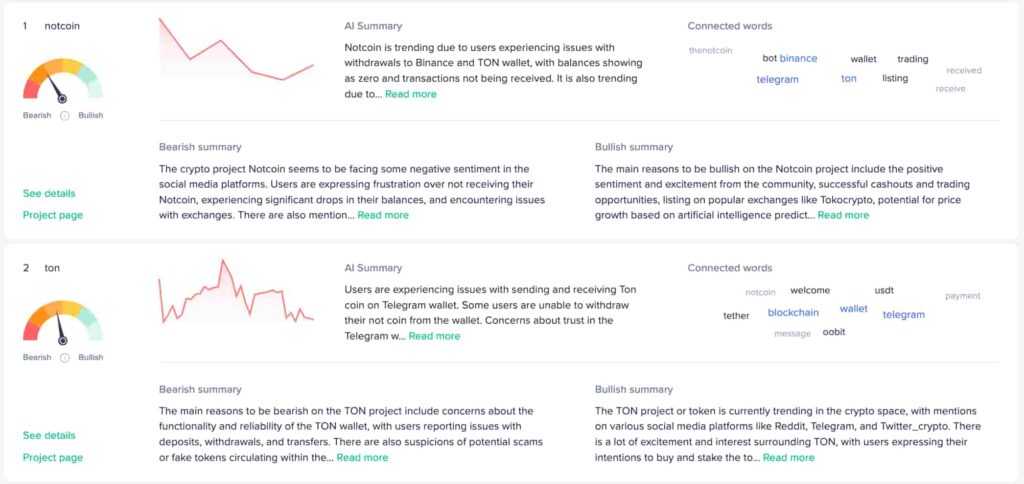

Notably, Santiment‘s social index signals a bearish momentum for Notcoin as users report withdrawal issues to Binance and TON wallet. The platform’s AI summary reports as follows:

“The crypto project Notcoin seems to be facing some negative sentiment in the social media platforms. Users are expressing frustration over not receiving their Notcoin, experiencing significant drops in their balances, and encountering issues with exchanges.”

– Santiment’s Bearish summary on “notcoin”

Conversely, NOT has had bullish mentions of successful cashout, trading opportunities, and crypto exchange listings.

Notcoin was born as a reward token for a Telegram game designed to onboard users on The Open Network (TON). The first negative experience has also affected the market’s overall perception of Toncoin, the blockchain’s native token.

“The main reasons to be bearish on the TON project include concerns about the functionality and reliability of the TON wallet, with users reporting issues with deposits, withdrawals, and transfers.”

– Santiment’s Bearish summary on “ton”

TON price analysis

On the other hand, Toncoin had a remarkable performance in 2024, up 184% year-to-date, currently at $6.67. The Open Network has successfully attracted investors and developers for its ecosystem, presenting solid long-term fundamentals.

Moreover, technical indicators suggest the token could hold its current prices or surge further despite the dominating sentiment. TON trades above its 30-day exponential moving average (30-EMA), and the relative strength index (RSI) suggests a strong momentum.

Therefore, the “avoid trading” warning is also valid for short-sellers trying to profit from TON’s current issues, as the digital asset could still perform despite recent events.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.