Palantir Technologies (NYSE: PLTR ) stock stands out in the artificial intelligence software industry. Since its founding in 2003, Palantir has been a key player in AI, initially helping governments process data to provide actionable insights. It has since expanded into the private sector, creating new business opportunities.

With decades of AI expertise, Palantir is becoming a top choice for companies looking to integrate AI models and decision-making into their operations. This momentum has caught investors’ attention, which is why Finbold conducted a thorough analysis of the technical and fundamental aspects of PLTR stock.

Trend reversal is fast approaching for PLTR stock

According to the technical analysis, PLTR shares are currently in a downtrend over the medium to long term. This trend indicates that investors have been selling at progressively lower prices.

Recently, the price has rebounded after breaking through a head-and-shoulders pattern. Resistance around $23.84 presents potential selling opportunities, where a decisive break above this level would neutralize the negative outlook.

A break above $26 would be a positive signal. Historically, volume has been high at price peaks and low at price troughs, weakening the downtrend and potentially indicating an upcoming trend reversal.

Rising growth and outlook bode well for PLTR stock

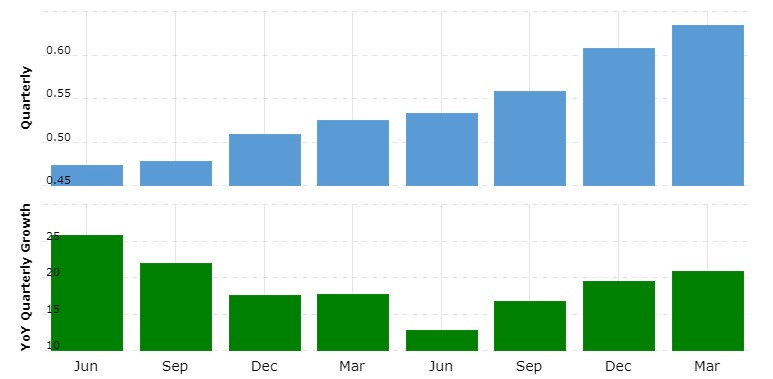

Due to rapidly increasing demand, Palantir’s revenue growth has been accelerating. In Q1, revenue increased by 21% to $634 million, the fastest pace since late 2022.

Palantir’s growth is going strong, as management projects revenue of $651 million for Q2, indicating a 22% growth rate. This growth acceleration appeals to investors and helps justify the stock price.

$480 million deal sees analysts rethink targets for PLTR shares

PLTR stocks have recently started to recover from the losses sustained in previous weeks, assisted by a $480 million contract with the United States Army as part of the Maven Smart System project, with work extending through 2029.

In this context, analysts at Bank of America have increased their PLTR stock price targets, assigning it a price target of $28 and giving the Palantir Technologies stock a positive ‘buy’ rating.

Meanwhile, William Blair & Company’s team believes that Palantir Technologies’s latest deal with the U.S. Department of Defense will bring in about $90 million annually, having assigned Palantir shares an underperformance grade.

The upcoming period will reveal whether bulls or bears were right about PLTR shares, with Palantir having the fundamentals and technicals on its side for now.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.