The previous year was prosperous for many investors, resulting in significant gains in the stock market. The outlook for 2024 seems promising, especially in the technology sector.

Reflecting on the positive trends observed in the previous year, Finbold has identified three stocks poised to sustain their robust performance over the next 12 months.

These stocks may be less known, but their technical and fundamental indicators and analyst ratings spell out future solid performances.

Stellantis (NYSE: STLA)

Stellantis (NYSE: STLA) is a multinational automotive manufacturing corporation resulting from the merger between the Italian–American conglomerate Fiat Chrysler Automobiles and the French PSA Group. Coincidentally, this stock is in the portfolio of the renowned investor Michael Burry.

Automaker giant is set to integrate ChatGPT into the voice assistants of Peugeot cars and vans, joining other automakers such as Volkswagen and Mercedes-Benz in incorporating this AI chatbot technology into their vehicles, capitalizing on the ongoing AI boom.

Stellantis Pro One’s commercial vehicle range now produces hydrogen fuel cell vehicles in-house for mid-size and large van models. This expansion reinforces Stellantis as the leading provider of zero-emission propulsion for European commercial vehicles.

At the time of press, STLA was trading at $21.96, gaining 0.41% since the previous market closure. This stock added 4.52% to its value in the last five trading sessions, while in the previous 365 days, its value increased by 36.57%.

Walmart (NYSE: WMT)

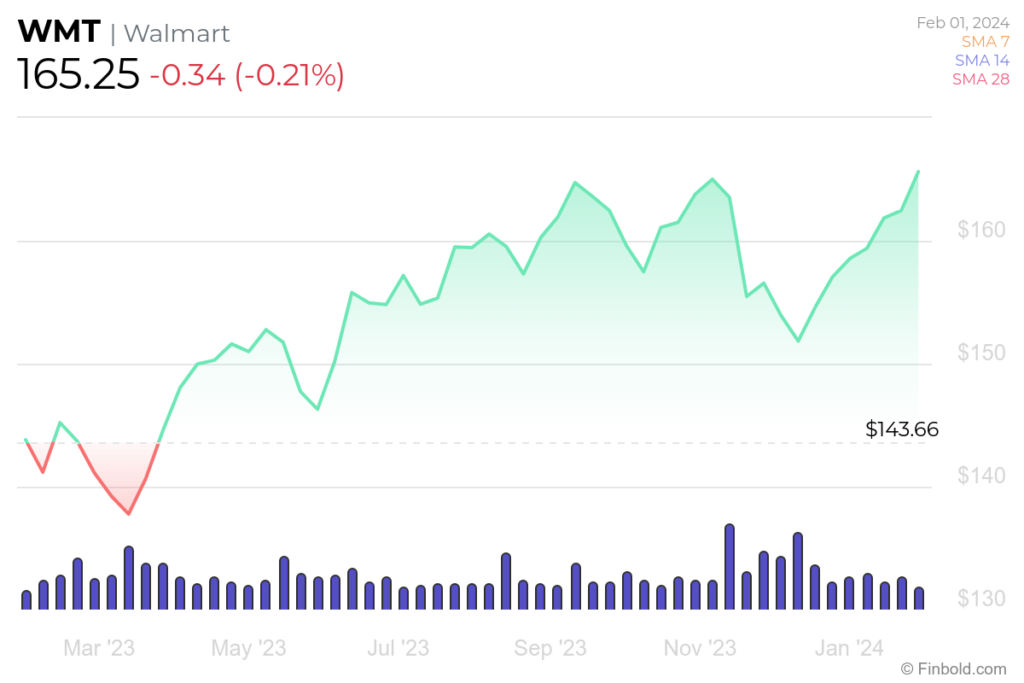

The retail industry giant Walmart (NYSE: WMT) maintained a solid and constant performance in the previous year and looks set to extend this winning streak in the upcoming months.

On January 30, Walmart declared a 3-for-1 stock split, emphasizing that a reduced stock price would facilitate broader employee ownership. This initiative aims to improve working conditions, enhance employee retention, and boost job appeal.

On January 29, the company introduced a fresh incentive program for store managers involving annual stock grants. Starting in April, U.S. store managers can obtain up to $20,000 in company stock, potentially elevating the total compensation for exceptional performers to exceed $400,000.

This stock boasts a 1.38% annual dividend yield and a $0.57 quarterly dividend amount.

At the time of writing, WMT stock was trading at $165.25, losing -0.21% of its value since the previous market closing. On the contrary, it added 2.39% to its value in the last five trading sessions and 14.23% over the past 12 months.

Savara (NASDAQ: SVRA)

The pharmaceutical industry always seems like a safe bet for investors, with hidden gems all over it. One of these is Savara (NASDAQ: SVRA), which specializes in producing treatments for rare respiratory diseases.

Savara’s lead therapy, molgramostim, in a phase 3 trial, is expected to complete patient enrollment next month, with a top-line readout now anticipated for Q2 2024. According to CEO Matt Pauls, with $114.8 million in cash, the company is well-funded through 2025.

Molgramostim, an inhaled biologic, is in phase 2 trials for treating autoimmune pulmonary alveolar proteinosis (aPAP), a rare lung disease affecting under 5,000 people in the U.S. It has received Orphan Drug designation from the FDA and EMA, along with Breakthrough Therapy and Fast Track designations from the FDA.

At the time of reporting, SVRA was trading at $4.94, losing -2.18% since the previous closing and -1.98% in the last five trading sessions. However, this stock added 97.60% to its value last year.

These stocks showcase the potential for further gains in 2024, as their technical and fundamental indicators look set to support them through this run. In addition to this, the leadership and projects undertaken showcase strong potential.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.