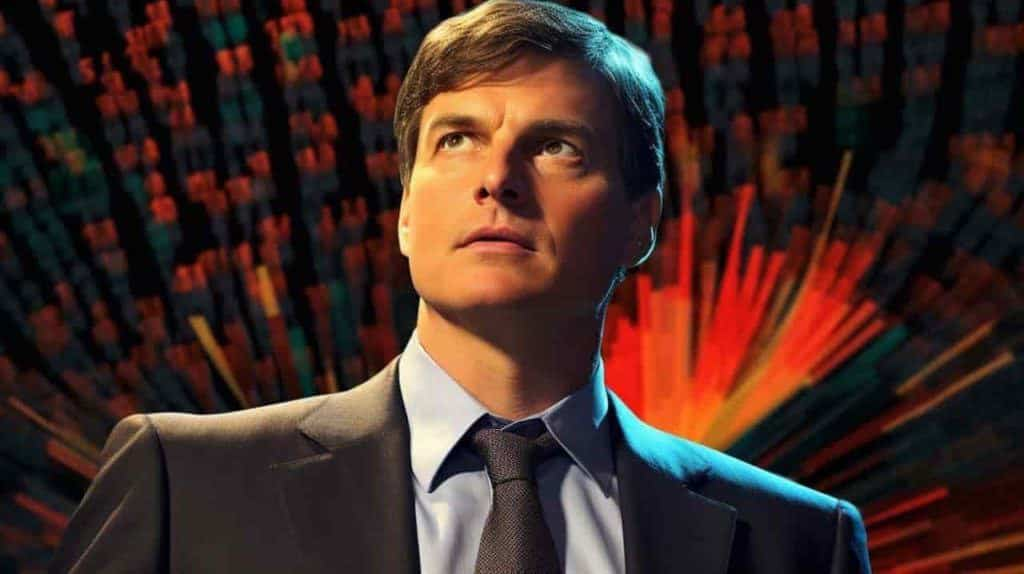

Investment maverick Michael Burry, renowned for his astute predictions during the 2008 recession, continues to face headwinds in his latest bearish venture against the semiconductor sector.

Last month’s revelation that Burry closed his bearish position targeting the broader US stock market at a loss raised eyebrows, especially as he redirected his pessimistic sentiments toward SOXX, a major semiconductor exchange-traded fund (ETF). Recent reports from Finbold underscore a growing challenge for Burry, as his bet against chipmakers seems to be mired in significant unrealized losses.

These losses mounted further on December 14, when five stocks within the SOXX ETF soared to 52-week highs, intensifying the concerns over Burry’s semiconductor gamble amidst the flourishing AI boom.

Which stocks have surged?

As highlighted by StockMKTNewz, a popular stock news account on X, dozens of US stocks reached fresh 52-week highs on December 14 in what was another strong session for the broader stock market.

Out of those, five stocks are constituents of the iShares PHLX Semiconductor ETF, or SOXX – the semiconductor fund Burry bet against in Q3.

These include Broadcom (NASDAQ: AVGO), Intel (NASDAQ: INTC), Qualcomm (NASDAQ: QCOM), Applied Materials (NASDAQ: AMAT), and Micron (NASDAQ: MU). All of these stocks have a significant weighting in the ETF that Burry shorted, with Broadcom topping that list at 9.75%.

Weighting refers to the proportionate representation of individual stocks within the fund.

Because these stocks drive the index’s gains and losses, the surge to 52-week highs in these five stocks resulted in SOXX climbing more than 2.7% on Thursday, bringing its total year-to-date rise to around 65%.

AMD (NASDAQ: AMD), the second biggest SOXX component by weighting, also printed a new 52-week high earlier this week.

With some predicting that the AI chip market could be worth a whopping $400 billion in four years, it’s hard to see semiconductor stocks stopping their current march any time soon. That is unless extraordinary bearish circumstances emerge, such as an economic recession.

In that case, investors’ appetite for stocks and other risk assets is typically reduced. Could that be why Burry shorted the SOXX ETF?

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.