As Bitcoin (BTC) surpasses crucial resistance zones and rises above the $52,000 threshold, the broader cryptocurrency market is starting to benefit from its gains.

Finbold’s cryptocurrency market analysis highlights six digital assets that have recently experienced notable price shifts, increased investor attention, or significant developmental advancements.

This week’s selections present appealing investment prospects, particularly for traders seeking entry opportunities below $0.01 per coin or token.

Shiba Inu (SHIB)

One of the most popular meme coins, Shiba Inu (SHIB), has experienced a significant price increase, which can be justified by the rising number of transfers on its network, Shibarium.

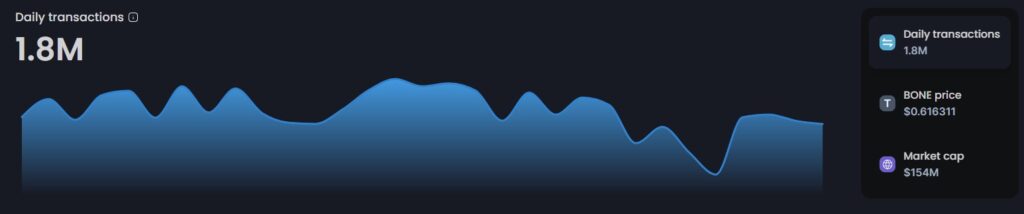

Based on on-chain data from Shibariumscan, daily transactions surged from approximately 530,000 on February 9 to around 1.8 million on February 14. This represents a significant increase of nearly 240% in just a few days.

The increasing number of transactions indicates growing utilization and engagement within the ecosystem, as Shibarium aims to support the Shiba Inu ecosystem by providing a scalable and efficient infrastructure for decentralized applications (dApps), including those involving SHIB transactions.

Conversely, SHIB’s price has risen to $0.0000096 at the time of writing after experiencing a -0.06% decrease, which put a dent in gains of 8.43% over the past 7 days.

SATS (1000SATS)

SATS (1000SATS) is a digital token created to commemorate the legacy of Satoshi Nakamoto, the pseudonymous creator of Bitcoin. Named after the smallest unit of Bitcoin, known as a ‘satoshi,’ SATS operates on the BRC-20 standard.

After a surge of over 10% in the previous week, the SATS price stabilized at $0.0000004665 to $0.0000005000 for approximately one week. Subsequently, heightened market volatility led to a breakdown below the support level.

However, SATS experienced a breakout early today during the initial trading hours, which then reverted and put its price to a current level of $0.0004674.

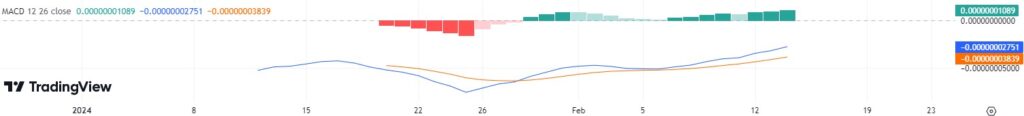

Technical indicators for SATS, especially the MACD, display a rising green histogram, implying increased buying pressure for this digital asset within the market.

BitTorrent (BTT)

BTT serves as the native token within the BitTorrent-New ecosystem, primarily utilized for rewarding contributors. Additionally, participants can use this token to procure various products and services available within the platform. BTT boasts a circulating supply of 932 billion tokens, resulting in a market capitalization of $788 million.

The BitTorrent technical community has recently initiated discussions on the BTIP-51 proposal.

BTIP-51 proposes a groundbreaking concept: integrating file metadata into the blockchain. This innovative proposal seeks to transform data storage by bolstering security measures and promoting decentralization within the network.

At the time of press, BTT price was $0.0000009853, marking a 0.69% increase in the last 24 hours, which adds to the substantial gains of 27.44% made over the past week.

Terra Classic (LUNC)

Terra Classic (LUNC) has recently reentered the top 100 crypto assets by market capitalization. Additionally, it is poised to achieve another significant milestone by burning 100 billion LUNC tokens.

According to the latest data from the Terra Classic analytics platform LUNC Metrics on February 14, the Terra Classic community is on the verge of burning 100 billion of its native tokens.

This collaborative effort aims to reduce the circulating supply of tokens.

And as the supply decreases, the price rises, as LUNC is worth $0.0001163 at the time of reporting, after 1.79% daily and 7.47% weekly gains, respectively.

eCash (XEC)

eCash (XEC) represents the rebranded iteration of Bitcoin Cash ABC (BCHA), which originated as a fork of both Bitcoin and Bitcoin Cash (BCH). Positioned as a “cryptocurrency designed for use as electronic cash,” eCash emphasizes its role as a medium of exchange for facilitating purchasing goods and services transactions.

eCash is experiencing a notable surge in adoption as a payment solution, evidenced by its integration into platforms like Crypto.com. Additionally, eCash has strategically formed partnerships with entities in the blockchain sector, including Binance Labs and Bitcoin.com.

With the increased adoption and visibility, XEC’s price increased to $0.00003399 at the time of press, following an upswing of 1.93% daily and an increase of 16.08% on the weekly chart.

XEC shows potential for a bullish swing as it is above its 200-day moving average, bouncing back from oversold territory and boasting 17 green days in the past month.

Siacoin (SC)

Siacoin (SC) serves as the native token of the Sia blockchain network and plays a pivotal role in facilitating transactions and interactions within the Sia crypto network. By harnessing the capabilities of decentralized blockchain networks, Sia aims to democratize cloud storage and enhance the adaptability of cloud services, all while reducing costs for users.

Its development team is constantly looking to upgrade the firm foundation of the Sia network by implementing grants, partnerships, and agreements with companies looking for creative and innovative solutions.

At the time of reporting, SC was trading at $0.009764, which comes after gains of 1.78% on the daily chart, supplementing an already green weekly chart of 16.43%.

Technical indicators for SC spell out a bullish prospect at a ‘strong buy’ rating of 16. Moving averages tilt towards the same opinion, with 14 grades in favor. However, oscillators remain neutral due to 8 indicators.

While these altcoins are currently experiencing gains, it is essential to highlight the volatility and fast pace of the crypto market. Therefore, investors should exercise caution when allocating their assets.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.