Although the majority of focus already this year has been on Nvidia (NASDAQ: NVDA) as it continues to climb from last year, its competitor Advanced Micro Devices (NASDAQ: AMD) also had a robust performance in 2023, adding over 100% to its value and looks set to continue its growth in 2024.

AMD recently doubled its focus on artificial intelligence (AI), producing chips specialized in training AI and delivering better memory capacity and performance than its predecessors.

The recent start of the year has showcased solid performance for this stock, as it further expanded its value by over 5%.

With all attention focused on AI and companies directly connected to it, Finbold utilized AI predictions from CoinCodex to provide the price prediction for AMD stock by the end of 2024.

The AI algorithms predict a slight increase in its stock price with shares expected to trade at $159.84 by the end of the year, representing a 9.06% increase from its current price of $146.56 at the time of writing.

Other industry giants could propel AMD stock even further

Anticipations suggest a resurgence in PC sales, potentially leading to improved sales revenue for AMD, given the company’s role as a supplier of chips for personal computers.

Prominent technology giants, such as Meta Platforms (NASDAQ: META) and Microsoft (NASDAQ: MSFT), have announced the adoption of AMD’s chips, signifying a notable departure from Nvidia’s chips. For companies unwilling to endure extended waiting periods for Nvidia chips, the availability of AMD’s latest AI chips provides a favorable alternative.

This development could be a catalyst that can propel the value of AMD stock to new highs due to the potentially high demands that MSFT and META might have.

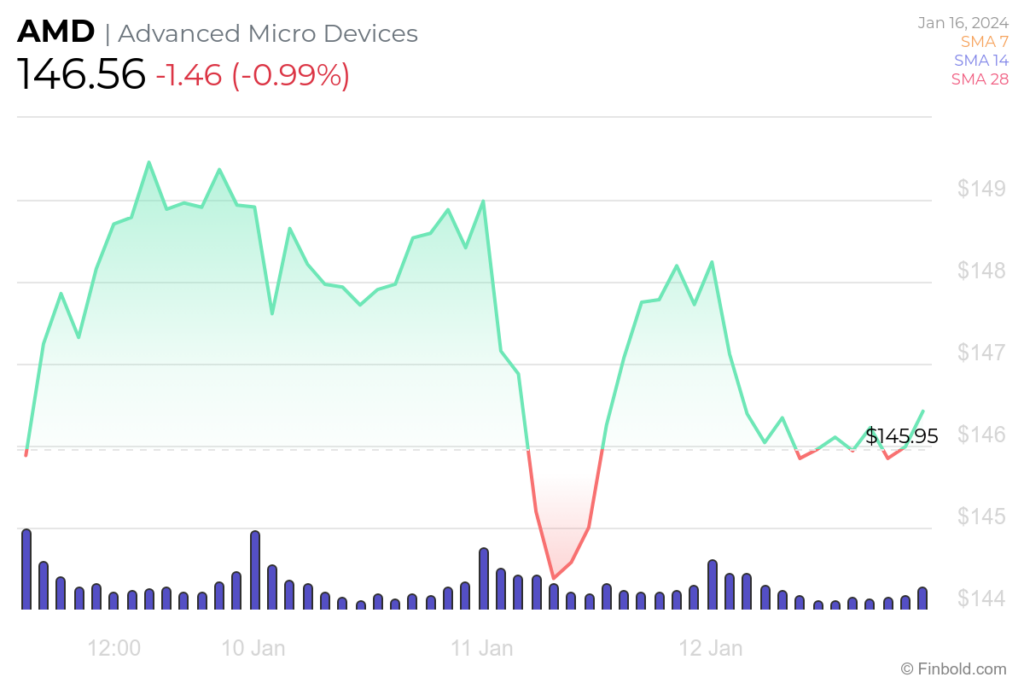

AMD stock price analysis

At the time of press, AMD stock was trading at $146.56, marking a decrease of -0.99% since the last trading session, contrary to the gains made in the previous five trading sessions of 4.42%.

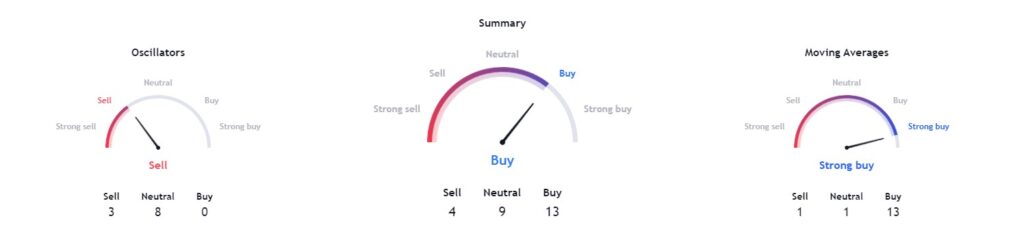

Technical indicators paint a clashing picture regarding this stock, as overall sentiment tilts toward ‘buy’ at 13, and moving averages agree with a ‘strong buy’ at 13. Oscillators, however, disagree while showing a ‘sell’ at 3.

Whether the broader adoption of its chips will allow AMD to counter Nvidia has influence over the microchip industry remains to be seen. As of now, it has stayed in the shadow of its competitor.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.