Ethereum (ETH) has faced sustained bearish pressure in recent weeks, with its price struggling to gain upward momentum. Weak on-chain data and a lack of bullish sentiment have raised concerns among investors and analysts about the cryptocurrency’s long-term trajectory.

However, in a surprising turnaround, Ethereum surged over 8% on March 19, reclaiming the crucial $2,000 level for the first time since March 10. The rally has brought optimism to the altcoin market, with broader gains seen across major cryptocurrencies.

Finbold AI predicts Ethereum price target for April

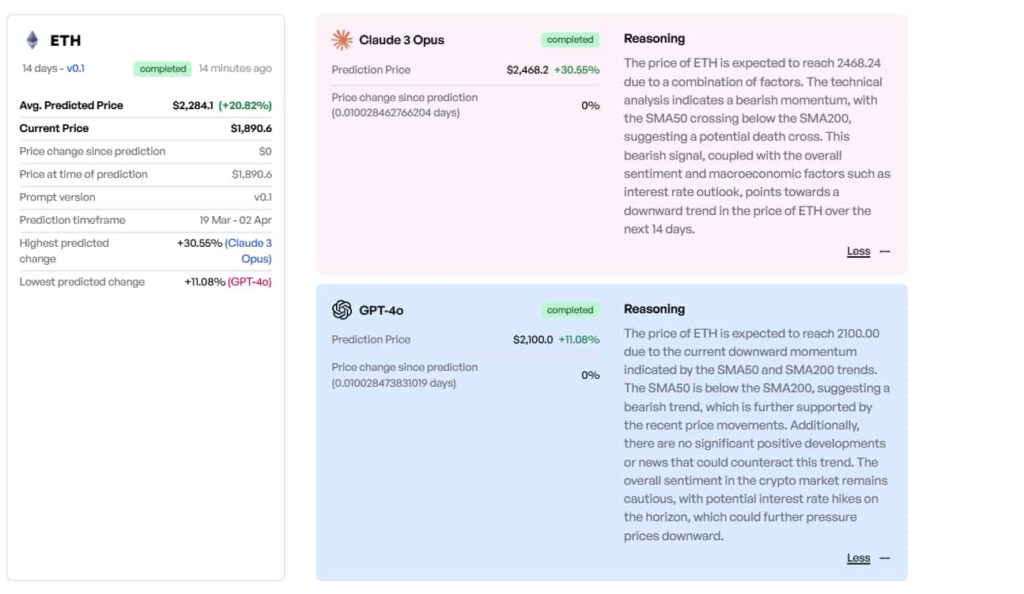

Despite the prevailing cautious sentiment, Finbold’s AI-powered prediction tool projects a potential bullish trajectory for Ethereum heading into early April.

The model forecasts an average price target of $2,284.1, marking a 20.82% increase from the price at the time of prediction, which stood at $1,890.6.

Among the models, Claude 3 Opus presents the most optimistic scenario, setting a price target of $2,468.2, with a 30.55% gain.

Interestingly, while it acknowledges bearish momentum, highlighted by the SMA50 crossing below the SMA200, indicating a potential death cross, it anticipates a strong recovery, possibly driven by shifts in macroeconomic sentiment.

Meanwhile, GPT-4o offers a more conservative outlook, forecasting ETH to reach $2,100, with a 11.08% gain, while highlighting the downward momentum from the same technical indicators.

GPT-4o also warns of potential downside risks from looming interest rate hikes and a lack of major positive developments in the crypto space, keeping near-term optimism in check.

Overall, while the AI models indicate near-term bearish signals, the projected average price still points to substantial upside potential for Ethereum over the next two weeks, depending on broader market conditions and macroeconomic developments.

Ethereum’s broader landscape

Beyond technicals, Ethereum’s broader landscape could heavily influence its next price shift.

One key development is the highly anticipated Pectra upgrade, which recently went live on the Sepolia and Holesky testnets. Following the discovery of several bugs during initial testnet trials, Ethereum developers opted to launch a third testnet, Hoodi, pushing the upgrade rollout to late April.

Designed to enhance scalability, transaction speeds, and cost efficiency, the upgrade could further stimulate demand for ETH.

Institutional interest in Ethereum is also growing. Notably, World Liberty Financial (WLFI), a decentralized finance platform backed by Donald Trump has significantly increased its ETH holdings, now holding 7,166 ETH indicating confidence in the asset’s long-term value.

From a technical perspective, Ethereum has entered its first week of recovery after three consecutive weeks of losses, finding support at the lower boundary of a year-long megaphone pattern.

This setup mirrors the 2019-2020 consolidation, which led to a bullish breakout. Analysts now expect ETH to potentially test the 1.5 Fibonacci extension level near $6,000 before the cycle peaks later this year. While this target reflects a long-term outlook, it underscores Ethereum’s strong potential for sustained growth.

Featured image via Shutterstock