Video game retailer GameStop (NYSE: GME) has encountered a challenging start to the year as its stock faces a downturn aligning with the general market.

The decline in stock comes as the company, under the guidance of CEO Ryan Cohen, works on implementing cost-cutting strategies and refocusing its operations.

The strategic shift involves a renewed emphasis on GameStop’s core business, which includes selling games, consoles, and gaming merchandise. At the same time, peripheral activities have seen reduced expenditures, reflecting a commitment to profitability and revitalizing the company’s core offerings.

AI prediction of GameStop stock price

To gauge the future trajectory of GameStop’s stock, Finbold turned to artificial intelligence (AI) predictions from CoinCodex.

According to data retrieved on January 21, the AI tool projected that GameStop’s stock will likely reach $34.73 on the last day of 2024. This forecast indicates a growth of almost 140% from the stock’s current price, suggesting potential optimism for investors.

What next for GameStop

In the meantime, GameStop continues to implement several strategies to align with its future goals. For instance, GameStop decided to shut down its non-fungible tokens (NFT) marketplace, which operated for approximately a year and a half.

The company attributed this move to uncertainties in crypto regulation, signaling a strategic reevaluation of its involvement in non-core ventures.

At the same time, investors will rely on Cohen’s management philosophy, which includes a commitment to having “skin in the game.” In this line, since assuming the role of chairman of the board, he has implemented equity ownership policies, contributing to increased executive turnover within the company.

In the past, Cohen has emphasized frugality to streamline operations and navigate the company toward profitability. The communication hinted at the potential jeopardy of GameStop’s survival if these measures fail.

GME stock price analysis

By press time, GameStop stock was trading at $14.51, showing minimal gains of about 1.5% within the last 24 hours. However, on a year-to-date (YTD) basis, GME is down 12%.

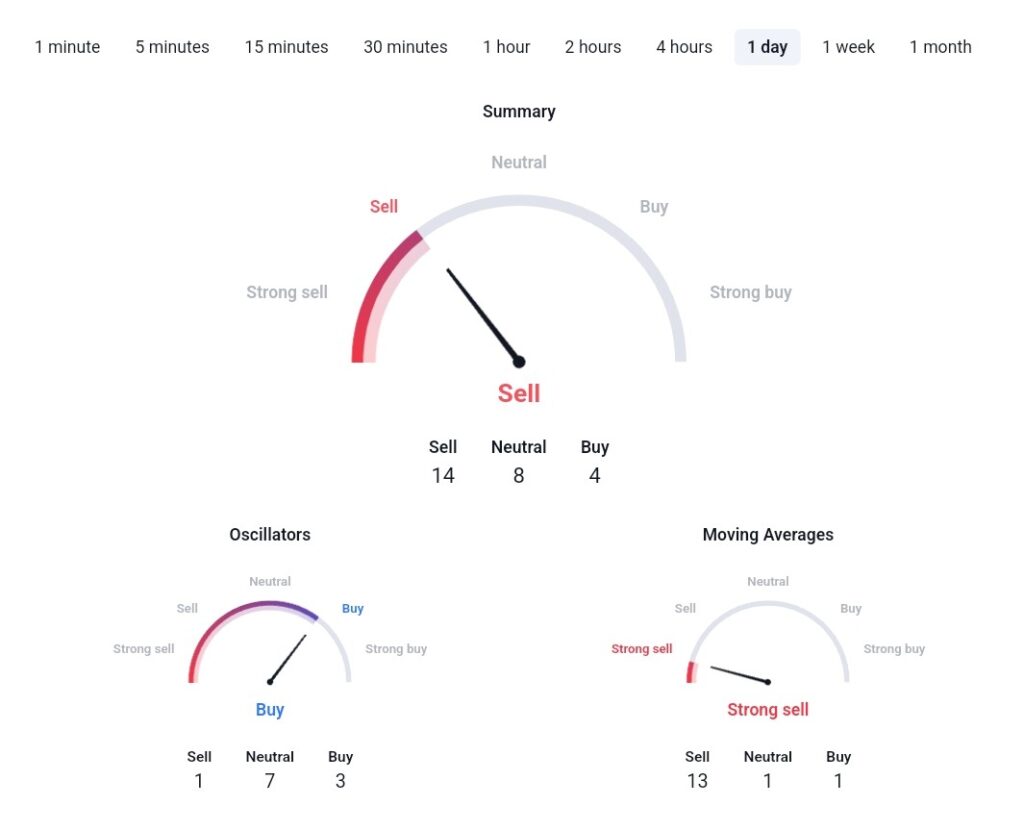

Elsewhere, a review of GameStop’s technical indicators aligns with bearish sentiments. A summary of the one-day gauges retrieved from TradingView recommends a ‘sell’ sentiment at 14 while moving averages suggest a ‘strong sell’ at 13. Oscillators are aligning with a ‘buy’ sentiment at 7.

Although the general market trajectory partly influences GameStop’s stock, its overall prospects will heavily depend on the success of the ongoing business strategies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk