With 2023 being an underwhelming year for Nio (NYSE: NIO), full of ups and downs, the beginning of this year is more of the same, as its stock price is down by -17.13% from the start of this month.

In 2023, Nio successfully delivered 160,038 vehicles, marking a notable 30.7% surge compared to the previous year while exceeding a 400 threshold of daily deliveries in October. This achievement is particularly noteworthy given the challenging global macroeconomic conditions and the persistent electric vehicle price competition in the company’s domestic market of China.

The disparity in performance prompted Finbold to employ the AI-driven forecasts provided by CoinCodex, aiming to project a potential price range for NIO stock by the conclusion of 2024.

As per the algorithms, the anticipated price for NIO is predicted to climb to $16.65 by the end of the year, showcasing a substantial 125% increase from its current level of $7.40 as of the time of writing.

Business milestones for Nio

While the annual earnings report is unavailable now, the observed sales growth suggests a positive trajectory. The company’s premium-priced products continue to find favor among customers. Several new models, including the recently launched ES6 SUV, were introduced last year.

A notable feature of NIO’s business model is its operation of battery-swapping stations. These stations provide subscribing customers the convenience of exchanging depleted vehicle batteries for fully charged ones in a concise duration of approximately three minutes.

NIO boasts approximately 2,200 such stations, primarily in China, with an expanding presence in Europe. The company aims to augment this network by adding 1,000 stations within the current year. The establishment and expansion of this infrastructure involve substantial financial investment, underlining the significance of the agreement forged with the Chinese automotive giant Geely, the owner of Volvo and Lotus, in November.

NIO stock price analysis

At the time of press, NIO was trading at $7.40 with an increase of 0.94% from the previous closure and a loss of -4.96% in the last 5 trading sessions, according to the latest data.

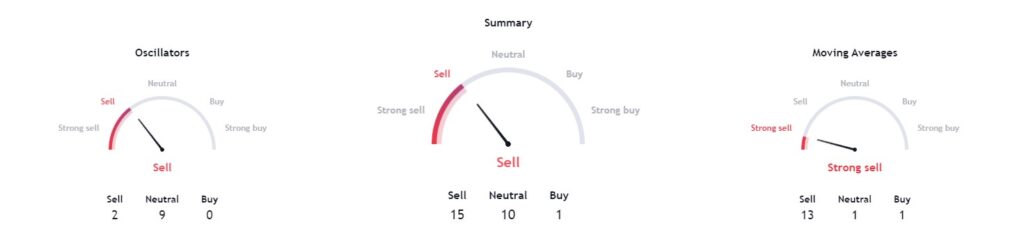

Technical indicators for this EV stock spell out a grim outlook. With a consensus of ‘sell’ at 15, moving averages are at ‘strong sell’ at 13, with oscillators agreeing with the overall sentiment of ‘sell’ at 2.

Only time will tell whether this EV company will weather the storm and pull its stock with it in 2024. As of now, the outlook could be better.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.