As Nvidia (NASDAQ: NVDA) stock moves to recover from the price declines it suffered in recent weeks amid fears that the artificial intelligence (AI) hype might be over, different AI models have conveyed general optimism regarding its price performance toward the end of this year.

Indeed, Nvidia stock price rose nearly 5% this week after losing ground in July and earlier in August, at least partially reacting to Bernstein analyst Stacy Rasgon’s argument that the three-month delay in the company’s next-generation chip will not significantly impact its market share.

ChatGPT NVDA stock prediction

Specifically, according to ChatGPT-4o, the AI model by OpenAI, “Nvidia’s stock could realistically range from around $806 at the lower end to $1,636 or beyond at the high end by the end of 2024, reflecting both conservative and aggressive growth scenarios.”

As the chatbot explained, the prediction relies on the average 12-month forecast among analysts, “with a high target of $200 and a low of $62,” and technical analysis (TA), which suggests a positive end-of-year target of around $1,636 and a pessimistic one at $806.

Meta AI NVDA stock prediction

At the same time, Llama 3.1 by Meta Platforms (NASDAQ: META) has stated that NVDA stock price at the end of 2024 “could range from approximately $130.88 on the lower end to $200 on the higher end,” based on the average price target among analysts and a forecast of $1,757.05 in the next 30 days.

As Meta AI pointed out:

“Nvidia’s strong growth in the AI and data center sectors is expected to continue driving the stock’s performance. The company’s revenue has been increasing significantly, with data center revenue reaching $18.4 billion in the last quarter, a 409% year-over-year increase. This growth trend supports a positive outlook for the stock’s future performance.”

Google Gemini NVDA stock prediction

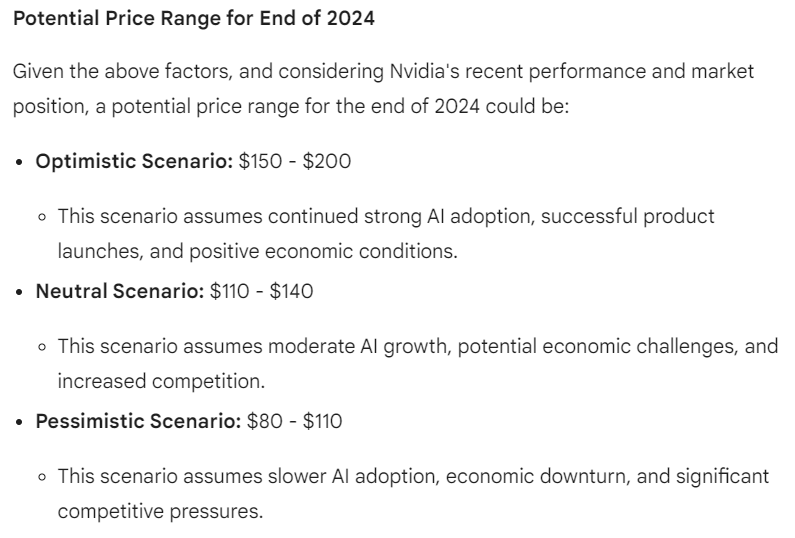

Finally, the generative conversational AI innovation by Alphabet (NASDAQ: GOOGL), called Google Gemini, has offered three scenarios and hypothetical NVDA stock price ranges based on Nvidia’s dominance in AI, macroeconomic and geopolitical factors, and market sentiment:

NVDA stock price history

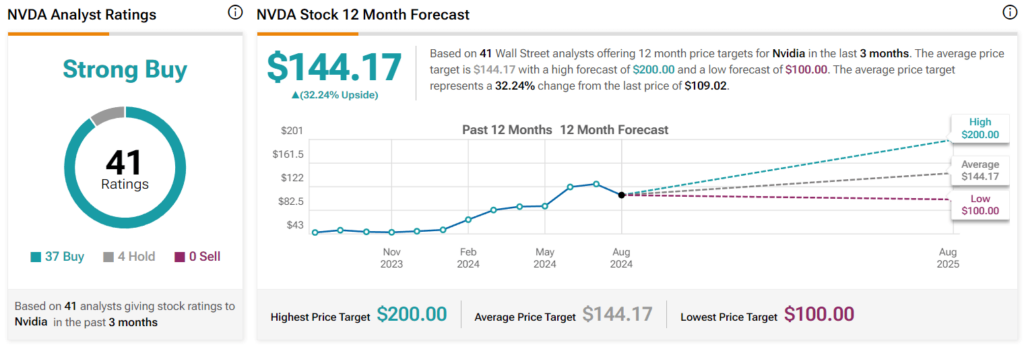

Meanwhile, the price of Nvidia stock at press time stood at $109.02, which indicates a 4.08% gain on the day, adding up to the 4.73% advance across the past week, as it reduced its monthly loss to 15.12% while accumulating a 126.32% increase on its year-to-date (YTD) chart, according to the latest data on August 13.

This illustrates a positive long-term trend but a negative short-term pattern, with NVDA stocks trading in the middle of their 52-week range, their support currently residing in the $98.91 to $105.96 area, and facing resistance at the $135.58 price level.

What experts say

It is also worth noting that 41 Wall Street analysts have offered their Nvidia stock price forecasts for the next 12 months over the past three months, with an average target standing at $144.17, the lowest at $100, and the highest at $200, and a consensus score of ‘strong buy.’

One of them is Wedbush’s Dan Ives, who is confident that the company’s highly anticipated earnings report, scheduled for August 28, will be not only an exciting event but also a ‘drop the mic moment’ for Nvidia, marking the end of the semiconductor behemoth’s struggles.

In fact, taking into account the Nvidia stock split and provided that its earnings meet or even surpass expectations, NVDA should be ready for a significant price recovery, particularly important as NVDA stocks have already dropped to as low as $100 in August, for the first time since May.

In conclusion, NVDA shares might follow the path set by any of the above AI models, and market experts generally seem to agree, but doing one’s own research should take precedence when investing, as trends in the stock market can easily and unexpectedly change.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.