Palantir Technologies (NYSE: PLTR) is one of the hottest stocks in the market, capitalizing on the artificial intelligence (AI) boom with a significant rally following solid Q2 2024 earnings results.

Indeed, PLTR reached the $30 resistance zone on August 9, marking a weekly increase of 38%. Following the company’s bullish forecast for the rest of the year, particularly regarding projected revenue, the market anticipates a further surge in the stock’s valuation.

Consequently, breaking through the $30 resistance is seen as a key indicator for reaching new highs.

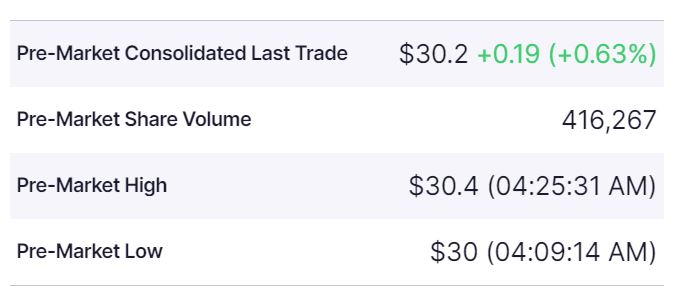

Elsewhere, ahead of the market opening on August 12, PLTR is trading in the green zone during the pre-market session. Specifically, the stock has rallied over 0.6% to a valuation of $30.23.

In the earnings report, Palantir’s revenue reached $678 million, while adjusted income from operations rose to $254 million. The data analytics company now expects annual revenue between $2.74 billion and $2.75 billion, compared to the earlier expectation of $2.68 billion to $2.69 billion.

Notably, the tech firm’s growth is significantly tied to its venture into artificial intelligence (AI). The company’s AI service tests debug code and evaluates AI-related scenarios.

In a major development in the company’s history, Microsoft (NASDAQ: MSFT) and Palantir are collaborating to provide cloud, AI, and analytics capabilities to the US Defense and Intelligence Community.

AI’s take on PLTR stock

With this bullish sentiment around the software company, attention is on how the stock will likely respond in the coming months. To gather insights, Finbold consulted OpenAI’s most advanced AI tool, ChatGPT-4o, to predict how PLTR will likely trade at the end of 2024. Indeed, the AI platform employs machine learning algorithms that provide predictive models that can offer a path for how the stock will trade.

The AI platform acknowledged that several factors would likely influence Palantir’s stock price by the end of the year. Company performance is a primary driver, with continued strong revenue growth from government and commercial contracts playing a crucial role. Achieving profitability could also positively impact the share price, along with innovations and improvements in software offerings.

Market conditions, such as overall sentiment, interest rates, and macroeconomic conditions, are also significant. The performance of the tech sector, especially other data analytics, and AI companies, will likely affect Palantir’s stock.

Additionally, ChatGPT-4o noted that the competitive landscape is another consideration, including the emergence of new competitors or advancements by existing ones and its ability to maintain or grow its market share.

The platform also cited the regulatory environment, such as changes in data privacy laws and regulations, as potentially impacting Palantir’s operations. The stability and growth of government contracts, especially in the US, are also considered crucial.

Palantir’s price targets

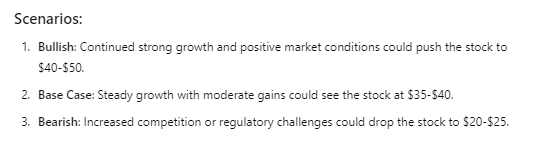

In a bullish scenario, where the Denver-based firm continues to grow its revenue at a high rate, improves profitability, and secures significant new contracts, ChatGPT-4o projected that the stock could potentially rise, possibly exceeding $40-$50 by the end of 2024.

On the other hand, in the base case scenario, where Palantir maintains steady growth with no major disruptions in its business model or market conditions, the AI platform predicted a price of $35-$40.

In a bearish scenario, where Palantir faces increased competition, regulatory challenges, or fails to meet growth expectations, ChatGPT-4o foresees the equity dropping to $20-$25.

Indeed, as Palantir’s fundamentals look promising, it’s worth noting that the stock is also susceptible to the general trajectory of the US economy, especially with lingering recession concerns.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.