As artificial intelligence solidifies its position and significance in the world, Nvidia (NASDAQ: NVDA) emerges as a symbol of this success. NVDA stock witnessed an impressive 240% price surge in 2023 and has continued to grow by over 60% since the beginning of this year.

Interestingly, Nvidia’s rival, Advanced Micro Devices (NASDAQ: AMD), might follow a similar trajectory this year, with the same pattern observed in AMD’s stock movement resembling the one exhibited by NVDA stock before its significant price surge.

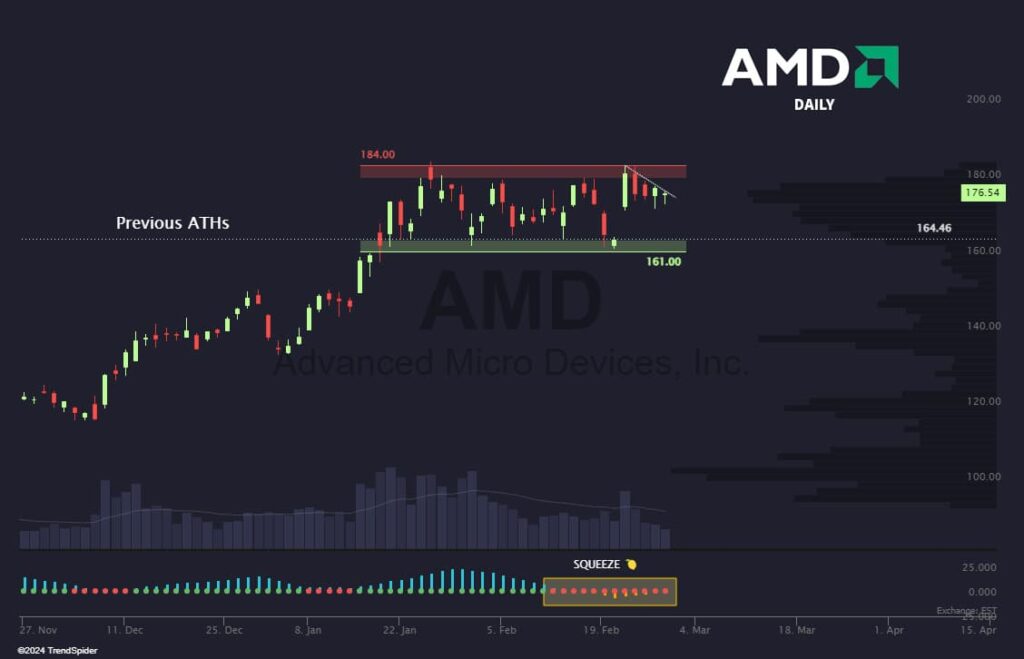

The similarity is noted in the movements resembling the sideways channel observed in NVDA stock price, which served as a consolidation catalyst before NVDA’s price surged to an all-time high. This consolidation pattern is also beginning to manifest itself on the AMD price chart.

Picks for you

Technical analysis of AMD stock

As for technical aspects of AMD stock, in the medium to long term, Advanced Micro Devices has broken below the floor of its rising trend channel, suggesting a slower initial rate of increase.

The price has retraced after a potential false break of the rectangle formation. A decisive move above $178 would provide renewed bullish signals for the stock. However, the price has retraced after a confirmed break below the $178 level, indicating a bearish signal.

Further downward movement could suggest ongoing bearish momentum for the stock. Traders may look for potential support levels below the current price to assess where the stock may find stability or potential reversal points.

Currently, the stock’s resistance level is at $181. An apparent breakthrough above this level would signal further upside potential. It’s worth noting that the RSI is showing negative divergence against the price, indicating a potential downside reaction.

Could AMD replace Nvidia’s supply?

Advanced Micro Devices emerges as a compelling alternative to Nvidia, with robust positions in numerous industries, AMD has maintained the second-largest market share in desktop GPUs for years.

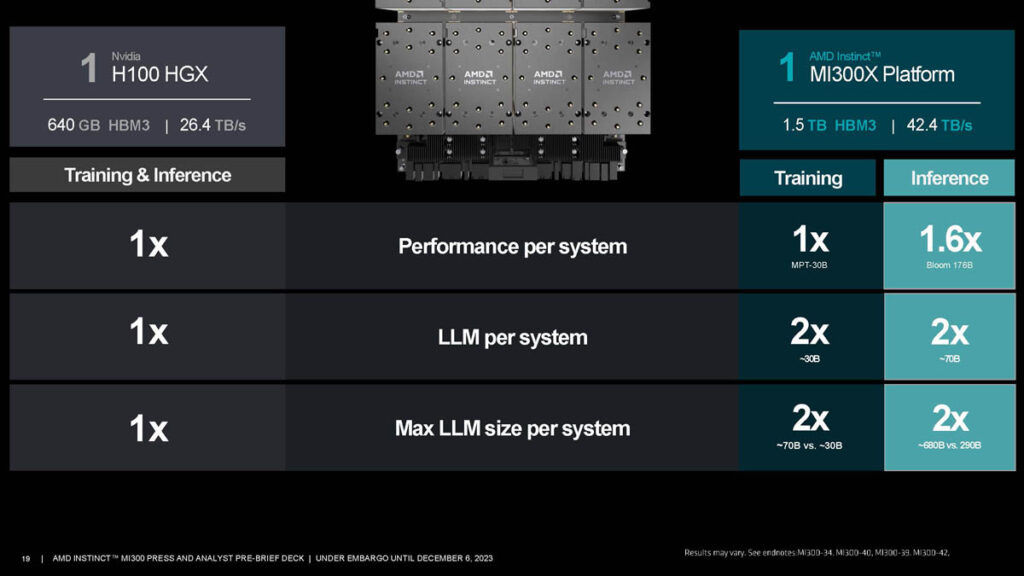

Throughout 2023, AMD focused on developing hardware capable of competing with Nvidia, and now its new chips have arrived. Last December, AMD revealed the MI300X AI GPU, boasting performance on par with Nvidia’s H100 for training and surpassing it by 10% to 20% for inference.

The introduction of AMD’s new chip has attracted attention, particularly with Microsoft’s (NASDAQ: MSFT) announcement in November. Microsoft revealed that its Azure cloud platform would be the first to incorporate the MI300X, enhancing its AI capabilities. Given Microsoft’s 49% stake in OpenAI, this partnership positions AMD strategically.

Additionally, AMD’s collaboration with Meta (NASDAQ: META), which plans to utilize the new chips, further brightens the company’s prospects in the AI sector.

Given AMD’s recent technological advancements aimed at expanding its presence in AI and the sector’s rapid growth, AMD stock appears poised to sustain its momentum in 2024.

However, for AMD to supplant NVDA, it must enhance its adoption by other major corporations. This could be accomplished by introducing new chip offerings and ensuring faster and more dependable supply cycles than its competitors.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.