Over the past three decades, significant events have reshaped the world, with advancements in technology, the internet, renewable energy, and the latest artificial intelligence constantly pushing the boundaries of innovation. Concurrently, these advancements have contributed to the gains of S&P 500 stocks.

As eras have evolved, so too have the leaders in the technology industry, transitioning from Microsoft (NASDAQ: MSFT) to Apple (NASDAQ: APPL) and then onto Nvidia (NASDAQ: NVDA).

However, when your company becomes synonymous with a particular sector—like Amazon (NASDAQ: AMZN) with e-commerce or Netflix (NASDAQ: NFLX) with streaming—it sets the stage for significant success in the modern era.

Technology stocks lead the pack in the S&P 500

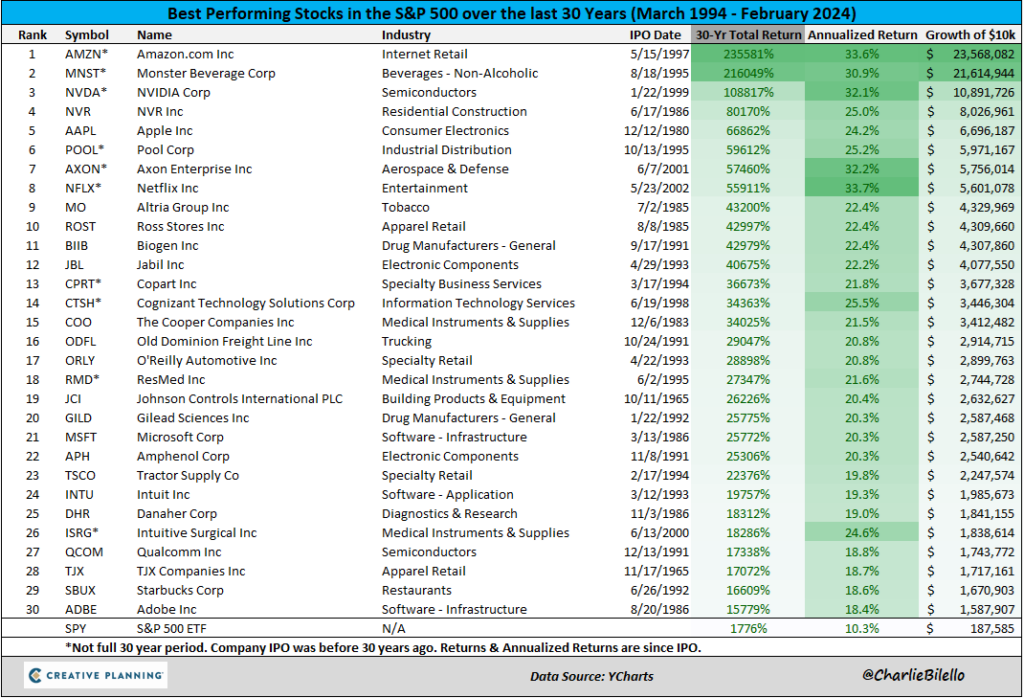

While it may not be the first stock that comes to mind, AMZN has experienced remarkable growth, boasting a return exceeding 230,000%. This has rewarded investors with an average stock gain of 33.6% for their trust.

Driven by the recent expansion of artificial intelligence and its increasing integration and significance across various industries, key player NVDA ranks third on the list, achieving a growth of 108,817% and a 32.1% return on traders’ investment.

APPL and NFLX are not far behind, with their 30-year returns at 66,862% and 55,911%, respectively. Netflix has added 33.7% to investors’ portfolios annually, compared to Apple’s 24.2%, despite Apple having a 22-year head start with its IPO.

Unlikely member of the top 5 performers in the S&P 500

Monster Beverage (NASDAQ: MNST) may surprise many on this list, but its impressive 216,049% stock growth and an annualized return of 30.09% make it hard to beat. If you were among the fortunate investors who backed MNST stock since its IPO in August 1995 and allocated $10,000 to this investment, your profit would exceed $21 million as of the time of writing.

When you contrast this with the 1776% return of the S&P 500 over the last 30 years, averaging 10.3% annually, the case for these industry leaders and their stocks becomes quite compelling.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.