A series of economic reports released on Friday have raised alarms that the United States economy may be on the brink of a recession. Bitcoin’s (BTC) price has suffered a recent crash following this macroeconomic scenario, but analysts see an opportunity.

The Bureau of Labor Statistics reported that the nation’s unemployment rate increased to 4.3% in July from 4.1% in June. Additionally, non-farm payroll employment rose by only 114,000 jobs, significantly below the anticipated 175,000 new jobs.

These figures have contributed to growing fears that a recession, long predicted by some economists, may now be imminent.

Notably, the stock market reacted swiftly and negatively to the news, while Nasdaq fell by nearly 2.5%, while the S&P 500 and Dow both dropped close to 2%.

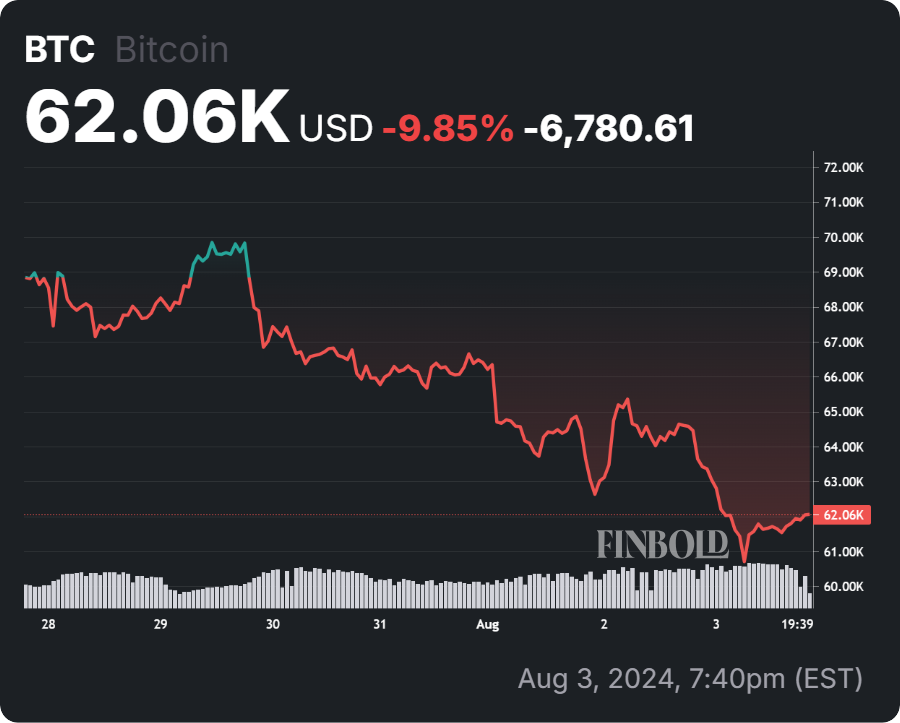

In the cryptocurrency market, Bitcoin’s price briefly surged to $65,400 before plummeting to around $62,350. Nearly all prominent cryptocurrencies experienced significant declines

Significant liquidations and volatility

Data from CoinGlass indicates that the volatility across crypto markets on Friday led to another surge in liquidations of both long and short positions. CoinGlass reports nearly $283 million worth of positions liquidated in the past 24 hours, with Bitcoin accounting for $85 million.

The volatility in the crypto market mirrored the bearish sentiment in the US stock market. The Nasdaq and S&P 500 continued to suffer, with the latter off 6% from its recent all-time high.

The “Magnificent 7” tech giants saw a collective market value swing of over $3 trillion in the past three weeks. The negative economic data and heightened recession fears also affected investors in Europe and Asia, compounding global market uncertainties.

Analysts’ perspectives and future outlook

Despite the current panic, some analysts view the situation as an opportunity for Bitcoin. The potential for a weaker U.S. dollar and Federal Reserve interest rate cuts could provide a boost to the cryptocurrency.

Analyst Stock Money Lizard noted that Bitcoin has reached the critical support level of $61,800, a historically strong reversal point. A daily or weekly close above this level could trigger a short-term bullish reversal, targeting the $66,000 to $69,885 range.

Should this support fail, the next downside targets are $56,800 and $51,740, aligned with Fibonacci extension levels. The Relative Strength Index (RSI) is near the oversold region, suggesting a potential rebound if buying pressure increases.

Similarly, analyst CryptoNueco highlighted Bitcoin reaching the $60.8k level, touching range lows, and retracing the liquidity pocket (LP). With short liquidations in lower time frames anticipated, an upside move is likely, offering a trading opportunity.

Analysts suggest monitoring for a rebound, as this could lead to a near-term recovery despite broader economic concerns. The next significant target is $71,600 if Bitcoin sustains above $60,800k.

Bitcoin price analysis

Bitcoin is currently trading at $62,070, reflecting a 5% decline in the past 24 hours.

The recent economic reports paint a grim picture for the U.S. economy, with rising unemployment and underwhelming job growth fueling recession fears. This has significantly impacted both the stock and crypto markets, with Bitcoin experiencing a sharp decline.

However, the current environment may offer a unique opportunity for Bitcoin to decouple from equities and benefit from a weaker U.S. dollar and potential Fed rate cuts.

Analysts suggest closely monitoring critical support levels and market indicators to navigate these volatile times effectively.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.