With the emergence of ChatGPT from OpenAI, the chatbot utilizing artificial intelligence (AI), the ability to analyze stock performance and potentially predict its movement, has proved helpful for investors.

Finbold has consulted ChatGPT to find out the potential performance of Apple (NASDAQ: AAPL) stock after the announcement of Apple Vision Pro release in the U.S. starting February 2.

Impact on AAPL price

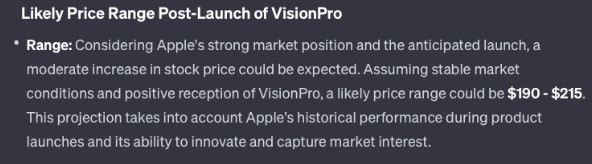

ChatGPT outlined potential price ranges and emphasized that introducing Vision Pro might positively impact AAPL’s price, likely putting it in the range of $190 to $215.

This is especially true concerning short-term hype, often a key factor in the immediate uptick of stock prices following significant events.

Picks for you

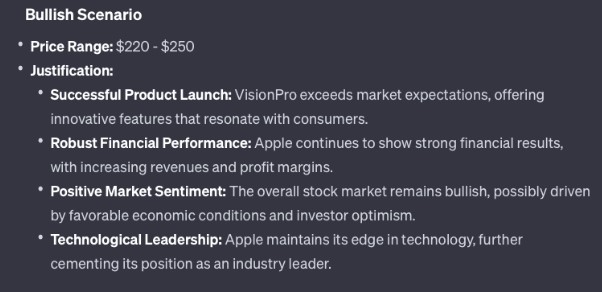

In case of exceeding market expectations and innovative solutions that satisfy the customers, Vision Pro might propel Apple’s stock price toward $220 to $250 due to market sentiment and technological leadership in the field.

In case of disappointment and poor utilization by customers, as well as a broader market downturn and fierce competition, AAPL stock might take a hit due to the underwhelming performance of its latest product, placing it in a range between $160 and $180.

AAPL stock price analysis

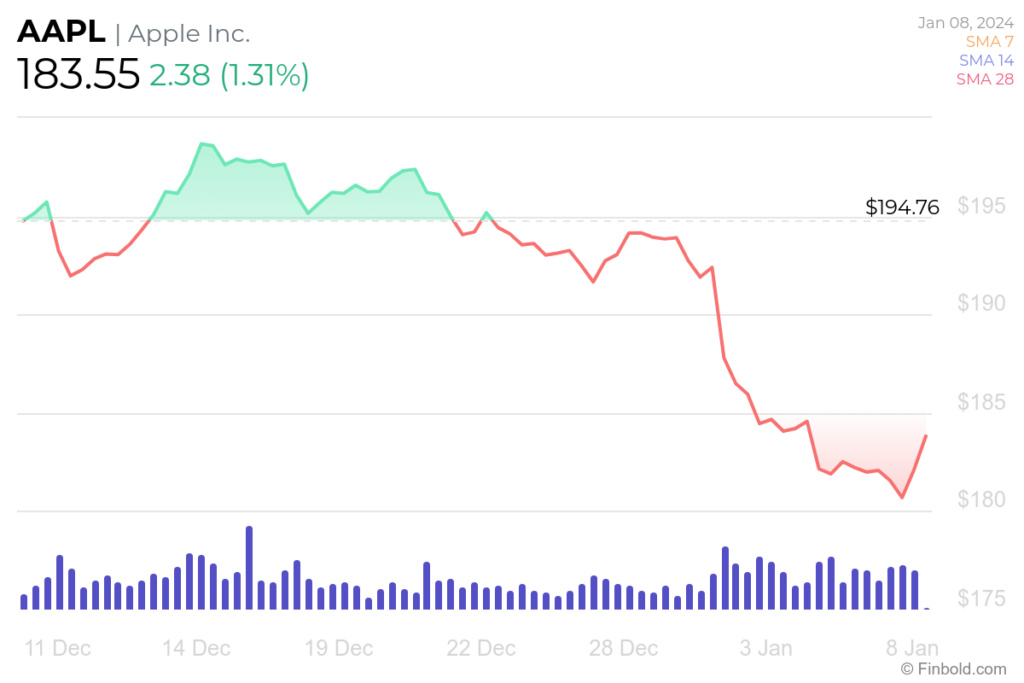

The price of the AAPL stock at press time was at $183.56, which indicates an increase of 1.31% on the day but declining -1.89% across the previous seven days, with its monthly chart witnessing a -6.21% loss, according to the latest information retrieved on January 8.

It is important to notice that this stock was recently downgraded by Barclays analysts, shifting it to underweight status.

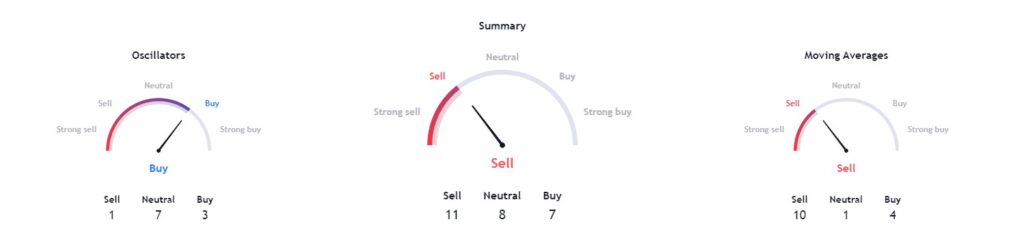

The current technical indicators spell out a bearish scenario for the Cupertino giant. Overall sentiment inclines towards ‘sell,’ at 11, with moving averages in agreement at 10, with oscillators disagreeing with a ‘buy’ rating at 3.

Whether the new product launch will spell out gains in the stock market remains to be seen, as it usually bodes well for this company and its stock.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.