Following the industry-wide trend, Dell (NYSE: DELL) is planning to utilize the ongoing artificial intelligence (AI) rally as it shifts its resources from the sales sector towards the new group focused on AI products and services, drawing analysts’ interest and potentially shifting its growth outlook in the upcoming period.

According to reports, Dell is planning to cut its workforce by more than 10%, affecting 12,500 job positions, after shredding 13,000 jobs already in the previous fiscal year, which brought its global workforce to a number of 120,000.

The sales team received a memo in which Sales executives Bill Scannell and John Byrne announced that Dell is undergoing restructuring efforts to become ‘leaner’ by streamlining management layers and reprioritizing investments.

The company also plans to revise its strategy for data center sales, although it has not disclosed the total number of jobs that will be affected by these changes.

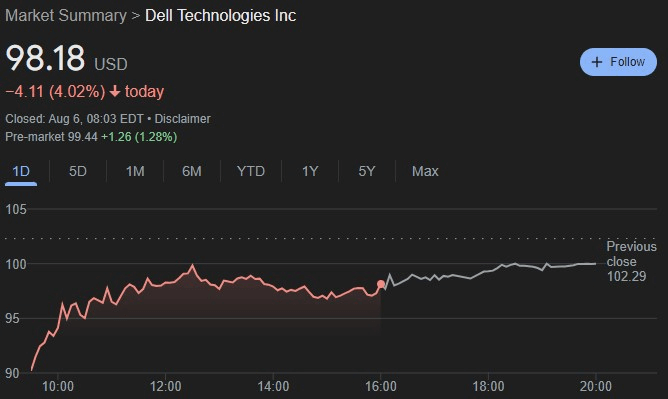

Dell stock price chart

In the meantime, DELL stock closed its latest trading session at $98.18 after a loss of 4.02%, which builds up on a negative trend of 12.58% in the past five trading sessions.

However, the pre-market shows gains of 1.28%, setting the price at $99.44 at the time of writing.

Technical analysis of DELL stock

Technical analysis of Dell Technologies’ stock reveals that it has broken below the rising trend channel in the medium to long term, signaling a weaker initial upward momentum.

The stock currently finds support at $81 and faces resistance at $130 amid the recent negative trend. The negative volume balance, where trading volume is high on days with falling prices and low on days with rising prices, further weakens the DELL’s position.

Additionally, with the Relative Strength Index (RSI) dropping below 30, the stock’s short-term momentum is strongly negative. For large-cap stocks like Dell, a low RSI can sometimes suggest that the stock is oversold, offering a potential opportunity for an upward correction.

Investors have been steadily lowering their selling prices, indicating growing pessimism and the likelihood of continued price declines.

Wall Street is optimistic when it comes to Dell’s stock

Analysts on Wall Street seem particularly optimistic when it comes to this hardware stock, as they have a bullish view of its fundamentals and growth prospects, reflected in a “strong buy” rating based on 12 experts’ opinions. Of these, 10 advise a “buy,” while one each recommends a “hold” and “sell.”

The average price target, set at $158.50, testifies to analysts’ bullish stance, indicating a potential 61.44% upside from current levels.

The upcoming Q3 earnings report, scheduled for August 29, will reveal whether the analysts’ optimism is warranted and whether the restructuring efforts had a positive effect.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.