Summary: Galvanized by expanding legalization and the gradual removal of social taboos, cannabis-related companies are becoming increasingly more lucrative for many investors. Due to being relatively young, these weed stocks mostly do not pay dividends, but several players have ventured in the direction of dividend payments and stable sources of income.

This guide will showcase the 3 best weed stocks that pay dividends and explain how to invest in them using a regulated brokerage like eToro.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

What are weed stocks that pay dividends?

Weed stocks refer to shares in publicly traded companies focused on growing, developing, manufacturing, and distributing cannabis and marijuana-related consumer goods.

Investing in anything remotely related to cannabis was unthinkable until relatively recent years. As fewer and fewer people frowned upon the mention of marijuana, the social taboo diminished, and weed has experienced growing decriminalization and legalization, especially in the United States. Therefore, a new market has begun to emerge and become prominent, drawing in quite a few investors.

Dividend stocks represent shares in companies that pay out a percentage of their profits to stakeholders as dividends, providing a stable source of revenue.

These stocks are especially attractive to investors looking to establish a reliable passive income stream, usually every quarter but also monthly or yearly. Furthermore, dividend payments do not affect the potential gains from stock face value speculation.

Dividend cannabis stocks merge the benefits of exposure to a rapidly growing new market with the stability of regular dividend payments. Let us proceed to list the three stock candidates that fit this description the most.

3 best weed stocks that pay dividends

We have chosen three dividend stocks on the market based on their current dividend yields, historical performance, and market capitalization. These include:

- Innovative Industrial Properties (NYSE: IIPR);

- AbbVie (NYSE: ABBV);

- Constellation Brands (NYSE: STZ).

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

1. Innovative Industrial Properties (IIPR)

Innovative Industrial Properties, Inc. (NYSE: IIPR) is a pioneering industrial company and REIT specializing in acquiring, owning, and managing licensed cannabis-specialized real estate in the United States.

Founded in 2016 in Maryland, Innovative Industrial Properties is the first publicly traded company to manage real estate for the medical cannabis industry. The company acquires freestanding industrial and retail spaces and leases them under long-term agreements to cannabis producers. In fact, the company oversees an investment capital of $2.40 billion, covering 108 properties with a total of 8,851,000 square feet across 19 states.

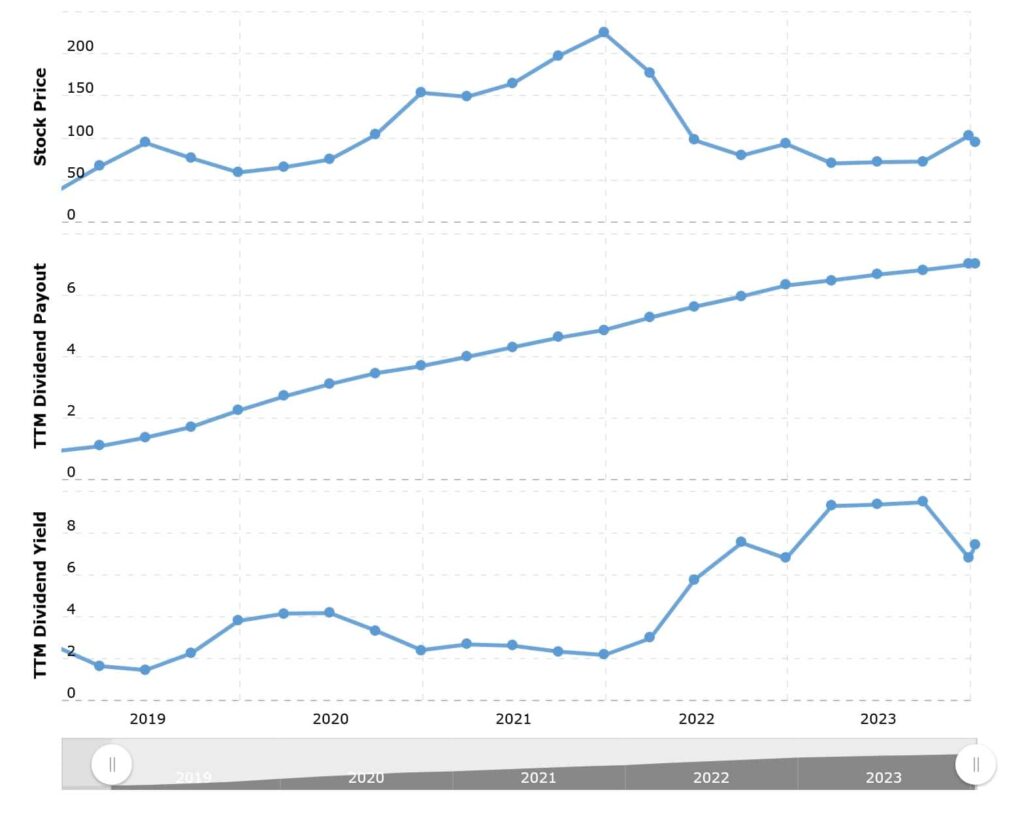

IIPR stock price today

IIPR estimated annual dividend yield

Your capital is at risk.

2. AbbVie (ABBV)

AbbVie Inc. (NYSE: ABBV) is an American multinational pharmaceutical company renowned for its emphasis on research and development in various domains, including immunology, neurology, and oncology. Some of its key brands include Humira, Skyrizi, Imbruvica, and Botox.

AbbVie has produced and distributed an anti-nausea drug, Marinol, from 1984 to 2019, which had dronabinol, a synthetic form of THC. While it does not currently hold any cannabis-related medicines in its portfolio, it has filed for at least 59 patents related to cannabis. Furthermore, it has not given up on its perspective on cannabis and is likely to pursue it again in the near future.

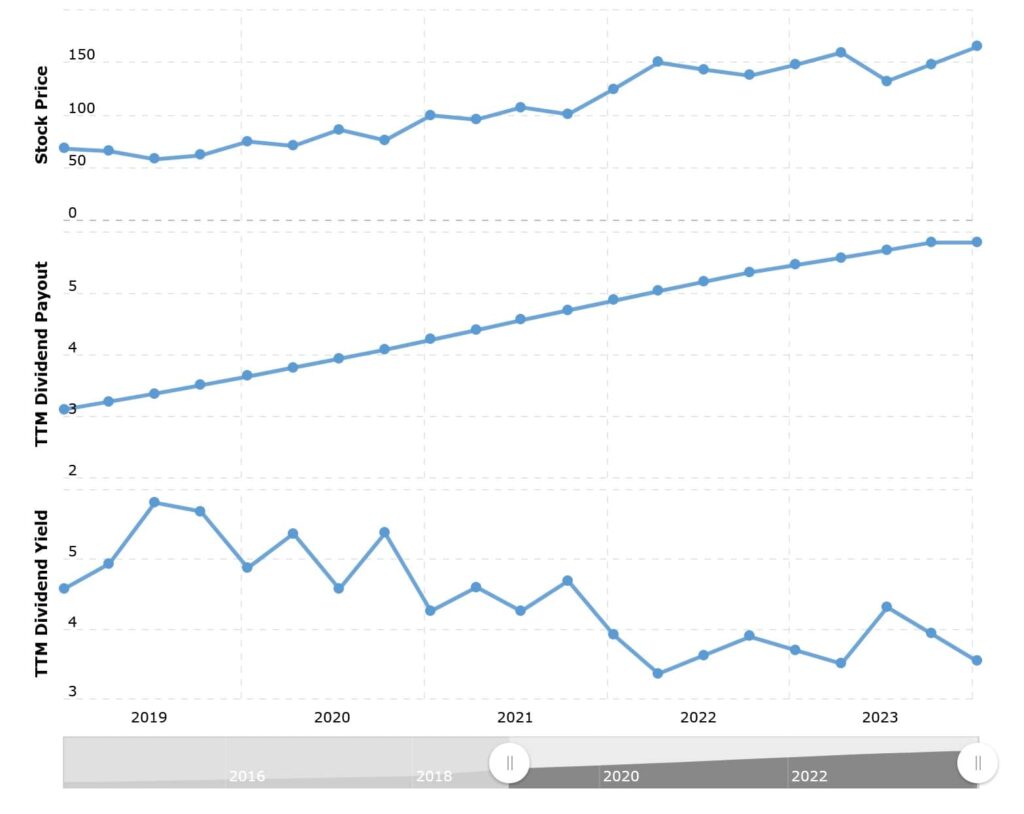

ABBV stock price today

ABBV estimated annual dividend yield

Your capital is at risk.

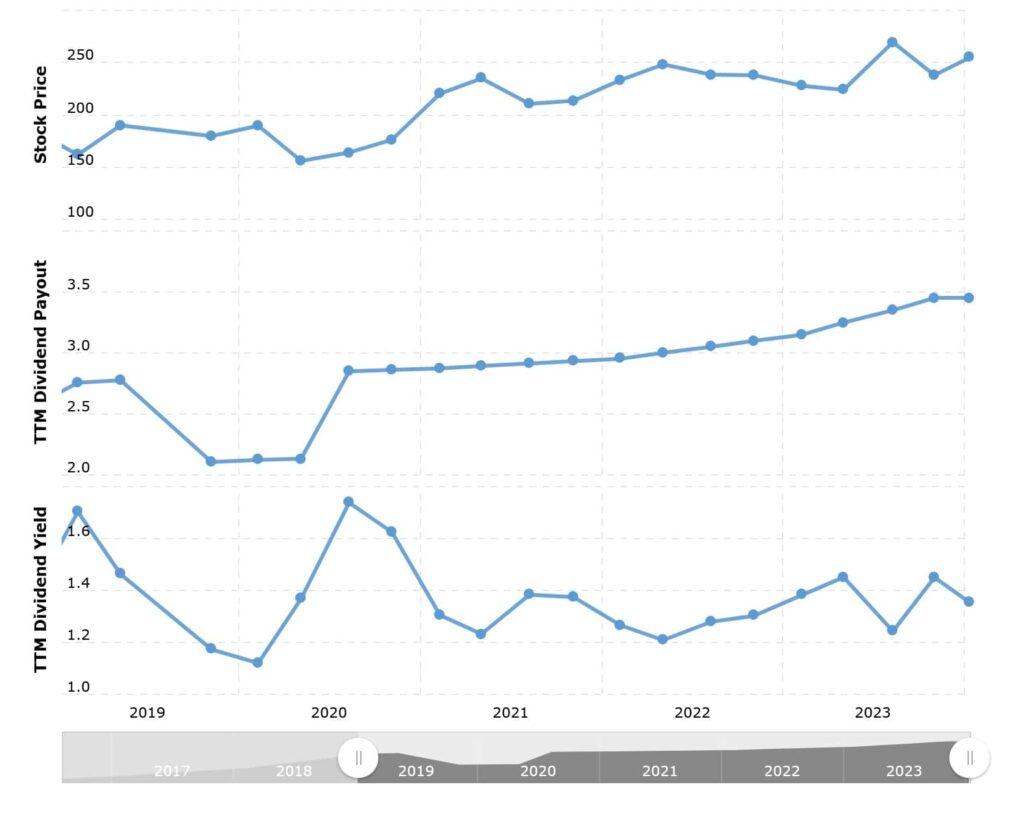

3. Constellation Brands (STZ)

Constellation Brands, Inc. (NYSE: STZ) is a leading American and international producer and marketer of beer, wine, and spirits. It is the largest importer of beer by sales in the U.S. and is known for its trademark beer brands, such as Corona and Modelo Especial.

On top of its alcoholic beverage portfolio, Constellation Brands has invested in the marijuana industry since 2017, when it purchased a 9.9% stake in Canopy Growth Corporation, a Canadian seller of medicinal marijuana products. Although the investment underperformed and Constellation Brands stepped back from cannabis-related ventures, it still has a significant stake in the weed business.

STZ stock price today

STZ estimated annual dividend yield

Your capital is at risk.

Where to buy weed dividend stocks

You can easily invest in weed stocks that pay dividends yourself. Our recommended choice for this is a brokerage platform called eToro. Enjoying widespread popularity with over 30 million registered accounts, it stands out for its robust features, including:

- Commission-free stock and ETF trading;

- 2,000+ stocks from 17 exchanges;

- Fractional shares available;

- Charting tools;

- User-friendly platform.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

Pros and cons of buying weed stocks that pay dividends

Pros

- Stable revenue source: Dividend stocks provide a consistent income stream through dividends, offering a steady and reliable cash flow. These payments are often desirable to conservative, income-oriented, and long-term investors;

- High yield potential: Dividend stocks can provide a steady income stream via regular dividend payments. Certain cannabis-related companies may redistribute a portion of their profits back to shareholders as dividends, offering attractive yields;

- Cannabis industry growth: Investing in dividend-paying weed stocks allows you to participate in the likely growth of the cannabis industry. As legalization and social acceptance of cannabis increase, companies in the sector should experience growth;

- Diversification: Adding weed dividend stocks to your portfolio can contribute to diversification, spreading your investment across different sectors and reducing overall risk.

Cons

- Volatility in the weed industry: The cannabis industry can be highly volatile due to regulatory uncertainties, still-forming legal landscapes, and market dynamics. This instability can impact stock prices, affecting capital appreciation and dividend payments;

- Limited options: Due to the relatively young weed companies, these stocks tend not to pay dividends, especially when compared to more established industries;

- Regulatory risks: The weed industry is affected by various regulatory challenges. Changes in regulations, either at the federal or local level, can significantly impact the performance of cannabis companies and their ability to pay dividends;

- Young industry: The cannabis industry is very young, and most companies in the sector are still in the early stages of growth. Investing in weed companies carries inherent risks, as not all companies may survive or prosper long-term.

For additional investments in the cannabis sector, consider the following articles:

- Best Weed ETFs;

- Best Marijuana Penny Stocks;

- How to Buy Green Thumb Industries Stock;

- How to Buy MariMed Stock;

- How to Buy Organigram Stock;

- How to Buy TerrAscend Stock;

- How to Buy Curaleaf Stock;

- How to Buy Verano Stock;

- How to Buy Aurora Cannabis Stock;

- How to Buy Trulieve Cannabis Stock;

- How to Buy Charlotte’s Web Stock;

- How to Buy Cronos Stock;

- How to Buy Jazz Pharmaceuticals Stock.

Common mistakes to avoid when investing in weed dividend stocks

Make sure to avoid these common investing mistakes:

- Lack of research: Research these weed dividend stocks in detail, along with the general state of the cannabis industry, before investing;

- Lack of strategy: Set your goals before you spend any money;

- Staking everything on one asset: Always diversify your portfolio;

- Falling prey to scams: Avoid illegal platforms and suspicious deals;

- Fear of missing out: If the numbers do not add up, do not make the investment: it is better to miss out than lose money.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about weed stocks that pay dividends

What are weed stocks?

Weed stocks refer to shares in publicly traded companies focused on growing, developing, manufacturing, and distributing cannabis and marijuana-related consumer goods.

What are weed stocks that pay dividends?

Weed stocks that pay dividends are dividend-paying shares in companies closely related or entirely dedicated to the growth, production, and distribution of cannabis and cannabinoid products.

Is it legal to invest in weed?

There are no specific legal hurdles when it comes to investing in publicly traded cannabis companies. However, always confirm the investing terms with your brokerage platform.

Why do people invest in weed stocks?

As weed experiences more social acceptance and further legalization, especially in the United States, the cannabis market expands, and companies tied to the cannabis industry become more likely to witness financial success. This trend makes weed stocks lucrative for many investors.

How do I invest in weed dividend stocks?

Investing in weed dividend stocks is the same as investing in any publicly traded company; you must register an account with a regulated online brokerage like eToro, transfer some funds, and buy the shares.

What are the best weed stocks that pay dividends?

Our preferred choice of weed dividend stocks to invest in includes Innovative Industrial Properties (IIPR), AbbVie (ABBV), and Constellation Brands (STZ).