Institutional investors are some of the most powerful players in global markets, controlling vast sums of money and wielding influence over financial decisions that affect millions of people. But who are the world’s largest institutional investors, and what do they invest in?

What are institutional investors?

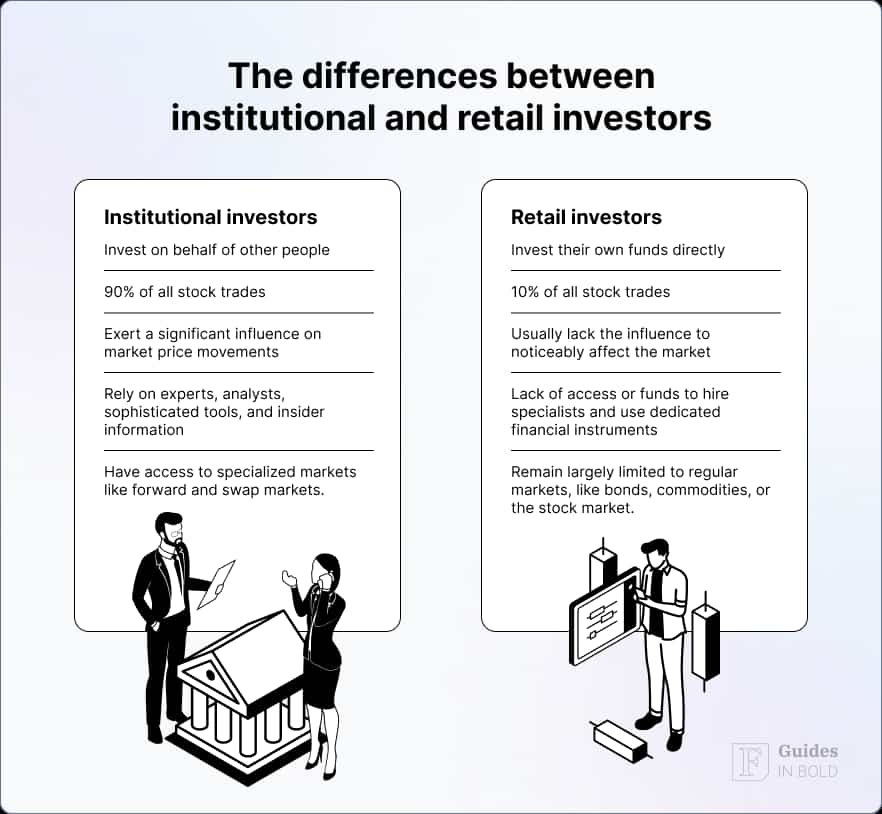

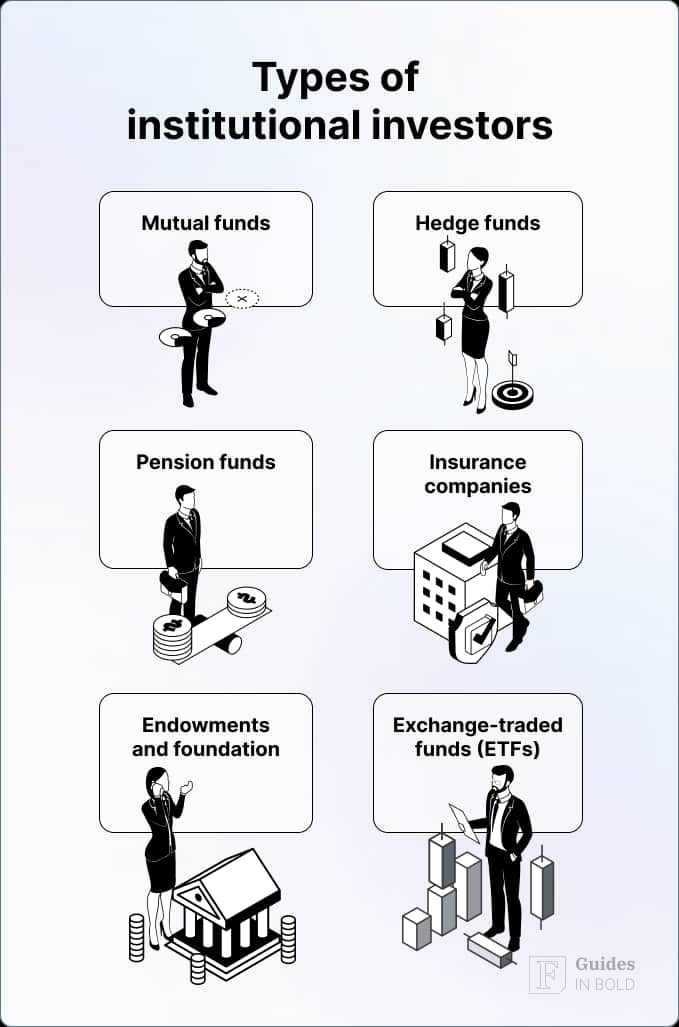

Institutional investors include mutual funds, hedge funds, pension funds, insurance companies, endowments and foundations, and exchange traded funds (ETFs). Their large-scale investments often give them the power to sway the market, influence company policies, and affect the broader economy.

They differ from retail investors, who invest individually, often in smaller amounts and with fewer resources, which limits their market influence compared to institutions.

Different types of institutional investors

- Mutual funds: Managed by professional asset managers, mutual funds pool money from many individual and institutional investors and invest it in a diversified portfolio of stocks, bonds, or other securities;

- Hedge funds: These are alternative investment vehicles that pool capital from accredited or institutional investors. Hedge funds use a wide range of strategies—including leverage and derivatives—to generate high returns, often aiming for absolute returns in both rising and falling markets;

- Pension funds: Set aside by employers, unions, or governments to provide retirement income for workers. Pension funds invest in a wide variety of assets, including stocks, bonds, and real estate, to ensure long-term growth and meet future pension obligations;

- Insurance companies: Insurance firms invest the premiums they collect from policyholders into various assets, such as bonds, stocks, and real estate, to ensure they can meet future claims and obligations. They play a key role in long-term investing;

- Endowments and foundations: Endowments are funds typically established by universities, hospitals, or other non-profits, and foundations manage funds for charitable purposes. Both invest in a variety of assets to grow their funds over time, ensuring long-term financial stability and support for their respective missions;

- Exchange-traded funds (ETFs): ETFs are investment funds that trade on stock exchanges, similar to stocks. They hold a basket of assets, such as stocks or bonds, and are designed to track an index or a specific asset class. ETFs offer liquidity, low costs, and easy access to diversified portfolios for both retail and institutional investors.

Who are the world’s largest institutional investors?

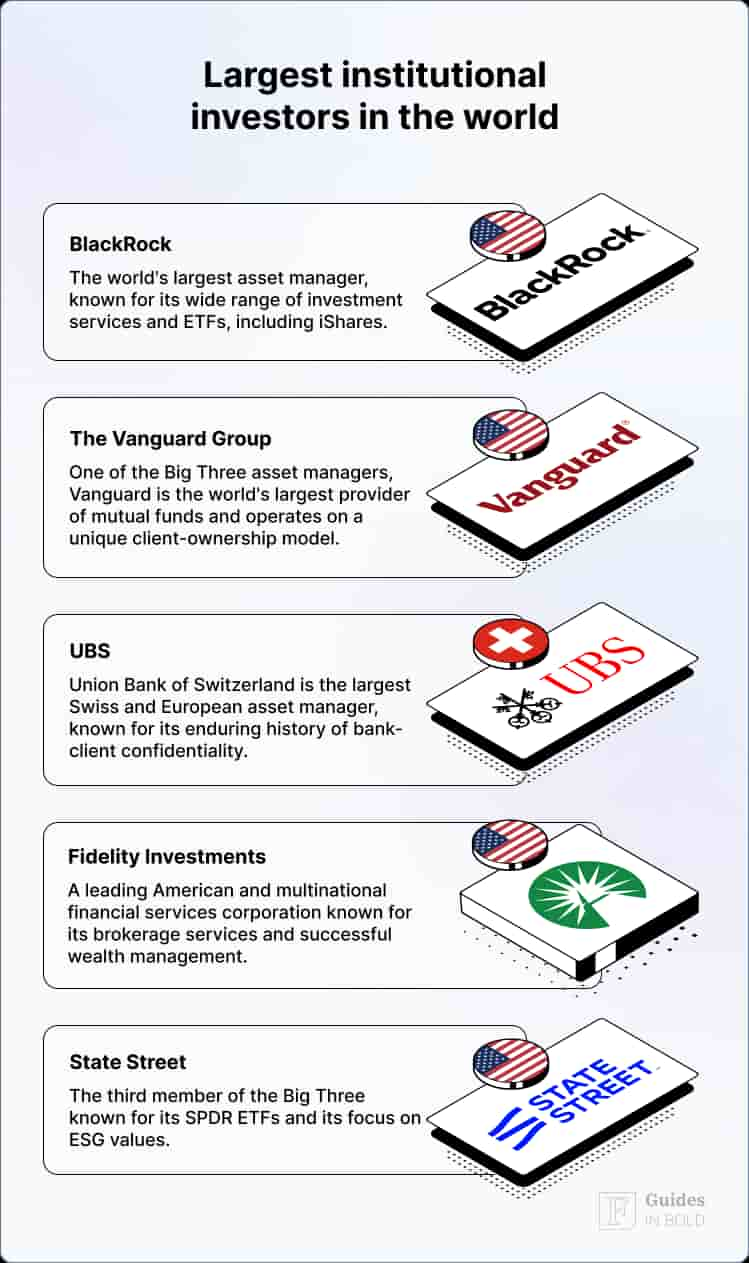

Some institutional investors stand out due to the size of their assets under management (AUM). These investors hold trillions of dollars in assets, shaping the world’s financial landscape.

That said, here’s a list of some of the largest institutional investors globally:

| Rank | Name | Type | Estimated AUM |

| 1 | BlackRock | Asset manager | $10.65 trillion |

| 2 | Vanguard Group | Asset manager | $9.9 trillion |

| 3 | Union Bank of Switzerland | Investment bank, asset manager, and wealth manager | $5.87 trillion |

| 4 | Fidelity Investments | Asset manager and investment advisor | $5.5 trillion |

| 5 | State Street | Asset manager and asset servicing | $4.4 trillion |

The listed institutions invest in various assets across all sectors, regions, and industries. Their investments can range from traditional assets like stocks and bonds to alternatives such as private equity, infrastructure, and real estate.

What do institutional investors invest in?

Institutional investors typically focus on a variety of asset classes, allowing them to spread risk while maximizing returns. Their investment strategies often involve a combination of the following:

- Equities: Stocks represent ownership in companies. As such, institutions buy large blocks of stock, gaining voting rights and influencing corporate decisions;

- Fixed income: Bonds and other debt instruments provide steady returns; therefore, institutional investors often hold large amounts of government and corporate bonds;

- Real estate: Institutions often invest in commercial real estates like office buildings, shopping centers, and industrial properties, or REITs.

- Private equity: Some institutional investors allocate funds to private equity firms, which invest in or buy out private companies;

- Hedge funds: Institutions sometimes invest in hedge funds, which use complex strategies to generate returns, including short-selling and leveraging.

Emerging trends in institutional investment

Emerging trends in institutional investment include a growing focus on sustainable investing and technology. More and more, institutional investors prioritize Environmental, Social, and Governance (ESG) factors in their portfolios. For instance, BlackRock (NYSE: BLK) has been a leader in this movement, encouraging companies to adopt better environmental practices.

In addition to sustainability, many institutions are also turning their attention to technology and innovation. They are investing heavily in well-established tech giants like Google (NASDAQ: GOOGL) and Apple (NASDAQ: AAPL), as well as up-and-coming startups in fields like artificial intelligence (AI) and blockchain, reflecting the increasing importance of technological advancement in shaping the future of markets.

Insider trading and institutional investors

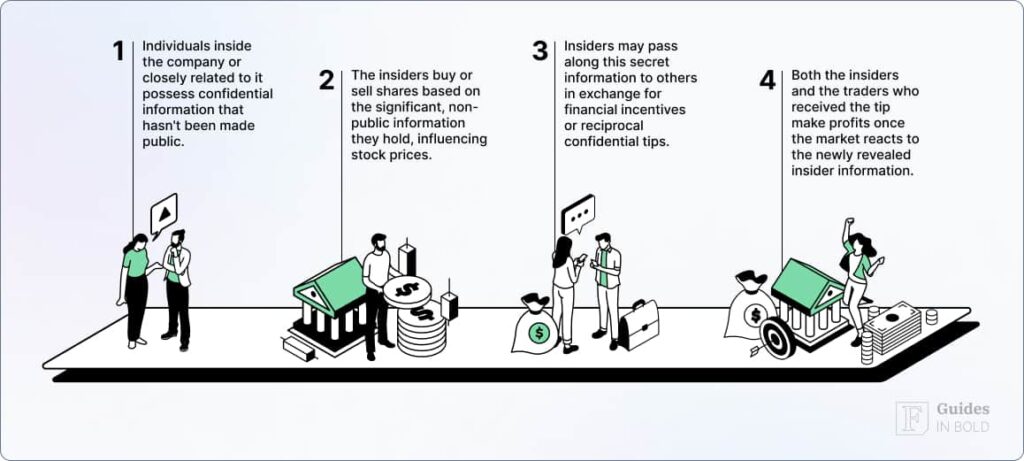

Insider trading occurs when individuals with access to confidential information about a company use that information to make investment decisions. This practice is illegal, but institutional investors often get criticized for their proximity to insider information. Due to their scale, institutional investors have significant contact with company executives, leading some to question whether they benefit unfairly from such relationships.

Recommended video: What is Insider Trading? Explained in 2 Minutes

However, research shows that institutional investors may help curb insider trading. For example, the study by Hillegeist and Weng from 2018 found that higher levels of institutional ownership are associated with fewer insider trades and lower profitability of such trades, especially opportunistic trades based on private information.

The findings of the study suggest that institutional monitoring discourages insider trading by influencing companies to adopt stricter blackout policies that limit insider trading during sensitive periods.

“Consistent with our hypothesis, higher institutional ownership results in significantly fewer buy and sell trades. The effects are both statistically and economically significant… Overall, our evidence indicates institutional owners consider informed insider trading as undesirable.” — Hillegeist and Weng

How do institutions avoid insider trading?

Institutional investors are subject to strict regulations to avoid insider trading. Many institutional firms set up compliance departments that monitor trading activity to ensure that their employees are not engaging in illegal behavior. Additionally, the Securities and Exchange Commission (SEC) regularly investigates institutional trading activity for suspicious patterns.

How to track institutional investors?

If you’re interested in tracking what institutional investors are doing, several tools and services offer real-time updates. For instance, Finbold Signals provides real-time notifications on institutional investor moves via email, Telegram, and Discord.

Other ways to monitor institutional investors include SEC Filings. Namely, publicly traded companies must file quarterly reports (Form 13F) that disclose large institutional holdings. You can access these reports on the SEC’s EDGAR database.

The bottom line

It’s no secret that institutional investors play a critical role in global financial markets. They influence the trajectory of economies and companies alike. Therefore, by understanding who the key players are and what they invest in, individuals can better grasp the forces that drive the markets. Moreover, tools like Finbold Signals can help you stay updated on institutional moves in real time, leveling the playing field.

In summary, institutional investors wield considerable power. Their ability to move markets underscores the importance of transparency and regulation. At the same time, tracking their investments can provide valuable insights for anyone looking to understand or participate in the world of finance.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs

What is an institutional investor?

An institutional investor is an organization, such as a pension fund or mutual fund, that invests large amounts of money on behalf of clients or members. They control significant assets and, as such, influence global markets.

What do institutional investors typically invest in?

They invest in a range of assets, including stocks, bonds, real estate, and private equity. Many also focus on alternative investments like hedge funds and infrastructure projects.

How do institutional investors affect stock prices?

Their large trades can impact stock prices significantly, often stabilizing markets by providing liquidity and absorbing market shocks.

Can I track what institutional investors are investing in?

Yes, platforms like SEC’s EDGAR database and services like Finbold Signals provide real-time updates on institutional investor activity.

What is the largest institutional investor?

As of late 2024, BlackRock is the largest institutional investor, managing over $10.65 trillion in assets.

Do institutional investors engage in insider trading?

Institutional investors are subject to strict regulations and compliance programs that monitor their trading activities to prevent insider trading.