Renowned investment expert Michael Burry, known for his accurate predictions during the 2008 recession, is encountering challenges in his latest bearish endeavor targeting the semiconductor sector.

In November, eyebrows were raised when it was revealed that Burry closed his bearish position on the broader US stock market at a loss, redirecting his pessimistic outlook toward SOXX, a major semiconductor exchange-traded fund (ETF).

Recent reports of gains highlight Burry’s increasing difficulties, with his bet against chipmakers appearing to incur significant unrealized losses.

On January 16, concerns heightened as the SOXX ETF surged more than 11%, amplifying worries about Burry’s semiconductor gamble, particularly amid the flourishing AI boom.

How much did Burry bet against with?

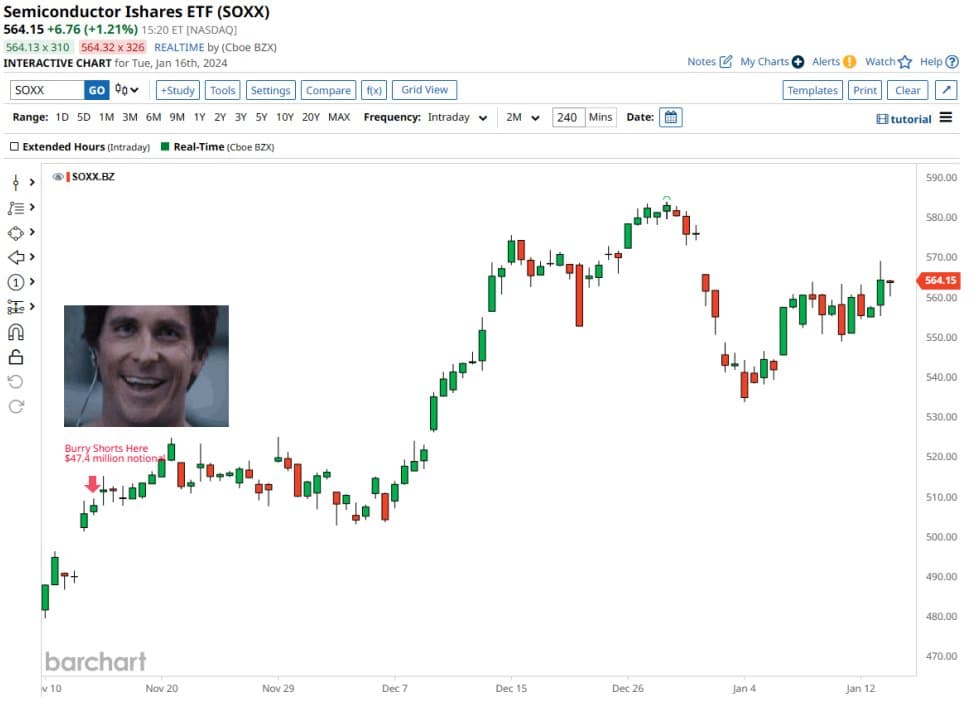

In November, Burry placed a puts order with a notional value of $47.4 million. However, the SOXX ETF saw a surge of over 11%, resulting in substantial unrealized losses of over $5 million for Burry, as the stock market tracker Barchart reported in a post on X on January 16.

And since the most prominent holdings in this ETF are Advanced Micro Devices (NASDAQ: AMD), Broadcom (NASDAQ: AVGO), and Nvidia (NASDAQ: NVDA), which experienced 61%, 32%, and 38% gains since the order up to the time of reporting, it is no wonder Burry is at such a loss on his bet.

Given predictions that the AI chip market could reach an impressive $400 billion in the next four years, it appears unlikely that semiconductor stocks will halt their current upward trend anytime soon.

Unless exceptional bearish conditions arise, such as an economic recession, the momentum in semiconductor stocks is expected to persist.

This might be precisely what Burry is waiting for, as he seems in this play for the long haul.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.