Investors are always keen to learn about Nancy Pelosi’s latest stock trading activity, as it usually signals the future performance of affected stocks. On July 3, Pelosi disclosed several stock trades, including selling Tesla (NASDAQ: TSLA) stock.

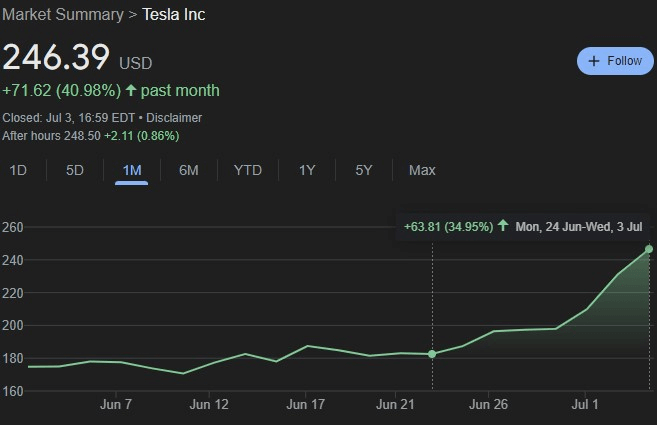

Namely, on June 24, the Former House Speaker sold all of her 2,500 TSLA shares for a profit of $460,000 pre-tax, but this time, Pelosi seemingly didn’t get the timing well, as she usually does.

Interestingly, the U.S. Representative’s trade would now be worth $621,000 due to the gains of 34.95% TSLA stock experienced since June 24.

Picks for you

This means she missed out on approximately $161,000 in profits, almost equal to her reported annual salary of $176,000.

Why did Tesla stock surge?

Tesla shares led the S&P 500 gainers after the company reported stronger-than-expected vehicle deliveries. The rally started after several Chinese EV makers reported strong sales data, raising investor optimism ahead of Tesla’s Q2 report.

Tesla delivered nearly 444,000 EVs in the second quarter, surpassing the consensus estimate of 439,000 units. Although the number was almost 5% lower than the year-ago period, the report had several positive aspects.

Notably, Tesla’s deliveries outpaced its production of 410,831 EVs, reducing inventory levels that had been a concern earlier this year. As a result, Tesla’s stock has rebounded with a nearly 30% gain over the past month.

Additionally, Tesla set a new record by deploying 9.4 GWh (gigawatt hours) of energy storage products in the second quarter, doubling the previous record of 4.1 GWh from the first quarter.

Pelosi’s stock portfolio is posting records

Despite mistiming her sale of TSLA shares, Nancy Pelosi’s portfolio has recorded a strong performance throughout 2024, primarily thanks to the gains from artificial intelligence (AI) stocks such as Nvidia (NASDAQ: NVDA), Apple (NASDAQ: AAPL) and Microsoft (NASDAQ: MSFT), which lifted her estimated net worth above $250 million.

Now, she decided to double down on her AI bet, buying $5 million worth of Broadcom (NASDAQ: AVGO) call options, with a strike price of $800 expiring on June 20, 2025.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.