As the Nasdaq 100 index (NDX) continues to display a rare sign of recovery for the stock market, witnessed more than 13 years ago, it seems that there will be no more corrections this year, at least according to a recent analysis by a prominent market trading expert.

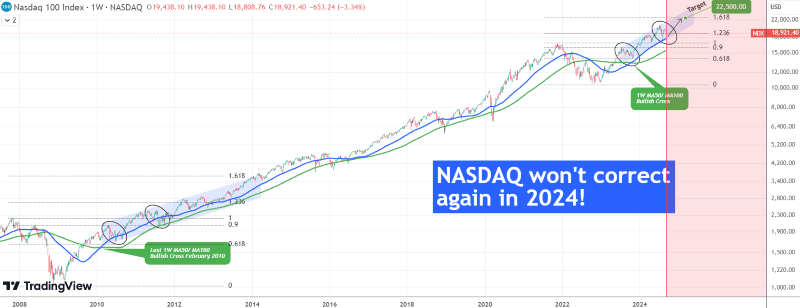

Specifically, a pseudonymous trading analyst, known as TradingShot, has highlighted the one-week bullish cross between the 50-day moving average (MA) and the 100MA, which occurred in February 2010 and again in October 2023, as per his TradingView post published on September 4.

NASDAQ performance history

As he further specified, it has been almost one year (October 24, 2023) since he called for “a mega buy opportunity on Nasdaq’s (NDX) last bottom,” after which the index “started an insane rally sequence right on that weekly candle and didn’t correct again that much before the recent July – August 2024 pull back.”

“The gains from that bottom buy signal have been almost +50%, and as the 1W MA50 (blue trend-line) was tested on the early August Low and held, we expect Nasdaq to resume and maintain the steady bullish trend for the rest of the year.”

NASDAQ next target prediction

Furthermore, TradingShot stressed 22,500 as the next target “before it gives a medium-term correction again,” which is “exactly on the 1.618 Fibonacci extension from the October 2022 market bottom” due to “remarkable similarities between the 2022 Inflation Crisis correction and the 2008 Housing Crisis.”

According to the expert, this helped identify the mega buy signal in October because the price formed a 1W MA50/MA100 bullish cross chart pattern, the first since February 2010, and the correction stayed above the 0.618 Fibonacci retracement level.

“So with the 1.236 Fib already achieved during the current (blue) Channel Up (…), the next in line is the 1.618 Fib at 22500. According to all the above, the next time that Nasdaq could correct might be early in 2025.”

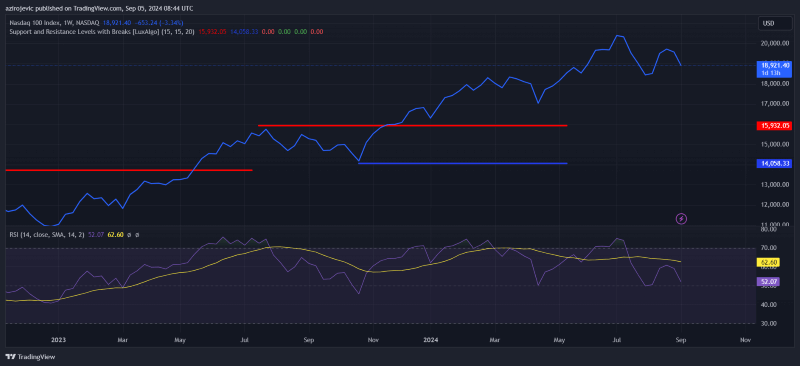

On the other hand, MarketPulse analysts predict further weakness for the NASDAQ 100, noting that all the major United States bench stock indices have started the month “on a weak footing,” with the 19,670 level as the key medium-term pivotal resistance on the NASDAQ 100, alongside the risk of revisiting the support at 17,160 – 16,930. As they explained:

“Only a clearance above 19,670 invalidates the bearish bias for a continuation of its impulsive upmove sequence for the next major resistances to come in at 20,900 and 21,680 in the first step.”

NASDAQ performance analysis

Meanwhile, the NASDAQ 100 index at press time stood at 18,921.40, recording a decline of 0.20% on the day, adding up to the loss of 3.30% accumulated on its weekly chart, while advancing 8.47% over the past month, and gaining 13.52% year-to-date (YTD), as per data on September 5.

All things considered, the trading analyst might be correct in his predictions for the NASDAQ index for this year, particularly as the technical analysis (TA) supports his observations. However, trends in stocks can easily change, so doing one’s own research is critical when investing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.