Amidst the recent surge in the artificial intelligence (AI) sector, stocks directly or indirectly linked to this industry have seen robust growth. One of the standout performers is Super Micro Computer (NASDAQ: SMCI), which has witnessed a remarkable 760% growth over the past year.

In 2024, SMCI stock has already surged by over 200%, pushing its valuation close to $900. This raises the question of whether investors missed out on potential earnings and whether SMCI stock is a buy.

On the other hand, those fortunate enough to acquire Super Micro stock at lower price levels might wonder whether now is the time to sell SMCI stock.

Is SMCI a good stock to buy?

Recent advancements in generative AI are potentially revolutionary, particularly in enhancing worker productivity. These cutting-edge algorithms can summarize emails, create presentations, and write computer code. The excitement surrounding AI is tangible as businesses rush to integrate this transformative technology.

Enter SMCI, which specializes in servers tailored for AI processing. They offer plug-and-play solutions that expedite deployment and a range of cooling technologies to suit various needs.

Supermicro’s recent fiscal 2024 second-quarter results are impressive. The company achieved record revenue of $3.66 billion, marking a remarkable 103% year-over-year increase and a 73% sequential surge.

Despite ramping up research and development spending by 54%, diluted earnings per share soared by 85% to $5.10. This performance supports SMCI’s plan to expand its AI product portfolio in the coming year.

SMCI stock price

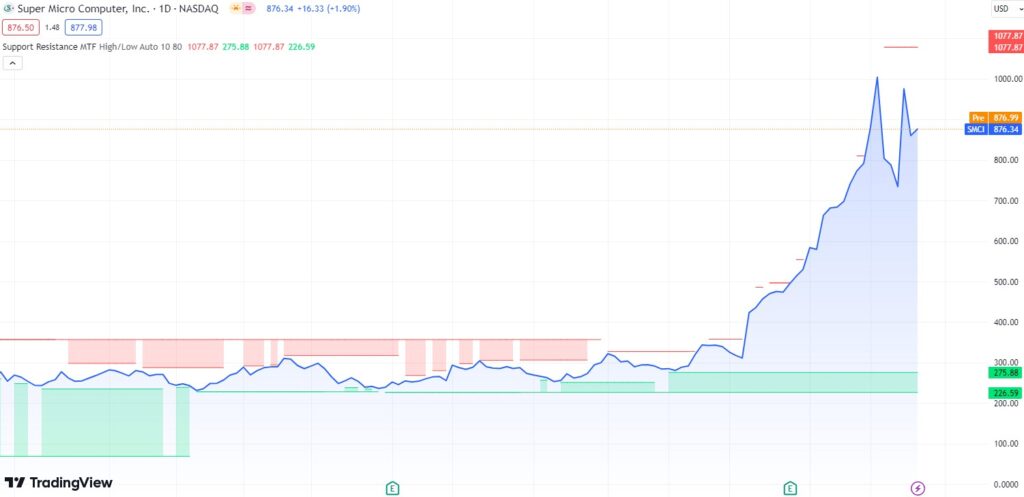

As of the market close on February 26, SMCI stock price was at $876.34, marking a 1.90% increase over the past 24 hours and an 11.63% gain over the last five trading sessions.

Over the past month, SMCI shares have fluctuated between $471.90 and $1,077.87, highlighting considerable volatility. Its current position in the middle of this range suggests potential resistance ahead.

Notably, when examining Super Micro Computer stock’s support levels, a significant area emerges at $789.31, as indicated by a trend line on the daily timeframe.

A notable resistance zone is also observed at the $1,077 level, identified across various timeframes.

SMCI stock forecast

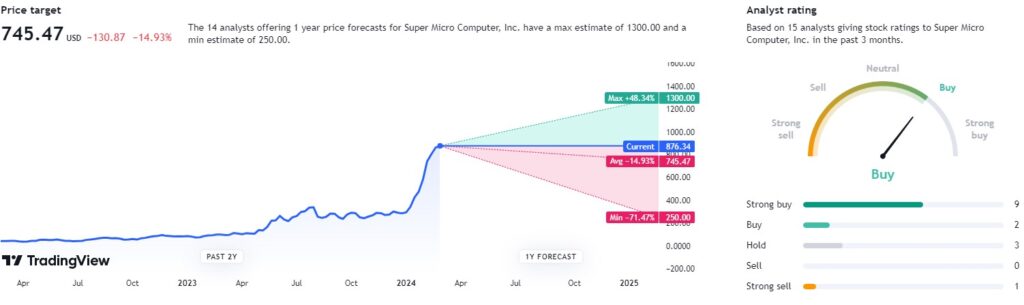

Regarding analyst predictions for the SMCI stock forecast, TradingView experts have assigned a ‘buy’ rating based on 15 evaluations. Among these, 9 experts recommended a ‘strong buy,’ 2 gave SMCI stock a ‘buy’ rating, 3 suggested a ‘hold,’ and only one advised a ‘strong sell.’

However, the average price target is set at $745.47, which represents a -14.93% decrease from the current Super Micro Computer share price.

The technical indicators and financials suggest a bullish forecast for SMCI stock, whereas analysts anticipate a price decrease for Super Micro Computer shares. Which side will ultimately prove to be right remains to be seen.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.