The broader cryptocurrency market has experienced losses driven by the sudden dip in the price of Bitcoin (BTC), and the largest altcoin, Ethereum (ETH), wasn’t spared. Investors might wonder whether this is the beginning of a bear cycle or that tides might change soon.

Given the circumstances, Finbold sought the support of AI-powered machine-learning algorithms to assess the expected price of ETH by the end of the month.

These algorithms evaluate ever-changing market conditions and scrutinize relevant indicators to forecast the likelihood of this cryptocurrency experiencing gains by the conclusion of January.

According to the algorithms, the projected price for ETH is expected to increase to $2,285 by January 31, reflecting a 2.60% rise from its present level of $2,227 as of the time of writing.

Analysts predictions

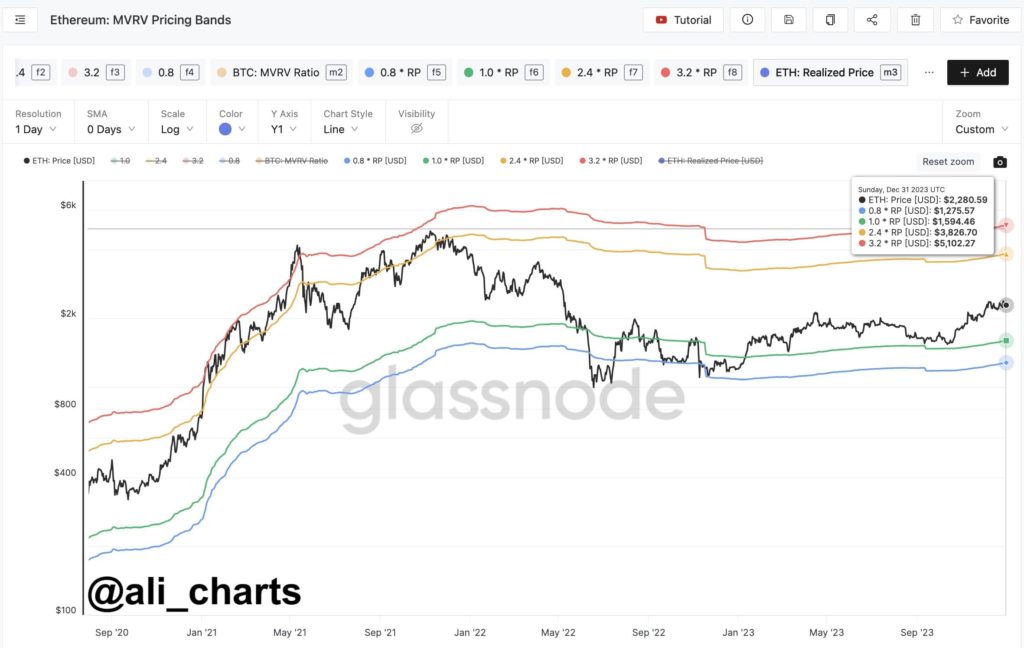

The MVRV comparison allows for evaluating whether the existing price is higher or lower than the perceived “fair value,” offering insights into market profitability.

As outlined in the Ethereum MVRV Pricing Bands, ETH’s forthcoming significant price targets at $3,830 and $5,100 were identified by cryptocurrency analyst Ali Martinez in an X post on January 2.

The given range seems relatively bullish to other analysts, as momentum needs to be garnered for ETH to continue towards the price range of $3,000 and $3,500, as per crypto expert Michael van de Poppe’s post on January 3.

Speaking of ranges, potential, and momentum, the current market sentiment registered by the fear and greed index toward this digital asset is in the greed section, standing at 65, as per the latest data retrieved on January 4.

ETH price analysis

At the time of press, ETH was trading at $2,227.82, reflecting a decline of -6.35% in the last 24 hours, adding to losses of -6.67% over the preceding week and contrary to a slight upside of 0.84% in the past 30 days.

At the same time, TradingView’s technical indicators for Ethereum show a neutral sentiment. A summary of these indicators indicates a ‘neutral’ rating at 9, with moving averages signaling a ‘sell’ at 8. Oscillators are inclined towards a ‘neutral’ rating, registering at 8.

Broader cryptocurrency market trends, transaction fees, BTC price movement, and investors’ support are only some factors that may drive the ETH’s price in the coming days and months.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.