While China has for years had a fraught relationship with cryptocurrencies, more recent news from the nation – and particularly from the locale of its second system, Hong Kong – have been decidedly more positive.

The latest developments indicating ever-greater adoption of digital assets came from the technology and e-commerce giant JD.com (NASDAQ: JD), which is set to release a stablecoin pegged to the Hong Kong dollar on a public blockchain and boasting a 1:1 exchange ratio.

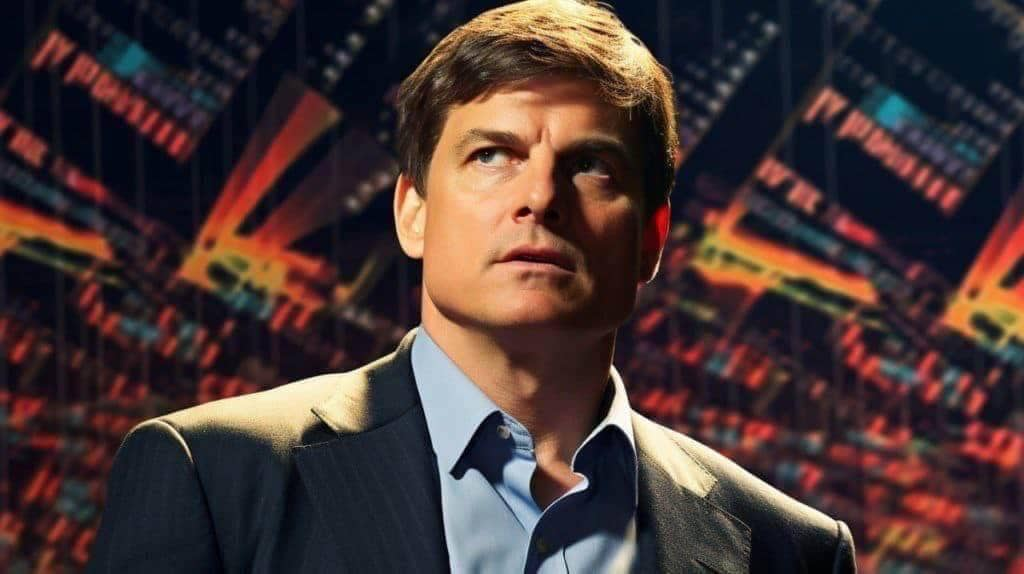

Coincidentally, the move has given ‘The Big Short’ investor Michael Burry significant exposure to the crypto markets – or, more precisely, to a digital assets company – as, as of the latest 13-f filing, JD was his biggest holding.

There is something of an irony in the development since, while not being particularly vocal about cryptocurrencies, the little Burry did say was mostly critical. Still, it is worth pointing out that the comments about the folly of crypto investors came at the time FTX was disintegrating.

Michael Burry’s troubled Chinese investments

Even without the issuing of a stablecoin, JD has not only been ‘The Big Short’ investor’s biggest holding but, along with Alibaba (NYSE: BABA), one of his more controversial picks.

BABA shares in particular have been a matter of intense coverage given that, ever since he purchased them, they have teetered on the edge of profitability without actually sending Burry into the green.

JD is a similarly troubled pick, and the famous investor has continuously adjusted his position. Indeed, he is most likely deeply in the red on the initial batch of shares from late 2022, given the firm’s stock market decline since, but is also likely in the green for some of his bigger and later purchases.

Crypto adoption gains steam in China

Meanwhile, along with increased adoption in Hong Kong, mainland China appears more accepting of digital access than it has historically been. For example, reports from the spring of 2024 indicate that the country’s experts have officially recognized the worth of Bitcoin (BTC).

Further reinforcing the notion, the 2024 expert seminar was focused on protecting BTC holders and their property rights, and especially on how to protect those who have lost cryptocurrency due to actions such as theft.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.