Most of the ‘Magnificent Seven’ had a solid first quarter in 2024, except for two: Tesla (NASDAQ: TSLA) and Apple (NASDAQ: AAPL). These two giants seem to be facing continuous challenges with production, finances, and insider sales.

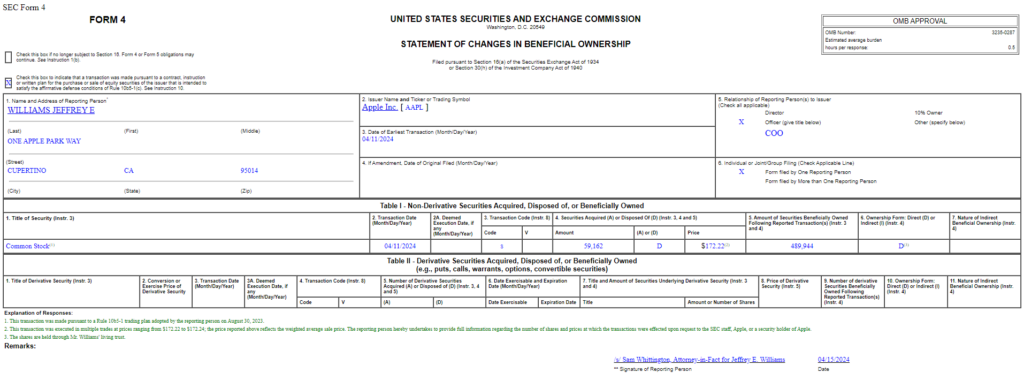

Adding to Apple’s woes, insiders at the company appear to lack confidence in its stock. Chief Operating Officer Jeffrey Williams sold 59,162 AAPL shares at an average price of $172.22 valued at just over $10 million on April 11, as revealed in his SEC filing.

Investors aren’t feeling optimistic, particularly with recent news of antitrust lawsuits and the company once again being overtaken by Samsung in mobile phone sales. These insider sales only add to the concern.

Picks for you

Apple’s troubles deepened by strong competition

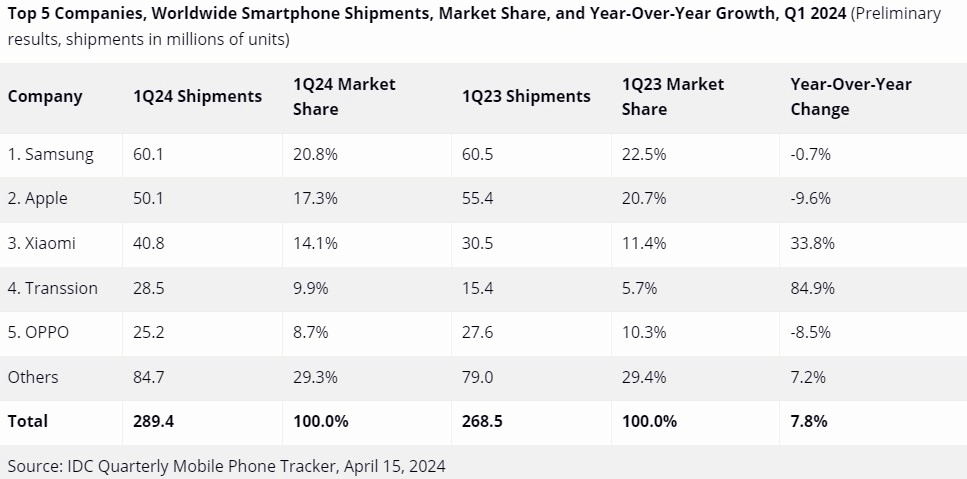

According to data from research firm IDC released on April 15, Apple experienced a roughly 10% decline in smartphone shipments in the first quarter of 2024. This drop was attributed to heightened competition from Android smartphone manufacturers vying for dominance in the market.

Despite this, global smartphone shipments saw a 7.8% increase to 289.4 million units from January to March. Samsung secured the top spot among phone makers with a market share of 20.8%, surpassing Apple in this quarter’s rankings.

After a robust performance in the December quarter, during which it surpassed Samsung to become the world’s top phone maker, the iPhone-maker has experienced a significant sales decline. It has slipped back to the second spot, now holding a 17.3% market share, as Chinese brands like Huawei continue to gain ground.

Insider sales rise by the fastest level in over a decade

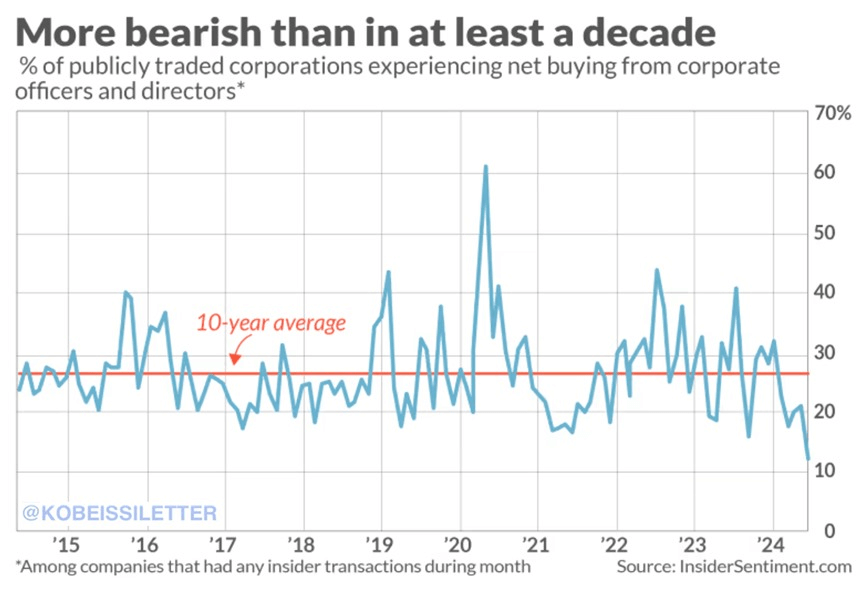

As corporate buybacks show an upward trend, there has been a notable increase in executives selling stock.

This trend has reached its highest pace in over a decade. The percentage of publicly traded firms witnessing net purchases from their executives has concurrently declined to 12.5%, a significant drop from the approximate 10-year average of 28%.

Typically, in a robust market environment, this share fluctuates between 20% and 40%.

This doesn’t bode well for the future performance of the stock market, as historical data suggests that the intensity and frequency of such sales have preceded market downturns in the past.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.