A cryptocurrency market crash caused $430 billion in losses for cryptocurrencies and $2 billion in liquidations for traders this weekend. Facing the fear, uncertainty, and doubt of Iran-Israel’s conflict escalation, increased short positions threaten a short squeeze for leading assets.

Notably, the crash liquidated over 500,000 cryptocurrency traders during the weekend, most of whom had bullish long positions. As the panic dominated within geopolitical tensions and the Iranian offensive, derivatives pivoted to a bearish state.

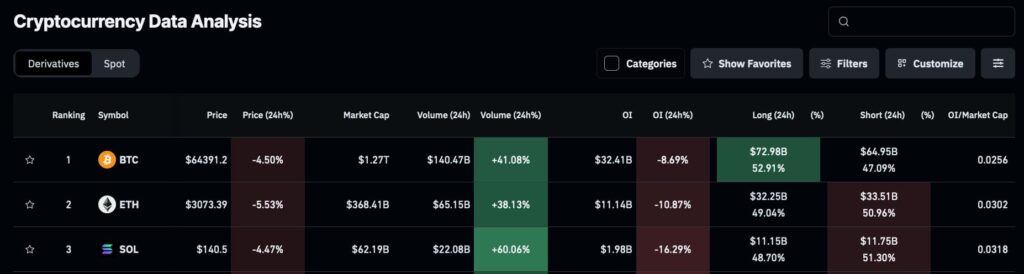

In particular, Bitcoin (BTC) and Solana (SOL) saw 41% and 60% of derivatives volume increase in the last 24 hours. The two cryptocurrencies have an open interest of $32.41 billion and $1.98 billion, respectively. Finbold retrieved this data from CoinGlass data on April 14.

Furthermore, both have accumulated significant liquidity pools from short-sellers’ liquidation prices. These pools make appealing targets for market makers and professional traders, potentially encouraging a short squeeze and a consequential surge.

Bitcoin (BTC) short squeeze potential

The higher potential for an incoming short squeeze lies in the leading cryptocurrency, Bitcoin. Besides the surging volume, and increased open interest with BTC futures, the block subsidy halving is expected for this week.

Thus, this year’s halving could be a strong ignite for short liquidations, despite the geopolitical uncertainties.

Precisely, $2.97 billion in Bitcoin shorts await liquidation at $71,691, being the largest liquidity pool registered this month-over-month. Moreover, smaller pools trace the path for a potential skyrocket above the previous high of $73,805.

A run to the first levels would result in 11% gains from Bitcoin’s current price of $64,391.

On the other hand, Bitcoin average transaction fees have already skyrocketed to a 4-month high above $24. This value nears the world’s average daily income, resulting in one Bitcoin transaction costing an average person’s full working day.

Solana (SOL) could skyrocket

Solana has a similar landscape with a significant liquidity pool at $190 per token. Yet, SOL needs a strong trigger to revert its current downtrend and short squeeze toward this target.

The Solana network is going through relevant challenges facing continued congestion issues and transaction failures. As a result, traders have favored short positions, which were rewarded amid the geopolitical tensions.

Nevertheless, the underlying bearish fundamentals could be approaching an end. Solana developers are already testing solutions that will potentially improve the network’s performance and could renew investors’ confidence in SOL.

A run to $190 would result in over 35% gains from the $140 traded by press time.

However, understanding the macroeconomic risks and financial asset behavior under geopolitical tensions is crucial to navigating the current market. Investors must place their bets carefully and weigh the risks with savvy management.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.