In a refreshing twist, Snapchat (NYSE: SNAP) saw a major boost in its stock after releasing its Q1 earnings, surpassing expectations by a large margin. In after-hours trading, the stock soared by as much as 30%.

A positive momentum carried over into premarket trading, with gains nearing 25%, pushing SNAP shares to $14.20 from their closing price of $11.40.

Following this significant surge, investors are now pondering whether SNAP stock can reclaim the elusive $20 mark, a level it hasn’t reached in nearly two years.

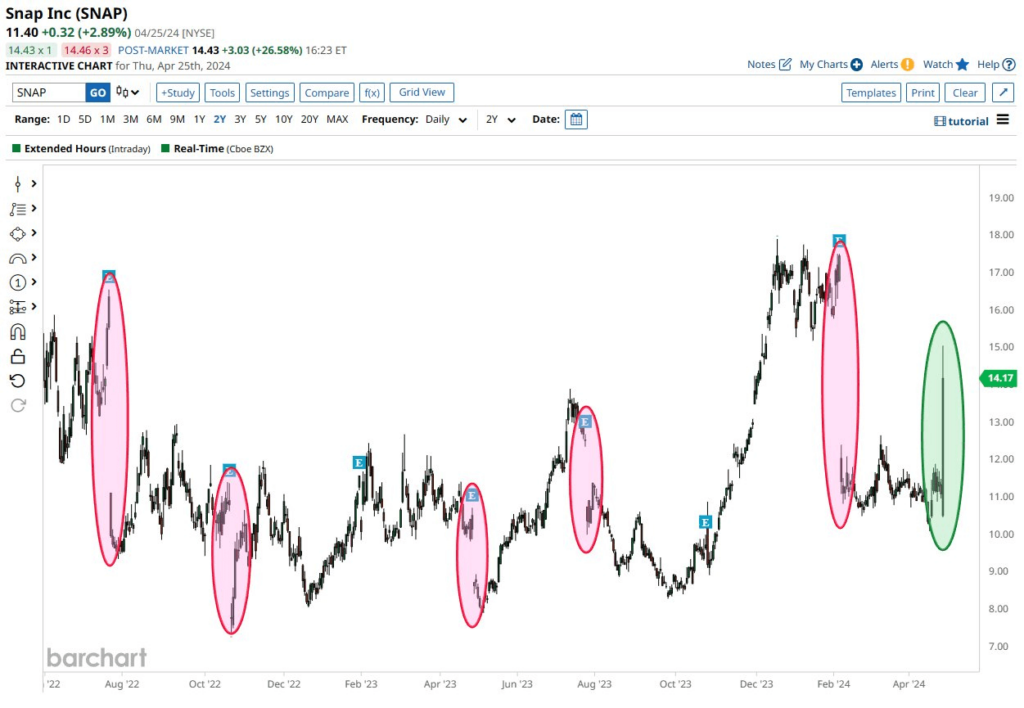

SNAP stock went against tradition with a post-earnings surge

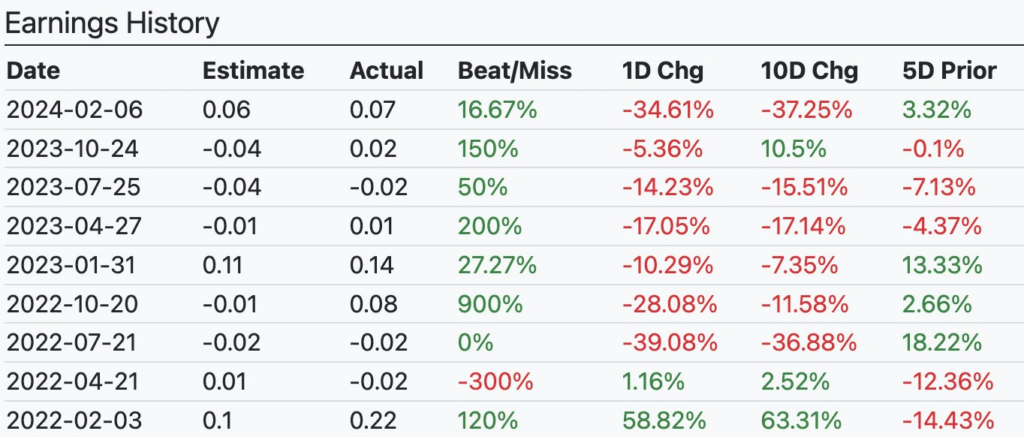

Despite analysts’ forecast of an adjusted EPS of -$0.05, Snapchat surprised with an adjusted EPS of $0.03. Revenue also surpassed expectations, reaching $1.195 billion compared to the projected $1.120 billion.

A positive earnings outcome has propelled SNAP shares into the green, a welcome occurrence not witnessed in over two years.

Maybe this marks a shift from the previous pattern where Snapchat outperformed expectations, yet SNAP stock took a hit. It’s a positive development worth monitoring for traders.

What caused the SNAP stock resurgence?

Snapchat’s efforts to revive its advertising business after the 2022 digital ad market setback yield positive results. According to their investor letter, revenue growth is largely attributed to enhancements in their advertising platform and the demand for direct-response advertising solutions.

During the quarterly investor call, Derek Andersen, Snap’s finance chief, highlighted that the company also profited from improvements in the broader operating environment, with a more robust brand environment observed across all regions in Q1.

Advertising revenue for the quarter hit $1.11 billion, while the ‘Other Revenue’ category, mainly driven by Snapchat+ subscribers, surged to $87 million, a 194% increase year over year. Snap reported over 9 million Snapchat+ subscribers during the period.

A positive outlook, strong guidance, and financial performance look good for SNAP shares and might lead to heightened confidence from investors.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.