Solana (SOL) is one of the blockchains with the most significant growths in the last five years. Since launch, Solana attracted billions of dollars in capital, becoming one of the favorite infrastructures for trading, despite some controversy.

Now, the leading Ethereum (ETH) competitor achieves a new milestone, making an all-time high in stablecoin’s capitalization, evidencing more growth. Interestingly, the stablecoin market cap in a blockchain is one of the most solid metrics when evaluating its fundamentals.

That because it is one of the hardest metrics to temper with, like active addresses, as Finbold explained, or trading volume, for example.

When talking about Solana, looking at a solid metric is even more important, considering the ecosystem’s infamous – and well documented – historic of inflating some metrics to fool investors, developers, businesses, and users. Crypto educator, DBCrypt0 has a complete video about this well-documented journey of deception, which the community is trying to overcome.

Solana has nearly $11 billion in stablecoins

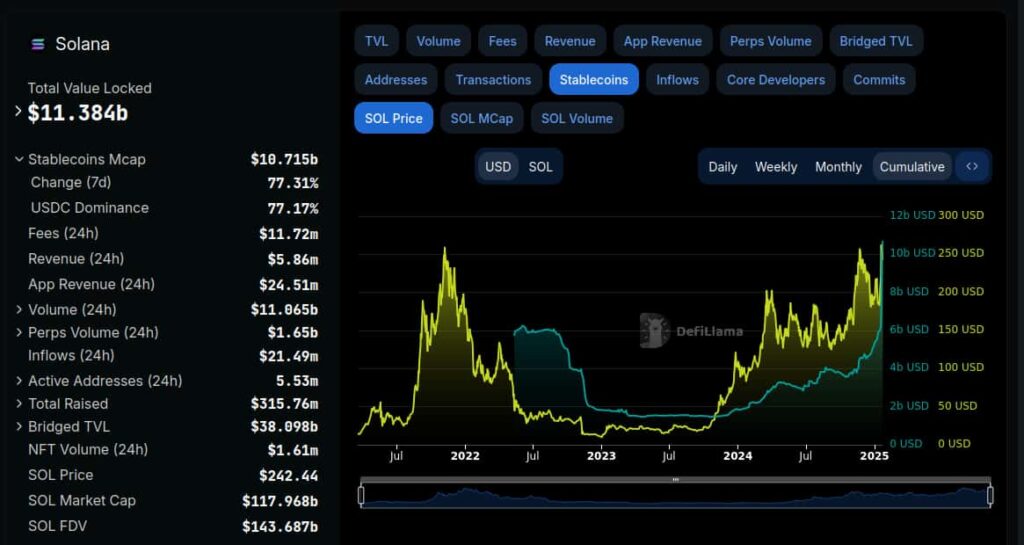

At the time of this writing, Solana has achieved $10.71 billion in stablecoins circulating or staked in its ecosystem. Notably, this amount is nearly as much as Solana’s $11.38 billion total value locked (TVL) in its many decentralized finance (DeFi) protocols.

Of the nearly $11 billion in stablecoins. 77.17% are made of Circle’s USDC, showing a clear market dominance.

From a price perspective, SOL is trading at $242.44 per token, also close to a price all-time high. The surge was potentially fueled by the massive dollar inflow, which enriches the ecosystem, and, thus, SOL’s perceived value.

Why does a higher stablecoin market cap matter for Solana?

Basically, Solana’s stablecoins market cap increases always that stablecoin tokens like USDC are minted in the blockchain.

This could come natively from Circle and other providers, as investors deposit U.S. dollars with the company, receiving the same amount in USDC or other stablecoins. Or when users bring these tokens from other blockchains, either by bridging them into Solana, or withdrawing from crypto exchanges.

In summary, a higher stablecoins capitalization means higher investment interest in the ecosystem or its native token (SOL), signaling intention to either buy Solana-based tokens or provide liquidity to farm yield. The conclusion is, inevitably, a wealthier ecosystem with higher capital flow, benefiting everyone involved.

The counterpoint

However, the stablecoin capitalization alone is not a conclusive indicator of mid- to long-term sustainability, despite favoring the short-term. Solana has grown, backed primarily by a highly speculative and short-term demand related to trading memecoins, with many rug pulls.

Etheraider commented on that in a post on X this morning, calling Solana “the fast food of crypto.” According to the commentator, Solana offers “just a quick dopamine hit with no substance,” as traders seek high-volatility plays. For example, as reported earlier today, with a trader going from hell to heaven in less than a day.

“Vast majority of Solana users don’t seem to champion any values, only [numbers go up],” Etheraider continued. “And it makes sense because: Casinos don’t have residents. They have tourists. And 99% of the casino goers are currently losing… And when the [money] dries up, the tourists go home.”

On that note, it is possible that the surge in stablecoin value on Solana is due to gambling activities around memecoins. In particular, speculating on Donald Trump’s recently launched $TRUMP, which has recorded over $38 billion in trading volume, as Finbold reported.

Essentially, Trump has chosen Solana to launch his highly speculative memecoin, while picking Ethereum to launch the World Liberty Financial (WLFI) long-term project.

All things considered, Solana could benefit from the recent surge in stablecoins capitalization, but SOL will require more solid use cases for longer-term sustainability.

Featured image from Shutterstock