Over recent times, developments have emerged that have yet to be fully assimilated by the stock market. These developments have led to shifts in the valuation statuses of various stocks, transitioning some from oversold to overbought conditions and vice versa. This transition heralds the likelihood of an impending price correction.

When an asset becomes overvalued, it typically suggests a bearish outlook, signaling an impending decline in the stock price. This anticipated decrease is expected as investors begin to sell off their positions.

Finbold analyzed the technical and fundamental indicators of specific stocks associated with this rating to assess whether they were poised for a price decrease.

Picks for you

Waste Management (NYSE: WM)

Waste Management (NYSE: WM) stock has seen significant gains lately, with shares surging by over 30% in the past six months alone. The company reported robust Q4 results, including record revenues, operating margins, and adjusted EPS in FY2023.

However, it appears that much of the recent share price increase has been driven by the underlying valuation expansion the stock has experienced. The current above-average valuation might indicate potential downside risk.

The RSI is one of the best indicators for the buying activity of a particular stock, where a high RSI may signal overbuying, particularly for larger stocks, which could trigger a downward reaction.

With an RSI reading of 87, the WM stock is treading in the dangerous ‘overbought’ territory, indicating a potential price correction.

Brown & Brown (NYSE: BRO)

Brown & Brown (NYSE: BRO), also known as Brown & Brown Insurance, is a brokerage firm specializing in risk management. Based in Florida, BRO operates over 450 locations globally.

BRO is the fifth-largest independent insurance brokerage in the U.S. and the sixth-largest globally.

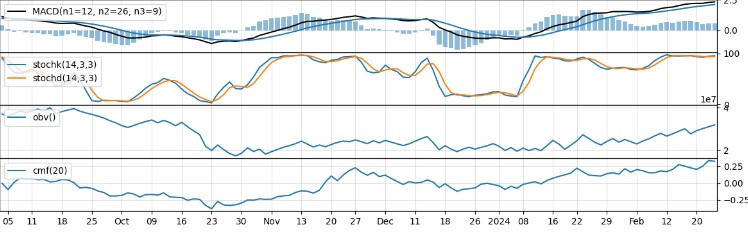

After analyzing the technical indicators, BRO’s stock price may encounter a short-term pullback or consolidation in the coming days. This is suggested by the overbought conditions shown by the momentum indicators. Nonetheless, the trend remains bullish, backed by the moving averages and MACD.

Berkshire Hathaway (NYSE: BRK.A)

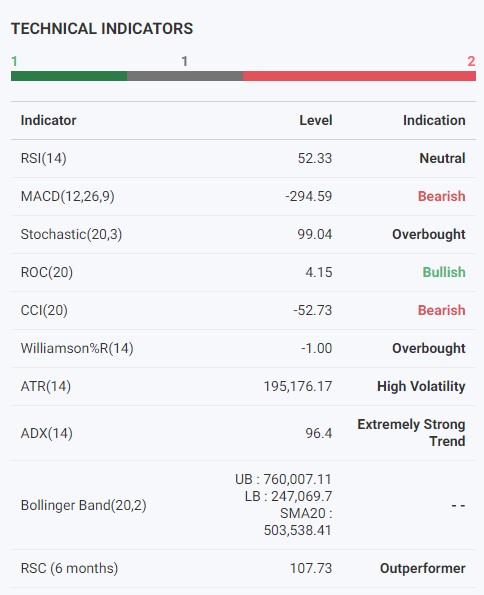

It may seem unexpected to find Berkshire Hathaway (NYSE: BRK.A) on this list, but the technical indicators are clear: most of them point to a strong bearish trend for this stock.

After analyzing MACD, RSI, Oscillators, CCI, and other pertinent technicals, it’s evident that the stock’s current trend is bearish and characterized by high volatility.

Even though these stocks are presently overbought and may face a possible correction, their financial strength and the solid guidance provided by some of the most experienced investors are promising indicators. This situation could present a “buy the dip” opportunity for traders.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.