During the holiday period, stock markets experienced a lull with minimal activity. However, certain stocks garnered investor attention, pushing them into the ‘overbought’ territory, potentially paving the way for a price correction.

When an asset is overvalued, it usually signals a bearish outlook, indicating a forthcoming decline in the stock. This expected drop in price is anticipated as investors start offloading their positions.

Finbold examined certain stocks’ technical and fundamental indicators touted with this ranking to determine if they were due for a price decrease.

Eli Lilly (NYSE: LLY)

The stock of pharmaceutical giant Eli Lilly (NYSE: LLY) has experienced significant market cap growth, propelling it to the 9th position by market cap on the S&P 500 index. Currently, the stock is experiencing a period of gains.

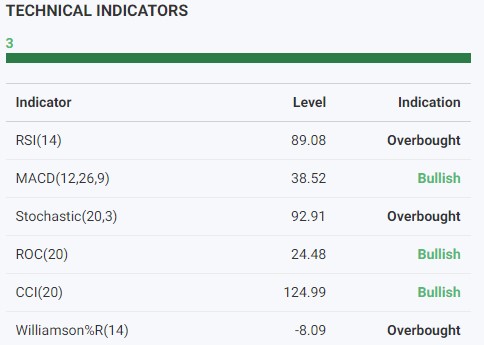

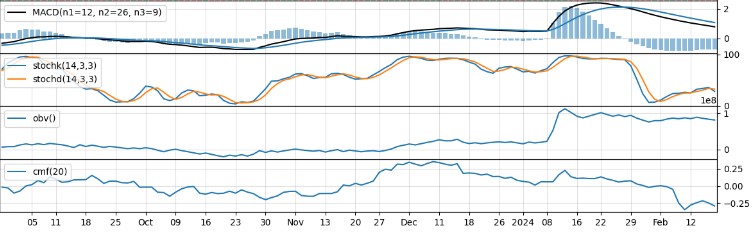

However, upon examining technical indicators such as the Relative Strength Index (RSI) at 89 and oscillators at 92.91, it becomes evident that the current trend has placed this stock in a precarious position.

General Electric (NYSE: GE)

General Electric (NYSE: GE) is undergoing a notable transformation, prioritizing the separation of its energy and aerospace divisions through spin-offs.

The CEO is recognized for orchestrating a successful turnaround and implementing strategic decisions. The company has demonstrated robust performance, particularly in its aerospace segment, marked by increased orders and revenue.

Nonetheless, opinions regarding the stock’s valuation diverge, with some experts expressing caution due to its high price, while others highlight the potential for future growth.

An RSI above 70 suggests strong positive momentum for the stock in the short term. The consistent increase in investor willingness to pay for the stock reflects growing optimism, implying a likelihood of continued price appreciation. However, a high RSI could indicate overbuying, especially for larger stocks, potentially leading to a downward reaction.

Juniper Networks (NYSE: JNPR)

Juniper Networks (NYSE: JNPR), headquartered in California, is a multinational corporation operating in the United States. The company specializes in developing and marketing various networking products, including routers, switches, network management software, network security products, and software-defined networking technology.

Analysis of technical indicators suggests a possible bearish movement in JNPR’s stock price in the coming days. Trend indicators and negative volume indicators signal a potential downward trend in the stock price.

Although these stocks are presently in the overbought zone, it’s crucial to consider the influence of market volatility.

Such volatility could either negatively affect their prices or potentially push them into a more positive volume trend. Keeping an eye on market dynamics is essential for gauging the future trajectory of these stocks.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.