Artificial intelligence has dominated the past year, revolutionizing numerous industries and driving semiconductor stocks to unprecedented heights. Micron Technology (NASDAQ: MU) appears poised to be the next beneficiary of this trend.

If we examine the yearly price chart for Micron stock, we can spot the beginnings of a potential inverse head-and-shoulders pattern, which often suggests a forthcoming reversal of the downward trend, as suggested in X post by stock tracker TrendSpider on March 6.

We may witness another round of price declines, albeit not as steep as the previous drop or the head formation. Subsequently, another rally might shape the right shoulder. Typically, the depth of the right shoulder is roughly equivalent to that of the left shoulder.

Another technical indicator in favor of MU stock

With the possibility of an inverse head-and-shoulders formation for MU stock, it’s worth noting that in recent months, Micron stock has broken through several resistance levels, bringing it within a few dollars of its all-time high, reached two years ago at $97.36.

As of March 6’s closing, MU stock’s closing price was $95.56. It now encounters one final resistance zone at $97.38. Should this barrier be breached, it could propel MU stock to new all-time highs, likely surpassing the $100 threshold.

Micron stock receives a nod from other technicals as well

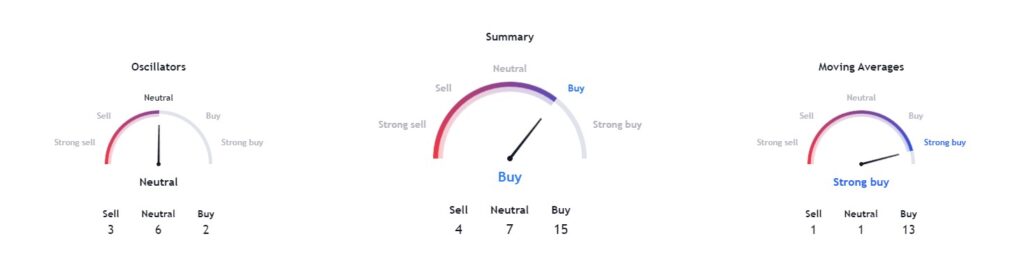

Other pertinent technical indicators for MU stock also lean bullish, with a ‘buy’ rating from 15 signals overall. Moving averages favor a ‘ strong buy’ at 13, whereas oscillators indicate a ‘neutral’ rating at 6.

Technical analysis compellingly supports MU stock and its potential future price movements. However, it’s crucial to consider real-world events that could significantly increase market volatility and alter the indicators unfavorably for Micron stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.