Warren Buffett, the renowned investor and Chairman of Berkshire Hathaway (NYSE: BRKA, BRKB), has expanded the company’s extensive portfolio by recently extending an Occidental Petroleum Corp (NYSE: OXY) position, and it seems that OXY stock is primed for a surge.

Occidental Petroleum stock has experienced a notable breakout above its 200-day moving average, reaching its highest price since early November.

This breakout might indicate potential testing of further resistance zones, with the closest one being set at $67.

Picks for you

Further technical indicators for OXY stock

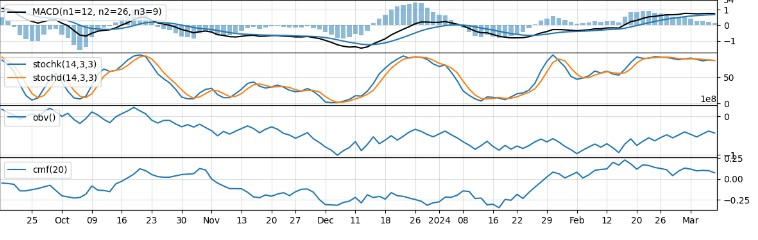

To assess the likelihood of OXY stock testing and surpassing its next resistance zone level, exploring technical indicators beyond the moving average could provide a clearer perspective.

Trend indicators like MACD and EMA indicate a slight positive trend, with the MACD line consistently above the signal line. Additionally, the EMA has steadily risen, suggesting a bullish sentiment in the short to medium term.

According to further technical analysis, OXY stock might experience sideways consolidation in the next few days, leaning slightly towards a bearish trend. Traders should be cautious and wait for more precise signals before making substantial trading decisions.

Real-life events that could influence OXY stock

A significant factor that could significantly impact oil companies is the fluctuation in the supply and demand of crude oil. Occidental Petroleum could be in for a pleasant surprise.

According to a report from the IEA dated March 14, the organization anticipates oil demand will increase by 1.3 million barrels per day (bpd) this year, up from the previous estimate of 1.2 million bpd. The agency attributes this adjustment to disruptions in maritime transport caused by Houthi attacks in the Red Sea, which increased fuel demand.

The IEA has also revised its supply forecast, but it has been downwards this time. It anticipates an additional supply of 800,000 barrels per day (bpd) this year. Consequently, the previous forecast, which indicated a surplus in the oil market, now suggests a deficit later in the year.

All this spells bad news for gas prices but good news for OXY stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.