One of Warren Buffett’s favorite holdings, Occidental Petroleum (NYSE: OXY), just exhibited a “Death Cross” pattern on its stock chart following a period of significant volatility, potentially foreshadowing a further decline in price.

Despite a weak performance year-to-date, Buffett has continued to increase his holding of OXY stock during this period, with gas and oil producers stock occupying a 4.86% position, which amounts to 255.3 million shares worth around $15 billion—nearly 30% of the company’s total share count.

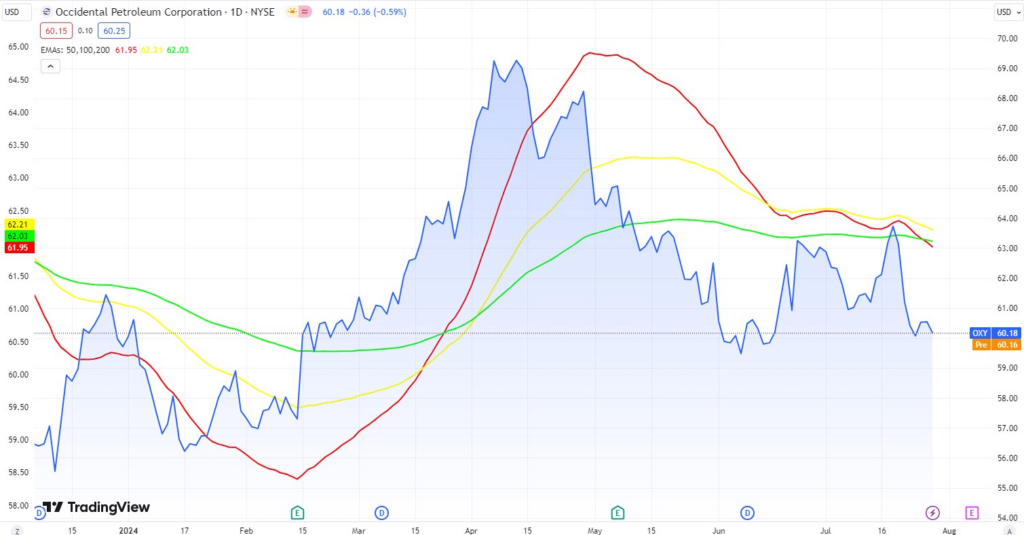

As of the latest close, OXY shares are trading at $60.18, decreasing 0.59% in the latest trading session, thus adding to the losses of 1.71% suffered in the previous five trading sessions and aiding the formation of the “Death Cross” pattern on the price chart.

Picks for you

The “Death Cross” pattern emerges when the 50-day simple moving average crosses below the 200-day simple moving average and is widely regarded as a bearish signal that forebodes a period of diminished returns.

Further technical analysis of OXY stock

A more profound technical analysis of Occidental Petroleum stock indicates that OXY shares are currently trading within a horizontal trend channel over the medium to long term, suggesting continued movement in the same direction.

Amid the weaker performance of the overall energy sector in the recent period, OXY stock fluctuates between support at $59.77 and resistance at $61.97, forming a rectangle pattern, where a decisive breakthrough in either of these levels will indicate the stock’s new direction.

Furthermore, the relative strength index (RSI) at 40 has decreased over the previous period, indicating diminishing investor buying activity.

The broader market dynamics remain unfavorable for OXY

Despite being one of Buffett’s top holdings, Occidental’s outlook remains challenging. Global oil demand is uncertain, and crude prices, using Brent futures as a benchmark, have recently ranged between $75 and $85 per barrel.

Prices currently hover around $75, with the International Energy Agency (IEA) and the Organization of Petroleum Exporting Countries (OPEC) providing divergent forecasts for 2024 oil demand growth at 1.1 million barrels per day (BPD) and 2.2 million BPD, respectively.

In addition, a wave of consolidation is occurring in the U.S. energy sector. Occidental’s planned acquisition of shale oil and gas producer CrownRock has been progressing slowly, with hopes of completing the transaction by August.

With the Q2 earnings report set for August 7, investors are looking to learn more about the company’s performance during this quarter and whether the acquisition of CrownRock will soon be completed.

Buffett is probably undeterred by the recent OXY stock dip

Known for his fundamentals first approach, Buffett places low significance upon technical analysis, as he is a long-term, dividend-oriented investor.

Moreover, the current dip in OXY stock price could prompt Berkshire Hathaway’s CEO to purchase additional shares as he has received regulatory approval to buy up to 50% of outstanding OXY shares in 2022.

According to SEC filings, Buffett bought an additional 7 million OXY shares worth approximately $434 million throughout June.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.