After delivering a stellar Q2 earnings report on August 28, Nvidia (NASDAQ: NVDA) stock experienced significant volatility, erasing almost 8% of its value in the subsequent trading sessions.

However, the latest trading session on September 2 brought a 1.51% gain, which allowed NVDA shares to close trading at $119.37, as pre-market on September 3 showed a decline of 2.05%.

Such volatility prompted me to use technical analysis and opinions from Wall Street experts to determine at what price NVDA shares will trade 12 months from now.

Technical analysis of NVDA stock

Technical indicators for NVDA stock in the previous 30 days reflect the current negative sentiment, as the price broke below its support zone at $122.95, and is currently trading just below its resistance zone at $120.20, with the following support zone identified at $102.81, a level NVDA shares reached on July 27.

Another indicator that further aids the bearish outlook for Nvidia stock is that its price is currently trading below its 50, 100, and 200-day simple moving averages (SMAs), indicating a further continuation of a downward trend.

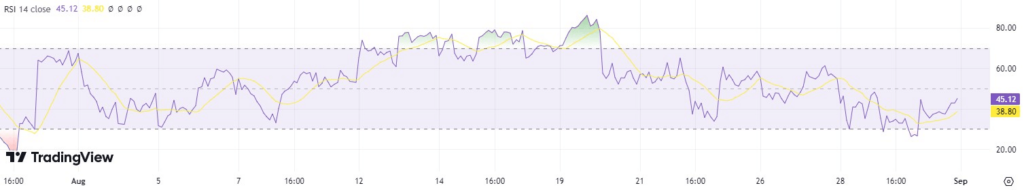

Previous trading sessions have also brought a lower buying volume for this semiconductor stock, visible on its relative strength index (RSI) chart, and a reading of 38 at the latest close, which threads close to the oversold zone at 30.

However, investors might use this opportunity as a profitable entry point, at least according to an overall technical sentiment that considers all the indicators and delivers a “buy” verdict.

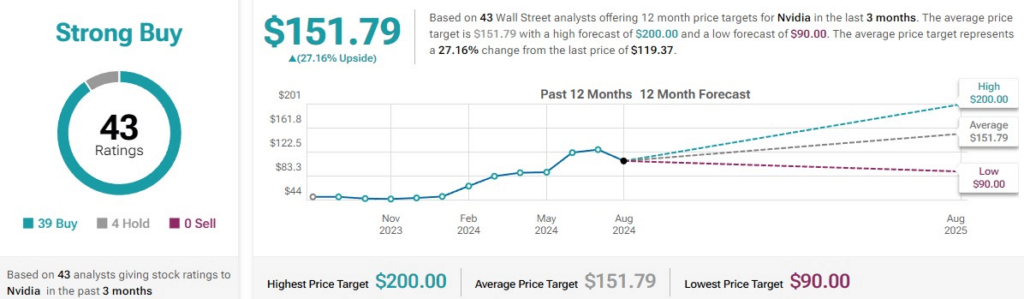

Wall Street is optimistic about NVDA stock in the next 12 months

In many ratings released after Nvidia’s Q2 earnings report, analysts from large Wall Street institutions expressed their bullish stances for the upcoming period and microchip makers’ performance.

Analysts from Bank of America confirmed their “buy” rating with a raised price target of $165 and view Q2 results as strong, with $30 billion in sales. However, they remain cautious over Q3 guidance, which was only modestly above consensus due to a delay in the Blackwell ramp.

Piper Sandler experts maintained their “overweight” or “buy” rating and set a $140 price target while seeing the current pullback as a buying opportunity. While margins compressed slightly, Nvidia is still well-positioned to capitalize on vital artificial intelligence (AI) demand.

Researchers at Cantor Fitzgerald also reaffirmed an “overweight” rating with $175 price targets while downplaying concerns about Blackwell delays. They highlighted that the semiconductor company exceeded guidance and projected solid growth into Q3.

JPMorgan notes that Nvidia’s July results beat revenue, gross margin, and EPS estimates despite slightly missing market expectations while keeping its “overweight” rating and increasing the price target from $115 to $155. The firm is optimistic about continued growth driven by strong AI demand, with no significant impact expected from the two-month Blackwell delay, and expects margins to improve next year.

Overall, Wall Street sees NVDA as a “strong buy” stock, with 39 experts recommending a “buy,” while four opted for a “hold.”

The average price target is $151.79, representing a 27.16% potential upside from the current price levels.

Based on the technical analysis, current price movement, and analyst rating, Nvidia stock presents a favorable entry point at a current valuation, making it a potentially profitable investment.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.