In 2024, the EV industry’s challenges with diminishing production, deliveries, and potential bankruptcies have impacted Lucid (NASDAQ: LCID), thus seeing its stock value drop by 36% since the start of the year.

Despite this, Lucid’s partnership with the Saudi Arabia Public Investment Fund (PIF) has been beneficial, aiding it through tough times.

An affiliate of the PIF recently invested $1 billion in Lucid’s convertible preferred stock, providing crucial financing and reassuring other investors as the PIF increases its stake to 60%.

Picks for you

However, this funding may only partially address Lucid’s financial woes, considering its reported $2.8 billion loss in 2023 and ending the year with $1.4 billion in cash.

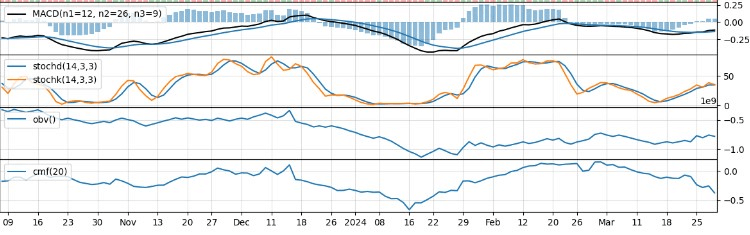

Technical analysis of LCID stock

On April 4, LCID shares closed at $2.65, marking a 3.64% decline and adding to the 9.56% loss observed over the past five trading sessions.

Analyzing the support and resistance levels for LCID stock, a support zone is identified between $2.62 and $2.64, established by multiple trend lines across various time frames.

Regarding resistance, significant areas include a zone from $2.91 to $2.93 and another from $3.04 to $3.08, both defined by intersecting trend lines across different time frames.

Based on technical indicators and analysis of the stock price chart, it appears that LCID’s price movement in the coming days is expected to trend downward.

Various indicators, including trend, momentum, and volume, indicate a bearish sentiment, suggesting that investors might continue to sell the stock. This could potentially result in further declines in prices.

However, despite the overwhelming bearish conditions that surround it, Lucid stock managed to eke out pre-market gains of 0.38% on April 5.

Wall Street sees potential upside for LCID stock

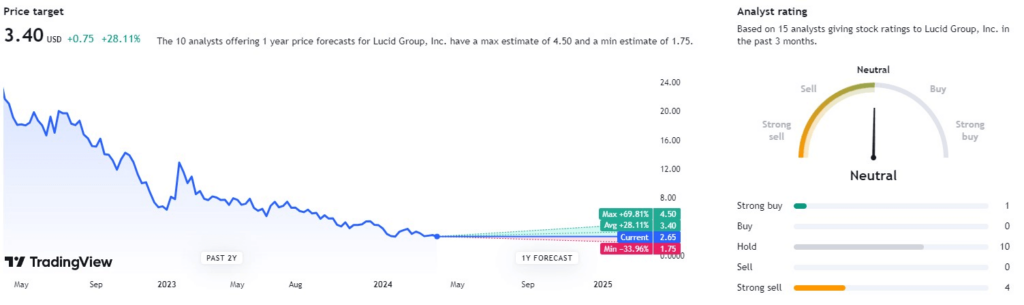

Although the general trend is bearish, analysts at TradingView cautiously perceive a potential upside for LCID stock. They have assigned it a ‘neutral’ rating based on 15 assessments.

Despite a cautious stance, the majority of analysts anticipate a potential upside for LCID stock in the future. Morgan Stanley analyst Adam Jonas, in a report from March 25, maintains his price target at $3. He emphasizes the significance of Saudi investment and advises traders to wait and observe its impact.

Among these, one analyst suggests a ‘strong buy,’ while 10 recommend a ‘hold,’ followed by four ‘strong sell’ ratings.

The average price target stands at $3.40, implying a potential increase of 28.11% from LCID’s current price levels.

It’s uncertain whether the significant support from the Saudi Arabian PIF will be sufficient for LCID to rebound and possibly progress, with Lucid aiming to bolster its sales with a significant discount on its Air model. However, the prevailing trend in the EV industry doesn’t seem promising for Lucid.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.