Qualcomm Inc (NASDAQ: QCOM) specializes in designing and licensing semiconductor chips for mobile devices and wireless communication products like processors, modems, and RF systems.

The company is also expanding its reach into automotive technology and computing markets. With a massive market capitalization of $182 billion, Qualcomm stands out.

Additionally, QCOM stock offers a dividend yield of 1.96%, higher than the tech sector median. Qualcomm has consistently increased its dividend every year for the past two decades, so this is something eagle-eyed investors should take into account.

With a modest payout ratio of around 36%, Qualcomm’s earnings support its dividend payments adequately.

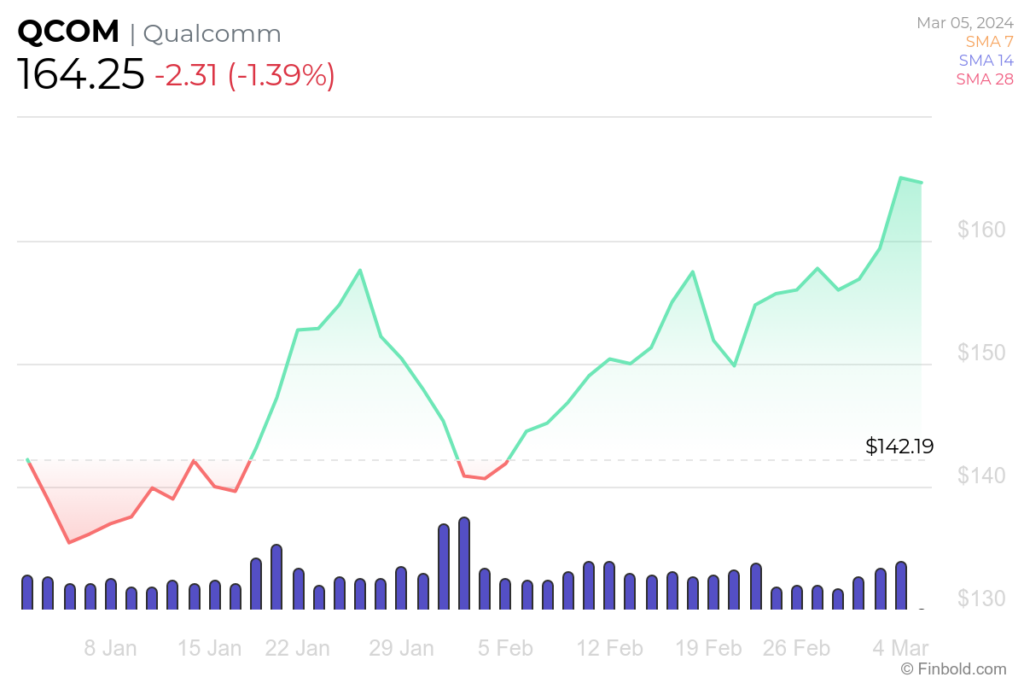

Qualcomm stock price chart

As of now, Qualcomm stock is trading at $164.25, nearing its all-time high (ATH) from 2022. It’s showing a loss of -1.39% since the market opened but has gained 5.66% over the past week.

QCOM stock price is up 15.64% for the month, totaling an impressive year-to-date (YTD) increase of 18.78%.

Wall Street QCOM stock forecast

According to analysts on TradingView, Qualcomm stock is considered a ‘buy,’ with varying opinions and relatively conservative price targets. Among 35 experts, 14 recommended a ‘strong buy,’ 6 suggested ‘buy,’ 14 advised ‘hold,’ and one recommended ‘sell.’

The average price target for QCOM stock is $163.09, indicating a decrease of -2.08% from its current level.

The estimated targets vary widely, ranging from a high of $180 (+8.07%), which seems feasible given recent trends, to a low of $120 (-27.95%). It’s worth noting that QCOM shares exceeded this lower expectation four months ago.

Strong alliances strengthen Qualcomm’s outlook

At the 2024 Mobile World Congress, Qualcomm’s Akash Palkhiwala discussed the company’s readiness for the next AI deployment wave. He highlighted the expansion of large language models into edge devices like smartphones, PCs, automotive systems, and IoT devices.

Qualcomm extended key licensing agreements, including with Apple (NASDAQ: AAPL), until 2027, showcasing Apple’s reliance on Qualcomm’s modems. The company introduced the Snapdragon 8 Gen 3 Mobile platform, offering generative AI capabilities for Android smartphones, with Samsung already incorporating it into the Galaxy S24 Ultra.

QCOM also expanded its agreement with Samsung for flagship smartphone launches through 2024. Additionally, Qualcomm’s presence extends beyond smartphones, with its Snapdragon Digital Chassis Solution launching 75 new models commercially in 2023 in the automotive segment.

This diversification offers investors opportunities beyond AI chip specialists and, combined with dividend payment, strengthens the case for investment in QCOM stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.