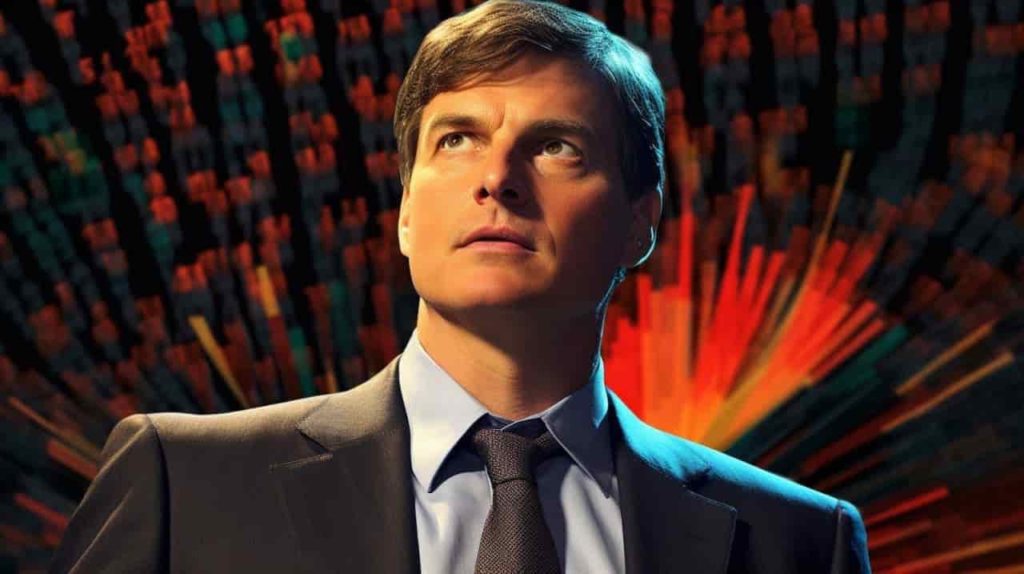

Earlier this year, the investing world was rocked by the surprising revelation that famed investor Michael Burry had placed a massive bearish bet against the stock market.

Burry, renowned for his role in ‘The Big Short,’ purchased put options with a nominal value of around $1.6 billion tied to two major exchange-traded funds (ETFs): SPDR S&P 500 ETF (SPY) and Invesco QQQ Trust ETF (QQQ).

Astonishingly, these 40,000 put options represented a staggering 93% of Burry’s portfolio, provided he hadn’t made any significant changes since their last disclosure in mid-August.

Picks for you

So what stocks is Burry shorting?

First of all, it’s essential to clarify that Michael Burry’s purchase of put options doesn’t equate to a straightforward short position on the stock market.

While both strategies are bearish, there is a clear difference. Short selling entails selling borrowed assets with the expectation of a price decline, whereas put options grant the right to sell assets at a predetermined price within a specified timeframe, offering a degree of risk management and flexibility not present in traditional shorting.

Now, as explained earlier, by buying these put options Burry placed a significant bearish bet against two recognized stock ETFs. These two funds track the performance of two major stock market indexes, including the S&P 500 and the tech-oriented Nasdaq 100.

The S&P 500 tracks the performance of 500 large-cap US stocks, while the Nasdaq 100 focuses on the top 100 non-financial companies listed on the Nasdaq stock exchange, predominantly in the technology sector.

So essentially, Burry took a bearish position against hundreds of the biggest stocks trading on the US exchanges, including all of the big names including Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOGL), Meta Platforms (NASDAQ: META), Tesla (NASDAQ: TSLA), Johnson & Johnson (NYSE: JNJ), Berkshire Hathaway (NYSE: BRK), Procter & Gamble (NYSE: PG), Nvidia (NASDAQ: NVDA), and hundreds more.

In other words, Burry bet against the broader US stock market.

Burry’s major stock sales

Apart from the put options, the same August regulatory filings also revealed that Burry had multiple other notable portfolio changes.

For instance, the hedge fund manager completely sold out the 250,000 shares in JD.com (NASDAQ: JD), which previously accounted for 10.26% of his portfolio.

Similarly, he offloaded all of his holdings in Alibaba Holdings (NYSE: BABA) and Zoom Video Communications (NASDAQ: ZM), which captured 9.56% and 6.91% of his portfolio, respectively.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.