IMPORTANT NOTICE

Finbold may provide educational material to inform its users about crypto and digital assets. This content is for general information only and does not constitute professional advice or training certification. Content is provided "as is" without any warranties. Users must conduct their own independent research, seek professional advice before making investment decisions, and remain solely responsible for their actions and decisions.

RISK WARNING: Cryptocurrencies are high-risk investments and you should not expect to be protected if something goes wrong. Don’t invest unless you’re prepared to lose all the money you invest.

By accessing this Site, you acknowledge that you understand these risks and that Finbold bears no responsibility for any losses, damages, or consequences resulting from your use of the Site or reliance on its content. Click here to learn more.

In this guide, you will learn everything you need to start trading cryptocurrencies. Once you end reading our guide, you will have all the background information on buying and selling digital assets. There’s a lot to cover in this guide, so let’s dive right in.

If you want to learn how to trade cryptocurrency, you’re at the right place. There are mountains of information available on the internet, which could easily overwhelm anyone, including a seasoned trader. To help you out, we have created this detailed guide to cryptocurrency trading for beginners updated for 2026.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

What is cryptocurrency?

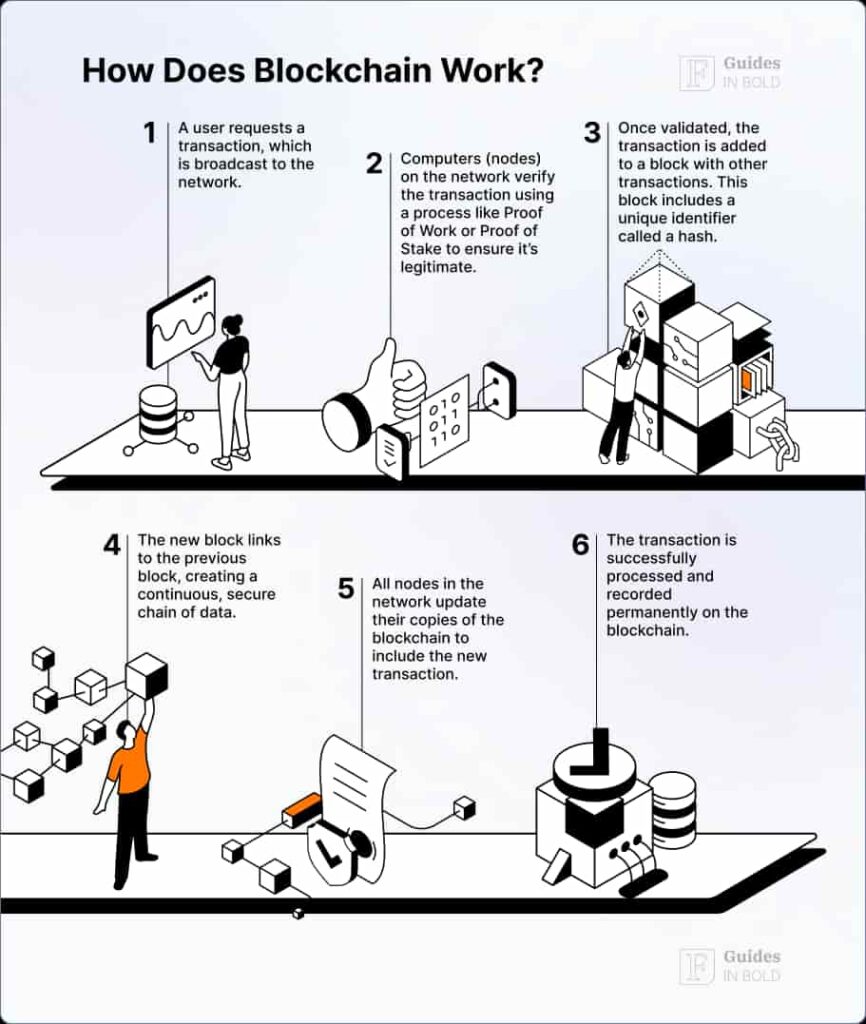

The difference is that unlike conventional currencies such as the U.S. dollar, cryptocurrencies are often not controlled by a single entity. They are also secured using complex cryptography coupled with a new form of online public ledger called a blockchain. It is distributed to anyone and everyone interested in having a copy. Watch the short video below to understand how blockchain works before we proceed further.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Cryptocurrency trading: how it all started?

Digital currencies have been around for more than a couple of decades in different experimental forms, but the first one to be successfully implemented was Bitcoin (BTC).

Bitcoin was created by Satoshi Nakamoto (pseudonym), who released its whitepaper called “Bitcoin: A Peer-to-Peer Electronic Cash System” [PDF] in October 2008 and launched the network in January 2009.

Bitcoin has spurred a whole new digital coin class that can now be bought and traded on cryptocurrency exchanges worldwide.

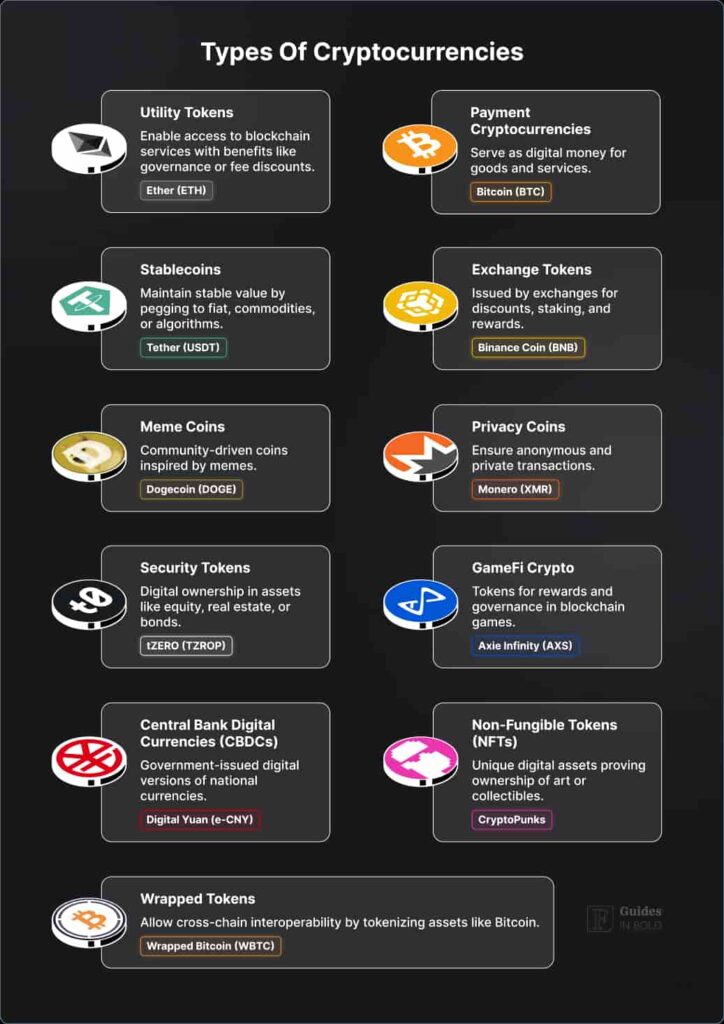

Other than Bitcoin, there are other well-known and recognized cryptocurrencies like Ethereum (ETH) – which is currently trailing Bitcoin in terms of network value; and Tether (USDT)- which is the leading stablecoin also in terms of network value.

Stablecoin definition

There are thousands of cryptocurrencies listed across major data aggregators such as CoinMarketCap, with new tokens launching regularly and others becoming inactive over time.

Types of cryptocurrencies

The diversity of cryptocurrencies extends far beyond Bitcoin, Ethereum, and Tether. Many are designed with unique purposes and functionalities, addressing different areas of the digital economy. To explore these distinctions further, read our in-depth guide on the different types of cryptocurrency and their specific roles in the digital landscape.

Crypto beginners’ corner:

- How to Invest in Crypto? Complete Beginner’s Guide

- Best Cryptocurrency Exchanges – Top 7 Picks

- 15 Best Crypto Books for Beginners

- Must-read Crypto Wallets Guide for Beginners

- How to Mint & Sell NFTs? Beginner’s Guide

- How to Stake Cryptocurrency? Step-by-Step

- 11 Crypto Slang Terms Explained

- Best Crypto Trading Bots – Top 3 Picks

- What is DeFi? Liquidity Mining Explained

Cryptocurrency trading vs. Investing

As you learn how to buy and trade cryptocurrencies, you must differentiate between crypto trading and investing. What is the difference? Which is better? And, how do you take advantage of this distinction to effectively make your trades? The two terms are often used interchangeably, but they are different.

They are only similar to the extent that the end goal is the same – gaining profit from your activities. They are different in that results from trading activities are generally expected within a short to medium-term period. This could be anything from minutes or hours to a few days or weeks. With investing, the trader is in it for the long haul. We’re talking about months all the way to years or even more.

As a beginner, you probably want to choose a trading strategy that involves medium to long-term trading and investing. This will typically require more time to research and analyze your trades before committing.

Crypto market vs. Stock market

The stock market has been around for a long time now, and there is a bunch of literature on the topic. But, how different or similar is it from or to the nascent cryptocurrency market? Here’s how.

Similarities between cryptocurrency and stock trading

- Stock trading and investing tools are more or less the same. This is especially true for technical traders using tools such as charts to analyze the market. You can use the same tools to perform TA (Technical Analysis) for trades on either market;

- Assets denominated using fiat currencies. The crypto market may be innovative and revolutionary with the assets designed to append the current financial system. However, the denominations in the marketplace are still valued compared to fiat currencies similar to the stock market;

- Trading and investing strategies are similar. In the stock market, traders can choose to day trade, swing, or position trade. They can also opt to buy and hold their assets for the long term. Similarly, traders and investors in the crypto market can do the same things;

- Similar market products. The stock market has been around for generations, leading to innovative products such as derivatives and techniques such as using leverage to inflate gains (and losses.) Those same products and techniques have been ported over to the new age cryptocurrency market. You can now trade Bitcoin futures, options, and leveraged tokens. You can use leverage on most of your trades on most leading cryptocurrency exchanges, such as Binance, Bitfinex, or BitMEX. The full list of digital asset exchanges with a leverage trading here.

Differences between stock and cryptocurrency trading

- Market volatility. Owing to its old age, the stock market is more stable and less volatile. The crypto market, on the other hand, is accustomed to wild price swings. It is pretty normal to see double-digit percentage swings in a matter of hours;

- Market maturity. Age is a significant factor in trading. The stock market has been around for a long time, while the crypto market is only about a decade old. This means that market value and trade volume in the former is much larger compared to the latter. The younger age also contributes to the wild volatility experienced in the crypto market;

- Market assets. In the stock market, you invest in the publicly listed company shares by buying their stocks. In the crypto market, you invest in the idea, the technology, or the currency (or token), but not the company (if any) behind the currency;

- Regulations. Since the stock market has been around for ages, regulators have had enough time to develop and implement rules and regulations governing the market’s conduct. This contributes to the minimal volatility we highlighted earlier. In the cryptocurrency market, this is not the case. The regulators are still grappling with understanding the emerging asset class, and this lack of (proper) regulations are part of the reason for the market’s wild nature.

Why trade cryptocurrencies?

Given that cryptocurrencies seem to have more negatives against the stock market but not enough positives, why would you want to trade digital assets? Well, here are some of the pros below.

Benefits of cryptocurrency trading

- 24-hour trading. As opposed to the stock market that opens and closes at specified times, there is no closing of the cryptocurrency market. You can trade cryptocurrencies 24/7/365 or even use trading bots and let your trades run all the time;

- Market volatility. This may be seen as both a negative and a positive feature. In the previous section, we focused on the negative, but let’s talk about the positive. Traders (not investors) live off market volatility. The crypto market has this in troves, and this means that as a trader, you will get better trading opportunities with the cryptocurrency market as opposed to the stock market;

- The multitude of assets. Despite its relatively young age, the crypto market has advanced so much so fast that traders now have access to similar stock market products, including futures, options, leveraged tokens, swaps, CFDs (contracts for difference). Whether you want to go long or short, ‘call’ it or ‘put’ it, look no further. Every kind of derivative currently available on the stock market has already been ported over. If not, it’s coming soon;

- Easy account opening. In crypto, there is a shallow barrier to entry. You can easily create an account in an exchange and start trading in a matter of minutes. That’s how fast it is to jump on board.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

On anonymity..

Cryptocurrency trading techniques

There are two main techniques to use to analyze and evaluate cryptocurrency. The techniques have existed for generations and have successfully been implemented for traditional financial assets. These are the Fundamental Analysis (FA) and Technical Analysis (TA). Often they are used complementary to each other, but it is possible to apply either independently.

Fundamental Analysis (or FA)

FA is the art of a trader using both economic and financial factors affecting a given asset to determine an asset’s value. Through FA, you will be able to know whether that asset is either overvalued or undervalued at the current valuation. If you can figure out that question, you can then decide whether or not to invest, when, and for how long a period you would look to keep the investment.

Fundamental analysis for cryptocurrency involves evaluating two important factors – on-chain and off-chain metrics. On-chain metrics include network hash rate, wallet addresses (active and dormant), network applications, token/coin issuance rate (inflation/deflation), network fees, and transactions.

Luckily, with cryptocurrency, most of the networks are public such as Bitcoin and Ethereum making access to these on-chain factors easy. To track both Bitcoin and Ethereum on-chain metrics, you can use Bitinfocharts.com. This website has loads of crypto-related data and is extremely simple to use and navigate.

Off-chain metrics basically include community engagement, exchange listings, government regulations, etc.

Technical Analysis (or TA)

Technical analysis is a trading discipline predicated upon the idea that a trader could predict an asset’s future price movements, given its historical price action. TA uses a host of technical indicators to achieve this, including trade volume, moving averages, trend lines, candlesticks, chart patterns, and more. At the end of a technical analysis, a trader should have identified trading opportunities and a potential entry point.

Cryptocurrency technical analysis can work for any trading timeline, from scalping and day trading to long-term investments.

Recommended video: The top 10 key chart patterns to be effective at trading | Technical Analysis Tips

Fundamental analysis vs. Technical analysis – which is better?

It entirely depends on the trader profile. Do you want to be the kind of trader that prefers to get in and out of trading positions multiple times a day (i.e., day trader)? Then crypto technical analysis will be your best friend. Instead, do you prefer to research and make informed bets every time (i.e., swing trader)? Then—a mix of both is the way to go.

For instance, you may use FA to determine that an asset is worth investing in. What you may not uncover with FA, however, is the right time to invest. For this, you will have to rely on technical analysis. Conversely, if you are using TA to work out future price movements for a given asset, you can use FA to confirm whether or not the price trend you are witnessing is poised to continue.

Therefore, there are advantages to using either technique over the other at various moments in your research, but to have a more complete picture, use both.

Cryptocurrency markets

When it comes to the available cryptocurrency markets, just like the traditional financial instrument markets, there are two classes: the spot and the derivatives markets.

Crypto spot market

As the name suggests, in a crypto spot market, assets are either bought or sold on the spot, meaning that delivery happens “on the spot.” If you buy Bitcoins, the coins are delivered immediately, and the payment is also settled immediately.

The spot market is made up of two kinds of traders:

- Makers – these are the initiators of a trade. As a maker, you list a potential trade on an exchange. For instance, if you want to sell your Ethereum coins, you will open a trade at a particular price point, inviting a potential buyer to fulfill your order;

- Takers – on the other side of the equation will be the trader that fulfills the order, and these are referred to as takers. As the name suggests, these traders “take” already existing orders and fulfills them

Makers bring liquidity to the marketplace. There are makers and takers on either side of the purchase coin. There are makers for both buy and sell orders, and consequently, there are takers for both buy and sell orders. An order book is the ledger on which available orders yet to be fulfilled are recorded.

For instance, if you are a buying taker, you could scan through the order book and opt to fulfill (take) an order that already exists or place an order. The platform will automatically match your purchase order with an already existing sell order.

Crypto derivatives market

The cryptocurrency derivatives marketplace consists of financial instruments whose value is based on a virtual currency’s value. These derivatives can be based on other derivatives’ value and forming multiple tiers – a house of cards if you will.

Cryptocurrency trading strategy

To be successful in cryptocurrency trading, you will need an effective trading strategy. What is it? A trading strategy is simply a plan that you will follow when executing your trades. It will comprise the kind of assets to invest in, the frequency of your trades, and your investments’ size.

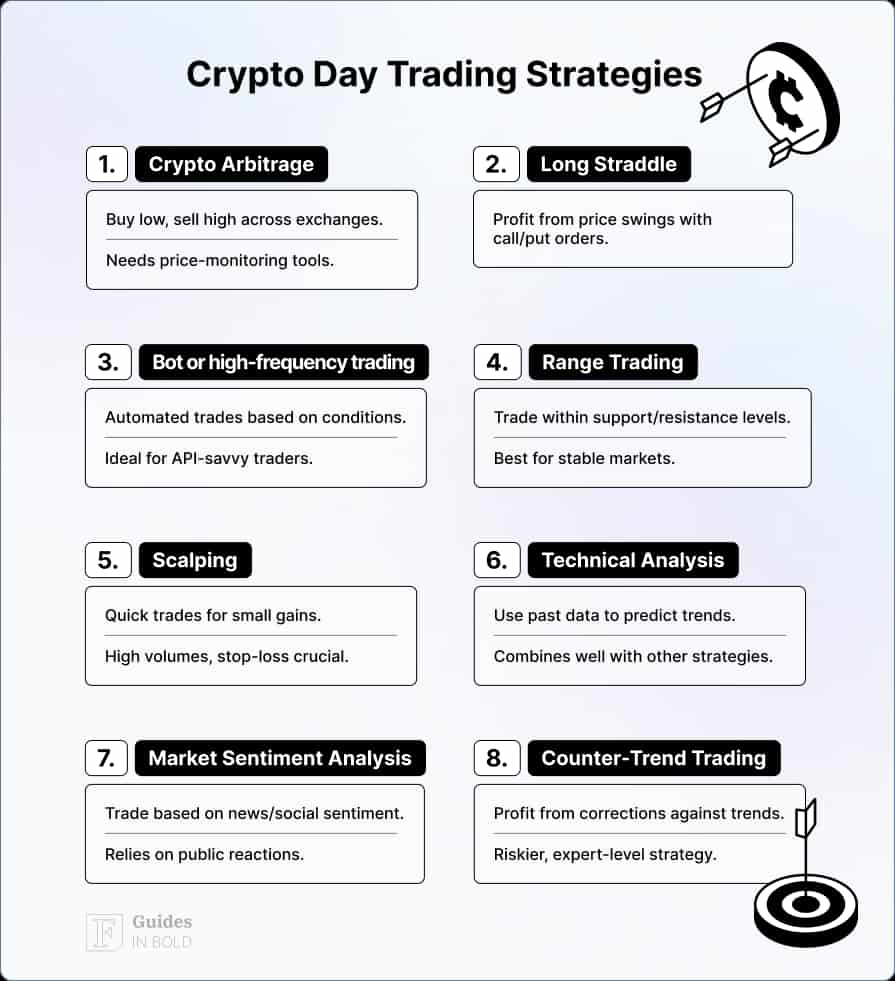

In this section, we will discuss some of the most common crypto trading strategies. Although keep in mind that you can always create your personal strategy that works for you. It could be based on these broad strategies or something completely new.

Why you need a cryptocurrency trading plan

Here’s why a crypto trading strategy is crucial to your success:

- It’s a map. Having and maintaining a trading strategy is akin to having a map. It guides your trades, helping you know when to trade, how, and why to perform a certain trade;

- Keeps emotions at bay. One of the biggest challenges facing traders is the interference of feelings and emotions. These become an impediment when an asset’s price starts trending in the opposite direction to a bet. In cryptocurrency, this happens so frequently that it easily leads to an emotional roller coaster. Successful traders have learned to keep trades free of emotions by sticking to their trading plans;

- Risk management. Having a trading plan effectively forces you to do the research necessary to create one, and part of that research is the risk factor to consider for every trade. Risk identification is the first step toward risk management.

Here are some of the popular strategies used by highly successful traders and investors:

Cryptocurrency day trading and Scalping

A crypto day trading strategy allows the trader to take full advantage of cryptocurrency assets’ price volatility. As mentioned earlier, virtual assets are currently extremely volatile, which works to the advantage of a day trader.

The crypto day trading strategy is a game of numbers strategy. A day trader will make multiple trades within a day, buying low and selling high within little gains that compound to large sums by the end of the day. Typically, sometimes it gets hard to perform this manually. For day trading crypto and to succeed in this strategy, you will need to consider automating your trades using crypto trading apps or crypto trading bots like Coinrule.

Scalping (a trading strategy in which traders profit off small price changes) is a part of day trading but typically involves concise trading periods. Think minutes.

When either day trading or scalping, many trades will result in both wins and losses. The idea is to make sure that the win/loss ratio is in your favor. Score more wins to consider your strategy a success.

Swing trading

When it comes to swing trading, the time period varies. Whilst in day trading and scalping, traders typically open and close positions multiple times within a day. In swing trading, this happens within a much longer period. This could be anything from a few days to a few months.

A crypto swing trader will aim to take advantage of an incoming or ongoing trend. In crypto, this strategy is sometimes referred to as BTFD (“buying the f’n dip”). It means buying when the price is low and selling when the price is high. Extensive application of both FA and TA techniques is necessary when using this strategy.

Position trading (HODL)

Also called trend trading or following the trend, this strategy involves long-term investing in assets. A trader/investor will typically buy or invest in an asset when the price is low and sell when the price is high, not unlike the other strategies. The only difference is the long time periods between opening and closing a position.

Trades set up through this strategy could take months and sometimes years. It is an ideal strategy for investors favoring a more hands-off approach. This strategy is sometimes called ‘HODL’ (or Hold On for Dear Fife) in cryptocurrency. The term is derived from a play on the word ‘hold’ – to buy and hold. A crypto trader would invest in a coin or token and hold it even when the prices are plummeting. Such a trader would thus be called a ‘Hodler.’

Margin trading (trading with leverage)

Margin trading is not a trading strategy but rather a trading method. Adopted from the traditional stock market, it involves a trader using borrowed capital to open positions on a trading platform.

As anticipated, the results from trading on margin are greatly amplified to either direction of the trading position. If you score a win, the reward is much larger, and the reverse is also true. If the trade goes sideways, you also lose a lot more.

To better understand leverage, assume you enter a trade with 5x leverage. This means that your trade’s position size is 5 times the capital you staked from your own pocket (i.e., margin). Usually, the exchanges with margin trading options offer a leverage up to 100x, which is a hazardous ‘game’ and not recommended for beginners.

Risk management

It’s hard to talk about crypto trading without talking about risk management in cryptocurrency trading. It is another essential part of your success journey. Risk in crypto trading refers to the chance of an undesirable outcome happening.

You may have heard that trading cryptocurrency is risky, and that is true, but so is trading all other financial instruments, including stocks and bonds. What differs is the level of risk.

There are different kinds of risks, and in this section, we will discuss those related to cryptocurrency trading.

Different types of risk

- Market risk. Perhaps the most widespread of all is the risk that a given asset’s market price or the overall crypto market will swing unexpectedly and negatively affect your market position;

- Liquidity risk. Refers to a situation where you are unable to exit a position. Typically happens when you can’t find a buyer for your asset;

- Legal risk. Refers to a situation where a government regulation or policy negatively impacts an asset or a trading platform. This could lead to liquidity problems if buyers for your asset are barred from purchasing it. Also, if a trading platform is banned from your jurisdiction, you could end up losing your funds stored with the exchange;

- Operational risk. It is the risk inherent if a trader cannot perform a trading activity such as exiting or opening a position. It could be caused by the failure of a trading platform or malfunction of a trading application etc;

- Systemic risk. Refers to a loss incurred due to a failure in the entire trading system. Closely related to the market risk, but this one is much direr given that it is caused not just by the market downturn but also the collapse of crucial systems within the marketplace. Think of the 2008 financial crisis. That was a systemic failure that led to a market meltdown;

- Custodial risk: Funds held on centralized exchanges may be exposed to operational failures, insolvency, or withdrawal restrictions. Many investors mitigate this by using self-custody wallets for long-term holdings.

Now that you understand the kind of risks you are most likely going to encounter, you should factor them every time you are about to make a trading decision.

Do you pay taxes when trading cryptocurrency?

When trading crypto, it is crucial to remember that you also have to pay fees to crypto exchanges. You can achieve higher profitability if you have lower platform fees. But, on top of the crypto exchange fees, it is essential to know that crypto tax comes on top of the trading platform fees. Just like with crypto exchange fees, if tax is not accounted for, it can lower your profits.

Though crypto was initially unregulated, the IRS has now announced the taxation of digital assets, including major currencies like Bitcoin (BTC) and Ethereum (ETH), among other top cryptocurrencies. The IRS now treats crypto as a regular asset, like property, stocks, bonds, or commodities such as gold. Similarly, cryptocurrency gains are taxed at different rates – either as income or capital gains.

Both crypto traders and investors should know and check if they need to pay taxes on crypto. For example, in the US, taxpayers must report their crypto trades by law to the IRS. Our thorough and all-encompassing crypto tax guide will break down everything you need to know from how crypto is taxed, what exactly is taxed, when, and how to pay them.

Portfolio management

Professional traders rarely have just one asset within their portfolio. Therefore, to juggle all their investments and trades, they need specific tools to be efficient while trading. And that’s where portfolio trackers come in.

They are software applications for desktop, tablet, and mobile devices that help track every kind of investment you make in the crypto market.

By tracking your portfolio and measuring your performance, you can easily improve upon it and make better trades. As the saying goes, you can’t improve what you can’t measure.

When it comes to crypto portfolio management, you want to know how much of a particular asset you hold and where it is stored. You also want to know how much you are gaining or losing from a particular trade or investment.

Keep in mind that you could have to maintain multiple portfolios. As a trader, you might employ different trading strategies simultaneously, meaning you are actively trading while at the same time swing trading and/or position trading.

To be a profitable trader, you will need a suite of applications from data portals and news aggregators to portfolio trackers. They all work in tandem to offer you real-time data you can use to make better trading and investment decisions.

How to pick the best cryptocurrency exchange for trading

There are hundreds of cryptocurrency exchanges in the market today. Some are centralized (a company runs them), while others are decentralized (a community runs them). Whichever option you choose comes down to your preferences. But here are a few factors to consider when choosing the best crypto exchange for a beginner:

- Liquidity. This is the number of assets supported as well as the sizes of the different order books. The volume of trades will give you an idea of the popularity and reliability of the exchange you are considering;

- Fees. Knowing the fee structure of a trading platform is important because this affects the kind of trading strategy you choose. The lower the fees, the higher the profit margins (given other factors are kept constant);

- Payment options. It would be best if you considered what payment options the exchange supports. This could be credit cards, wire transfers, other cryptocurrencies (crypto to crypto deposits), etc. Some platforms support a wide range of options, while others have limited options;

- Security. This is especially important in cryptocurrency. A trading platform needs to have the best security in place to secure its assets and those of its customers. On top of this, there should be an insurance policy for extra assurity;

- User experience. The ease of navigating a trading platform is also a big consideration, especially so for a beginner. Typically, centralized exchanges are much more user-friendly as compared to their decentralized counterparts;

- Customer support. Even though a trading platform seems easy to use, it is also important to consider how easy it is to reach the help care desk. You can check Reddit and other relevant places to read reviews about a platform’s customer support efficiency. This may come in handy when you have an issue.

Recommended platforms for your first trades

#1 Uphold (best for trading multiple assets with one account)

Uphold allows users to trade between cryptos and multiple asset classes as a single account gives you access to 50 U.S. stocks, over 200 cryptocurrencies, four precious metals, and 27 national currencies.

The exchange uses proprietary security procedures, such as storing 90% of funds in cold storage and having an insurance policy that protects currency stored on the platform against security breaches.

Uphold is a solid multi-asset trading platform for anybody looking to purchase precious metals, fiat currencies, stocks, and cryptocurrencies. In addition, unlike many of its rivals, Uphold provides carbon credit tokens, which are a kind of eco-currency.

Read our Uphold-related guides:

- Uphold review;

- How Long Does Uphold Verification Take? | KYC Guide;

- Is Uphold Safe? What Beginners Should Know;

- Uphold Trading Fees Explained;

- How to Create Uphold Account? Step-By-Step Guide.

#2 Coinbase (suitable for beginners)

Coinbase is a suitable cryptocurrency exchange for beginners who want to prioritize security and convenience. The platform makes buying and trading cryptocurrencies simple, while also providing high levels of security and transparency. In addition to its user-friendly interface, it offers trading, institutional benefits, and digital storage to consumers in more than 100 countries.

Coinbase fees, on the other hand, may be more expensive than those charged by competitors, but since the company is publicly listed on the Nasdaq and is regulated in the United States, it is a good fit for customers who are hesitant to buy or trade crypto. Therefore, in exchange for simpler deposit and withdrawal options, you will have to pay a greater fee.

Read our Coinbase-related guides:

- Is Coinbase safe?;

- Coinbase KYC guide;

- Coinbase fees explained;

- How to withdraw from Coinbase;

- Coinbase review.

#3 Binance (best for spot & advanced trading)

However, those traders who want to step up to manual trading can choose Binance for low fees, a variety of order types and payment options. Whatsmore, Binance caters to experienced users with comprehensive charting options, with an abundance of advanced indicators and overlays. There are over 500 cryptocurrencies for trading and an enormous selection of transaction types.

Despite the fact that Binance is user-friendly and provides three tiers of service structured according to trading expertise. However, it is not as straightforward to use as the Coinbase platform and it is more oriented to those already familiar with spot trading.

Recommended video: How to buy cryptocurrency with a credit or debit card on Binance

Additionally, the user experience is ideal for a beginner. There are both Classic (previously named as basic) and Advanced user interfaces catering to both beginners and advanced traders.

Classic interface:

Advanced interface:

Binance supports the widest selection of deposit/withdrawal options of any exchange currently and the widest geographical coverage as well. You can also download a mobile application on either iOS or Android and trade on the go.

To learn how to execute trades on Binance watch this video:

Read our Binance-related guides:

- How long does Binance verification (KYC) take?;

- Binance fees explained;

- How to withdraw from Binance;

- How to sonvert small balance to BNB on Binance;

- Binance coin (BNB) explained;

- How to buy & sell NFTs on Binance NFT Marketplace;

- Binance review.

IMPORTANT: Before you start trading cryptocurrencies

Other recommended related guides:

- Who Started Bitcoin? The True Story of Satoshi Nakamoto;

- Best Crypto Exchanges to Buy & Sell Bitcoin;

- Best Crypto Wallets;

- How to stake cryptocurrencies;

- How to buy Ethereum;

- Crypto Day Trading Guide for Beginners;

- How to Mint & Sell NFTs | Non-Fungible Tokens;

- How to convert the small balance to BNB on Binance;

- Best crypto trading bots | Top 3 picks;

- What is a Rug Pull in Crypto?

Choosing the best crypto exchange:

- Coinbase review;

- Binance review;

- Kraken review;

- KuCoin review;

- Uphold review (buy crypto, metals, US stocks);

- VirgoCX review (for Canadian traders);

- CoinGate review (accept crypto on your store);

Conclusion

Hopefully, you have learned a lot and you are now more informed and knowledgeable about cryptocurrency trading and investing than you were at the beginning.

Now it’s your turn. We enjoyed researching and writing the guide with you in mind. Good luck!

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about crypto trading

What is the best Cryptocurrency exchange for beginners?

Binance. This is because it has some of the lowest trading fees in the market, provides a complementary mobile app for users to keep track of asset prices on the move, has a comprehensive education resource section and supports one of the broadest selection of payment methods. Additionally, it adheres to strict safety and security standards. All these are factors that make it ideal for a beginner.

What is the best cryptocurrency trading strategy?

It depends on your goals. Looking for short-term gains, then scalping and day trading would be the best strategy for you. If, instead, you are looking for long-term gains, consider position trading or holding your coins over a long period (HODL).

Is trading cryptocurrencies profitable?

Crypto trading is profitable, but only if done correctly. Follow the steps, strategies, and tips shared throughout our guide, and you will be in a better position to make profitable trades. And a golden rule: Plan your trade, trade your plan.

How do I start trading Cryptocurrency?

Trading cryptocurrency is not unlike trading stocks in the traditional markets. The principles are similar albeit there are a few differences in execution. To start trading crypto, follow these steps:

- Do your research. Just like in the stock market, you need to do a thorough research of the market and the assets before you decide to invest real money;

- Find the best crypto exchange for you;

- Buy crypto of choice;

- Trade the crypto for profit (plan your trade, trade your plan);

- Withdraw profits or reinvest.